Constellation Energy Soars on $16.4 Billion Calpine Deal

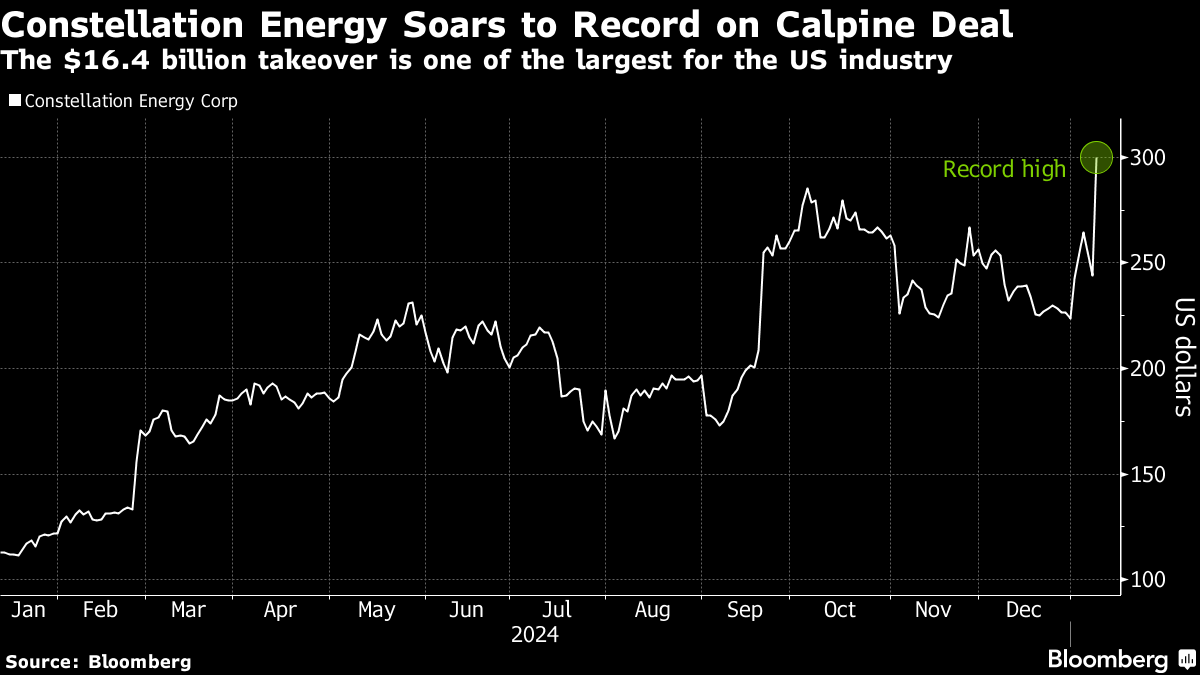

(Bloomberg) -- Constellation Energy Corp. shares surged to a record high after agreeing to acquire closely held Calpine Corp. for $16.4 billion in a deal that will create the largest fleet of US power stations.

The stock closed 25% higher at $305.19 on Friday in New York, a record one-day gain. Constellation agreed to pay a mixture of cash and stock, and assume about $12.7 billion of Calpine’s net debt in the deal, the companies said in a statement.

The stock surge underscores the value of reliable electricity. Constellation is expanding as energy consumption in the US is forecast to climb at the fastest pace in decades. Demand is expected to grow almost 16% over the next five years, driven by data centers running artificial intelligence operations, as well as the electrification of homes and cars and a shift away from fossil fuels in manufacturing.

“Post transaction, we’re the biggest fleet in the country,” Constellation Chief Executive Officer Joseph Dominguez said during a Friday conference call. “We’ll generate more electricity than any company in the US.”

Constellation operates natural gas and hydroelectric power facilities and the biggest US nuclear fleet, with a total 32.4 gigawatts of capacity. Buying Calpine will add 78 plants in 22 states with a generating capacity of 27 gigawatts, including the biggest US gas plant portfolio.

The share movement is notable given that Constellation’s stock price almost doubled last year, largely on optimism that the emergence of AI would continue boosting power consumption.

Rare Accretion

The stock jump also reflects the structure of the deal, according to Jefferies LLC analyst Paul Zimbardo. Constellation will pay $4.5 billion in cash, using funds on hand and cash flow generated by the acquisition. The transaction will boost Constellation’s operating earnings per share by more than 20% in 2026 and by at least $2 a share in future years, the companies said. Constellation is paying 7.9 times estimated 2026 earnings.

“To guide to 20% accretion is very rare,” Zimbardo said in an interview. “This is going to make a mega energy and electricity company.”

Bloomberg News first reported earlier this week that the companies were nearing a deal.

The takeover would be one of the largest for a US power generation company, and crystallize a substantial return for Calpine shareholders Energy Capital Partners, Canada Pension Plan Investment Board and Access Industries, which together took the company private for $5.5 billion in 2018.

Lazard Inc. and JPMorgan Chase & Co. are financial advisers to Constellation on the deal, while Kirkland & Ellis is its legal counsel. Evercore is lead financial adviser to Calpine. Morgan Stanley, Goldman Sachs Group Inc. and Barclays Plc are additional financial advisers to Calpine and ECP, and Latham & Watkins and White & Case are serving as legal counsel.

The transaction shows that electricity is becoming increasingly critical as the world becomes more focused on systems that need it, said Dominguez.

“The most valuable energy commodity in the world is a clean and reliable megawatt,” he said. “Demand for our products is expected to grow at levels we haven’t seen in a lifetime.”

(Updates with closing share price in second paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions