China’s Exports of Solar Silicon Outpace Imports For First Time

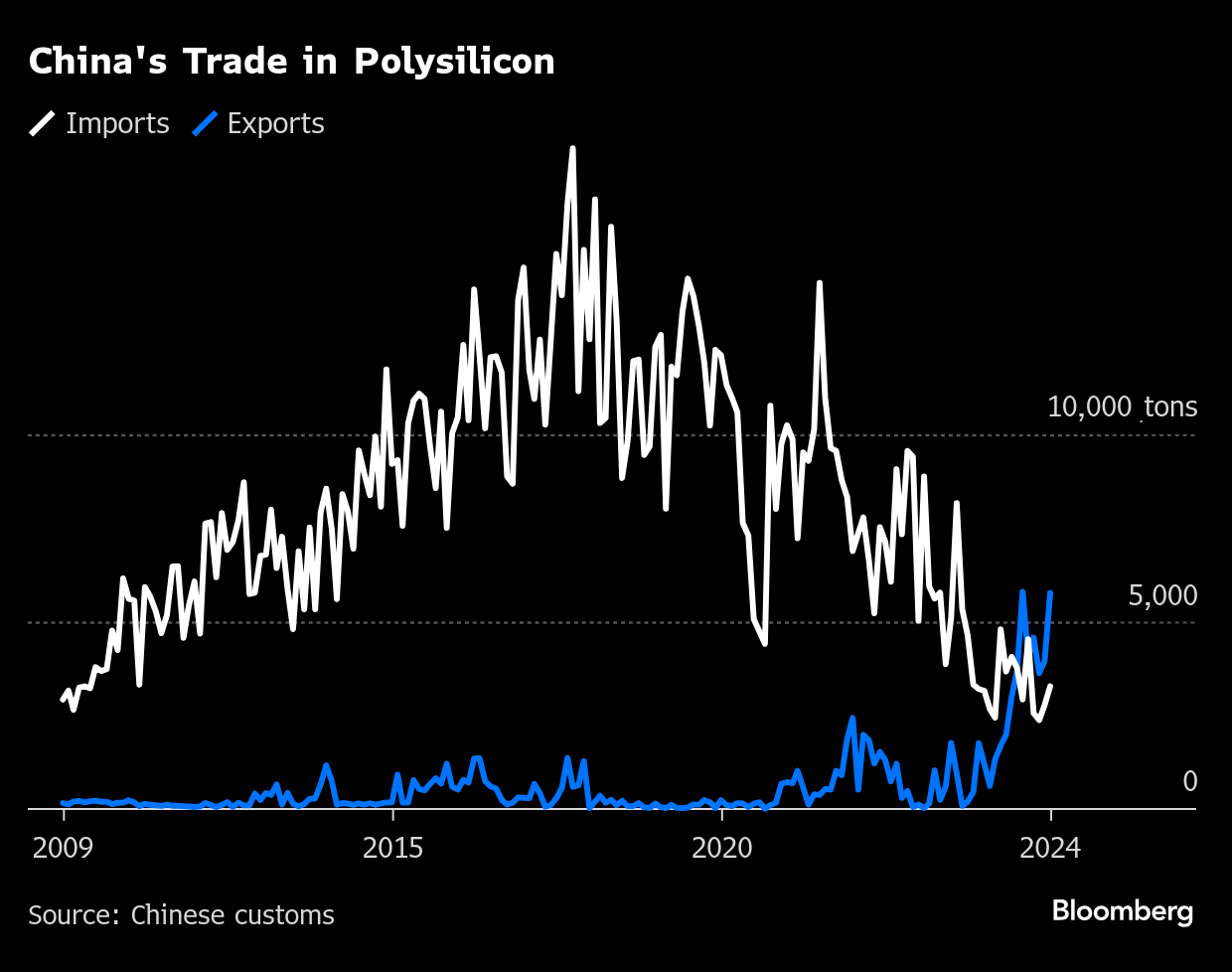

(Bloomberg) -- China’s exports of polysilicon used by the solar industry exceeded imports last year for the first time, as panel manufacturers shifted more operations overseas to contend with a glut at home.

The country exported 5,765 tons of polysilicon last month, bringing the annual total to just above 40,000 tons, according to Chinese customs data this week. Imports were about 39,800 tons, including 3,275 tons in December.

China’s polysilicon makers have also been forced to reduce output to cope with a huge domestic surplus that has seen prices tumble nearly 90% over the past two years.

Other Data Points:

- The average price for the most expensive wafer was unchanged at 1.66 yuan per piece in the week through Thursday, according to the China Silicon Industry Association. Prices vary for different types of wafer products

- Supply shortages have eased after downstream consumption fell as factories start to close for the Chinese New Year holiday

- Wafer prices are unlikely to rise again in January as demand turns weaker

- The average price for the most expensive polysilicon-type was also unchanged at 41,700 yuan a ton in the week through Wednesday, the association said earlier

- Downstream companies have stocked up before the holiday and transactions were limited this week

- The polysilicon futures market launched last month has “greatly stabilized” confidence in prices, with more leading producers willing to participate in futures trading

- Prices expected to continue rising to a “relatively reasonable range” after the holiday due to the sector’s self-discipline measures and as downstream stocks fall

What Happened This Week:

- China broke its own record in installing renewable power in 2024, as the world’s top polluter continues to push its energy transition while the US shifts away from fighting climate change.

- Some 277 gigawatts of solar and 80 gigawatts of wind capacity were added, allowing China to hit its 2030 target six years early

- China is expected to add 273 gigawatts of solar and 94 gigawatts of wind in 2025, driven by the needs of state-owned developers and provincial governments to meet their capacity goals, according to BloombergNEF

- The National Energy Administration revised its rules for the distributed solar sector, requiring large-scale, industrial and commercial projects to consume all the power they generate

- Major solar companies, including Tongwei Co., Jinko Solar Co. and Xinjiang Daqo New Energy Co., released gloomy annual results, attributing losses to a severe mismatch between supply and demand

- China’s industrial hub of Zhejiang saw spot power prices drop below zero for the first time this week, signaling weak demand that could put the brakes on solar’s rapid expansion

- Region’s spot power price fell to -200 yuan/MWh on Jan. 19-20, the government-owned Energy Magazine reported

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Germany’s Merz Takes Aim at Greens in Final Election Stretch

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands