EU Nations Push to Relax Gas Storage Target Amid Price Rally

(Bloomberg) -- A group of nations is pushing the European Commission to allow more flexibility on refilling requirements for gas storage ahead of next winter, as rapidly depleting stockpiles and surging prices raise concerns about the cost of meeting the current targets.

At a meeting of the Gas Coordination Group in Brussels on Thursday, a number of countries will push for an easing of targets designed to ensure that inventories are 90% full by Nov. 1, according to people familiar with the matter who asked not to be identified.

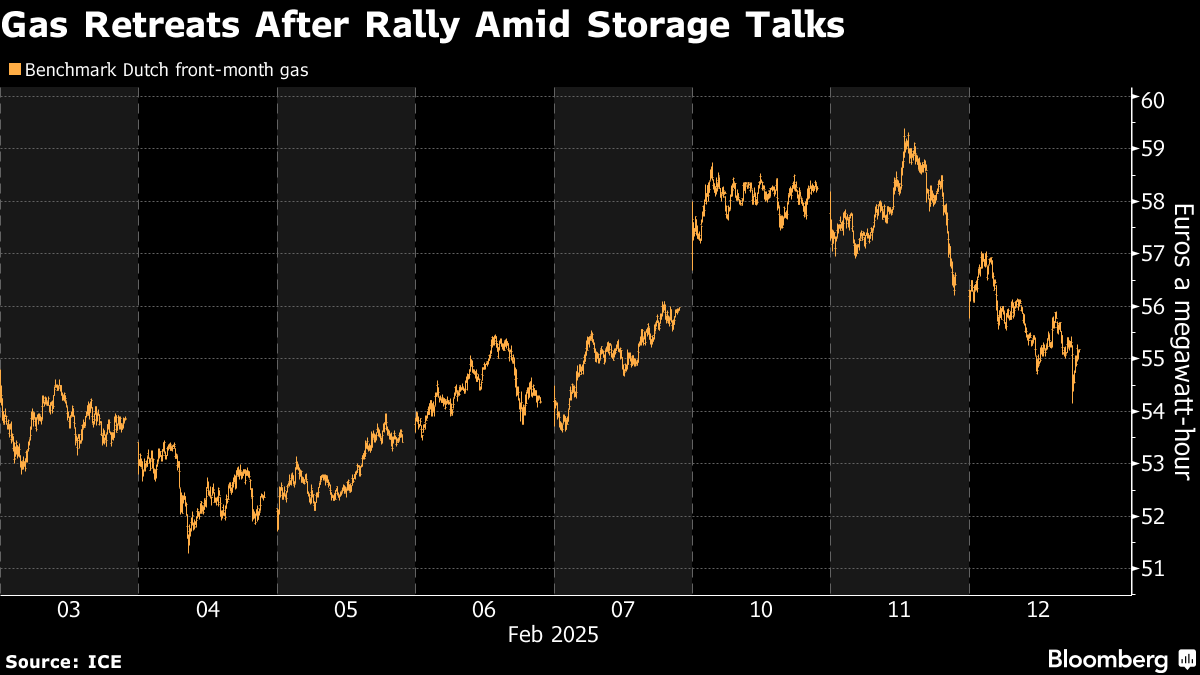

The move marks an expansion of the demands by member states about softening refilling targets for future years, reported by Bloomberg last week. Benchmark natural gas futures dropped as much as 6.3% on the news, extending an earlier decline.

A combination of colder weather, low wind generation and the loss of Russian supplies through Ukraine has meant that the region has been drawing down inventories of gas more quickly this year. Storage sites are now 48% full on average, the lowest seasonal level since 2022.

The prospect of increased demand this summer for refilling pushed prices to a two-year high earlier this week. Summer prices are also stubbornly high, even after the recent retreat, making it unprofitable to store the fuel. Germany’s market manager Trading Hub Europe GmbH is considering subsidies for refilling stocks.

“Current EU storage targets, which mandate specific levels for specific dates early in the year, tend to push up prices,” said Jonathan Stern, a Distinguished Research Fellow at the Oxford Institute for Energy Studies.

There needs to be greater flexibility to allow stockpiling when markets are most beneficial, he said.

The Commission, the bloc’s executive arm, is currently planning to propose a two-year extension to existing rules that expire at the end of the year, along with interim filling targets, early next month, according to people familiar with the matter. Member states are grasping the opportunity to try to convince the Commission to take into account their demands and relieve some of the pressure the targets are creating on gas prices.

At least six countries support relaxing this year’s target, one of the people said. It’s not clear whether there is enough support from others to force through the changes by June, to allow enough time before the coming winter. The countries still support the general principle of the targets and may settle for tweaks to next year’s filling season, the people said.

If the commission proposal stops short of these expectations, the group of member states may try to change the regulation during talks in the EU council on the final shape of the measure. It will require a qualified majority backing from national governments.

There is a concern that overly strict targets this year are contributing to a surge in gas prices as traders bank on governments stepping in to fill storage during the coming months. Prices hit the highest level in two years this week.

The Gas Coordination Group’s role is to discuss filling trajectories and to make sure that companies in different member states do not try to outbid each other on the market, forcing prices to spiral higher.

The recent surge in gas prices has contributed to a renewed push to amend the existing gas storage regulation amid fears of rife speculation in the market, one of the people said. Ensuring that Europe has affordable energy so that its heavy industry can compete globally is a political priority for Ursula von der Leyen, president of the European Commission.

Separately, the Commission is due to present its affordable energy action plan later this month. Officials are grappling with how best to curb prices, including on the financial markets. Some have advocated using a cap, though it has faced fierce pushback from energy producers and traders.

Dutch front-month futures, Europe’s gas benchmark, settled 3.6% lower at €55.66 per megawatt-hour. The spread between gas contracts for this summer and the following winter fell by more than 30%, hitting a three-week low.

The market was already in a bearish mood on Wednesday as the US intensified efforts to broker a peace deal between Moscow and Kyiv, raising hopes for the return of some lost Russian supply. Minutes before the European gas market closed, President Donald Trump said he spoke with his Russian counterpart, Vladimir Putin, and that the leaders agreed to begin talks on ending the war in Ukraine.

(Updates with Trump-Putin call in final paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Key Permit for New Jersey Wind Farm Trump Opposes Is Voided

Clean Tech Stocks Rise as Germany Marks €100 Billion for Climate

Danish Investor Raises €12 Billion for Renewable Energy Fund

What It Will Take for Rich Countries to Reach Net Zero: You

Bill Gates’ Climate Group Lays Off US and Europe Policy Teams

Trump’s EPA Takes Aim at Biden Curbs on Power Plant Pollution

Deals Seeking $45 Billion in Climate Funds Seen Managing US Exit

TotalEnergies and RWE join forces on green hydrogen to decarbonise the Leuna refinery

Shale Pioneer Sheffield Warns Oil Chiefs of Grim Times Ahead