Global Air Travel Surges While Switch to Clean Jet Fuel Lags

(Bloomberg) -- Global air travel surged to record levels last year, and airlines are consuming far less sustainable jet fuel than expected. This is a dire combination in the effort to counteract climate change, with aviation contributing about 4% of human-induced warming to date.

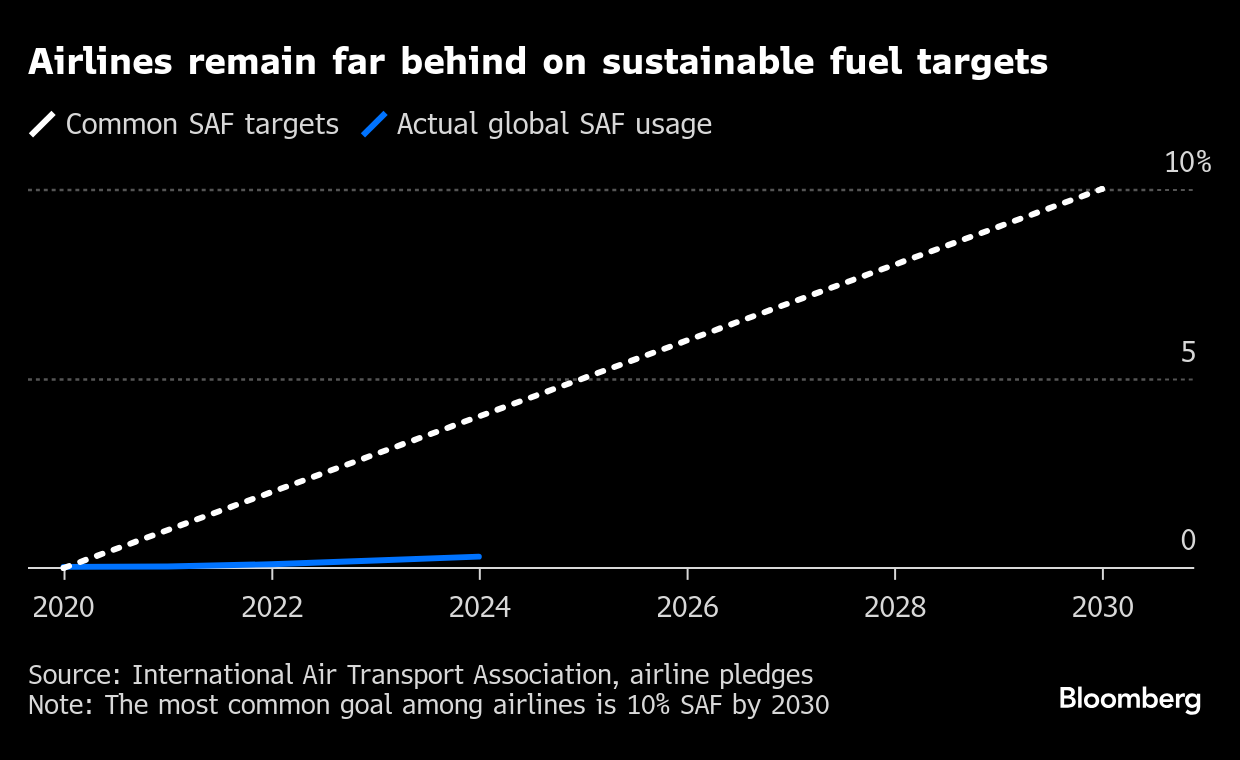

Most carriers have vowed to address their growing contribution to greenhouse gas emissions by using vastly more fuels derived from lower-emitting sources like used cooking oil and energy crops. Air France-KLM, Delta Air Lines Inc., and Cathay Pacific Airways Ltd. are among a large group of airlines promising to consume 10% sustainable aviation fuel, or SAF, by 2030.

But adoption of these cleaner fuels has been slow even as air travel jumped 10% in 2024—and 4% above pre-pandemic levels—to reach an all-time high, according to figures released last month by the International Air Transport Association (IATA). SAF accounted for about 0.3% of commercial aviation’s fuel consumption last year, according to IATA’s estimates, well below the industry group’s earlier forecast of 0.53% for 2024.

To reach 2030 targets, airlines will need to boost consumption of SAF more than 30-fold.

“I think 10% is a target that likely won’t be met by 2030,” says Jimmy Samartzis, chief executive officer of LanzaJet Inc., which is building several sustainable fuel plants around the world, including in the US and the UK. “I think that’s just the reality across the industry.”

All of this obscures a potentially bigger problem: Even if airlines can somehow replace 10% of their fuel with lower-emitting alternatives by the end of the decade, those climate benefits would be wiped out by the industry’s expected growth. UK Chancellor Rachel Reeves, for instance, recently spurned climate activists by voicing approval for the construction of a third runway at London’s Heathrow Airport. IATA, meanwhile, predicts global air travel will grow another 8% this year.

“Growth typically scuppers what you try to do on the decarbonization side of aviation,” says Alice Larkin, professor of climate science and energy policy at the University of Manchester in the UK.

The airline industry counters that air travel is important for overall economic growth, which will be needed to fund a massive energy transition to avoid the worst consequences of climate change. “What we really need to be able to tackle climate change is more growth…more tax revenue and more money to fund all of these things that we are going to have to do,” says Marie Owens Thomsen, chief economist and senior vice president of sustainability at IATA.

The aviation industry expects that SAF production will skyrocket after 2030, eventually supplying up to 90% of its fuel. And it attributes the recent shortfalls to the lack of supply, with only a handful of companies historically producing the cleaner fuels.

Several new large plants have started operating in recent months. Diamond Green Diesel, a joint venture between Valero Energy Corp. and Darling Ingredients Inc., recently started up its refinery in Texas, which can produce over 200 million gallons of SAF per year. Phillips 66, meanwhile, has converted a refinery near San Francisco to churn out renewable fuels.

In both cases, though, the refineries can toggle between producing renewable fuels for road transportation or aviation, depending on various factors, including appetite from airlines. With SAF costing at least twice as much as conventional jet fuel, it’s not clear if airlines will gobble up the available supply. Officials for Valero and Phillips 66 both declined to say how much SAF the refineries have been producing so far in 2025.

A patchwork of new regulations could spur more demand. Starting this year, both the European Union and the UK require that SAF accounts for 2% of jet fuel. Singapore is planning to add a levy to tickets next year to purchase more of the cleaner fuel, while the Canadian province of British Columbia will require jet fuel to be at least 1% SAF by 2028.But many airlines push back against these types of requirements. California regulators withdrew a proposal last year to require more SAF amid opposition from airline industry groups. This has left voluntary purchases by airlines — buttressed by a patchwork of government incentives — as the sole driver for cleaner aviation fuels across much of the world.This voluntary demand has disappointed some makers of SAF. Neste Oyj, a Finnish producer of cleaner aviation fuel, warned in October of lackluster voluntary purchases and said that some airlines were looking to postpone their carbon-reduction plans. (Air New Zealand ditched its 2030 climate target last summer, but Neste declined to name any specific carriers.)There was no indication of a pullback at a BloombergNEF conference last week in San Francisco, where officials at Delta and United Airlines Holdings Inc. touted their ongoing commitments to cleaner fuels. “We know it’s the right thing for United, we know it’s the right thing for our shareholders,” said Lauren Riley, United’s chief sustainability officer, during a conference panel. “We’re going to continue to invest in sustainable aviation fuels.”SAF accounted for 0.17% of United’s jet fuel consumption in 2023, which was right around the global average that year; Delta came in at 0.09%. Some European airlines are further ahead: Air France-KLM led all passenger carriers with over 1% SAF in 2023. (Most individual airlines haven’t yet reported their 2024 totals.)Riley praised new state incentives, like a $1.50 per gallon credit in Illinois, which can help make SAF pencil out for airlines. “I now have reason to walk into my CFO’s office and say, ‘I want to go procure this sustainable aviation fuel for use at O’Hare, which is our hometown hub, at this volume, because we can actually afford it,’” she said. “Having these state-based policies is really, really important.”Unexpected setbacks, however, still loom large for many SAF plants under construction. BloombergNEF, which tracks the development of renewable fuel facilities, found that 46 forthcoming plants announced delays last year.When LanzaJet announced the opening of its new SAF plant in rural Georgia a little over a year ago, it hoped to reach its full annual output of 10 million gallons by the end of 2024. But the plant has yet to produce any jet fuel after the facility was pounded by Hurricane Helene in September, which knocked it offline for six weeks. It’s also been dealing with “some standard equipment issues and challenges with things like compressors,” says LanzaJet’s Samartzis.

“It takes time to sort of work your way through, work out the kinks, optimize the unit, and ensure that it is safely producing fuel,” he says.These challenges fuel skepticism that there will be enough SAF—and that airlines will purchase all of the available fuel—to hit their climate targets.“A lot of people bandy around quite a lot of numbers in relation to SAF, as though once you’ve said it, it’s just going to materialize,” says Larkin of the University of Manchester. “I’m very skeptical at the moment as to whether you can make those sorts of quantities.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Want Solar Panels on Your Roof? How to Navigate Market and Tariff Chaos

New Danish Nuclear Power Fund Targets Raising €350 Million

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Spain Signals Openness to Keeping Nuclear Power Plants Open

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

As Tesla Falters, These New EVs Are Picking Up the Pace

Fashion Is the Next Frontier for Clean Tech as Textile Waste Mounts

High-Powered Solar Cells Are Poised to Replace Batteries

New Jersey Forest Fire Shuts Stretch of Garden State Parkway