DeepSeek and Ozempic Are Complicating Decarbonization Forecasts

(Bloomberg) -- DeepSeek’s recent claim that it can make artificial intelligence less power hungry is just the latest reason the energy industry should rethink all of its assumptions about future demand.

Across some 200 charts, clean energy expert Nat Bullard lays out a number of other surprising factors impacting decarbonization forecasts in his annual presentation released online.

Bullard, an advisor and co-founder of energy information platform Halcyon, shows how new information about fast-developing areas like generative AI and diabetes drugs, which can cut food consumption, adds layers of uncertainty to outlooks.

Already the world is facing a complicated path to net zero, according to Bullard, who previously held roles at BloombergNEF — including chief content officer — until 2023.

For instance, it may have been a record year for renewable energy in 2024, but coal and gas demand also climbed.

“We are burning more fossil fuel and emitting more CO2 than ever,” he says. “At the same time we are manufacturing and installing more wind, solar, and batteries than ever before. It is a complex moment.”

Here are some of the other highlights.

Data Isn’t Everything

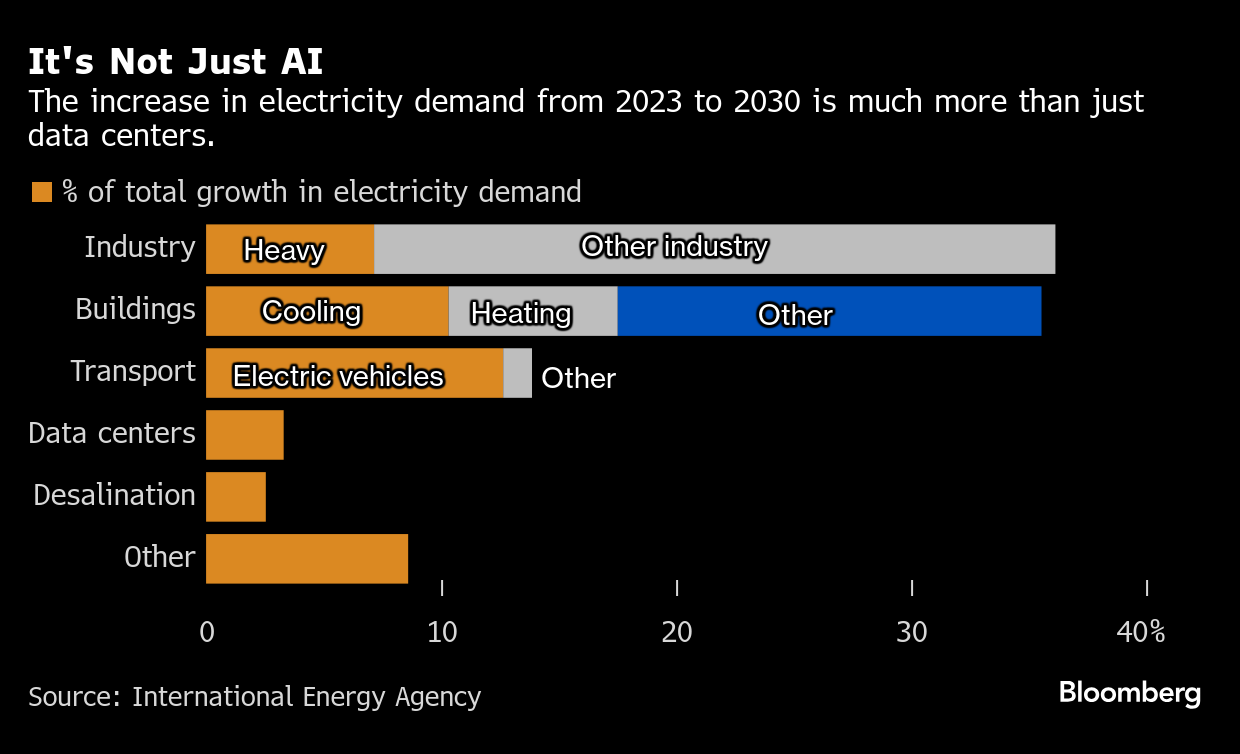

Global electricity demand growth is poised to accelerate over the next few years but only a fraction of that is forecast to go toward fueling AI. In a scenario meant to reflect the current policy landscape, the International Energy Agency showed in an October report that data centers have a limited role in electricity demand growth between 2023 and 2030.

Yet the sector faces numerous other challenges, Bullard says. The US interconnection queue — the backlog to hook up new generation projects to the grid — expanded 30% between 2022 and 2023, while the typical wait has tripled in less than two decades.

This means newly completed clean energy sources are not coming online fast enough in the US.

AI Has Greater Efficiency Potential

Data centers in the US and Europe are gobbling up electricity and raising concerns about their climate footprint. Virginia, which hosts more than 300 centers, saw the industry account for about a quarter of electricity consumption in 2023, while in Ireland the sector used more electrons than urban households, Bullard’s presentation shows.

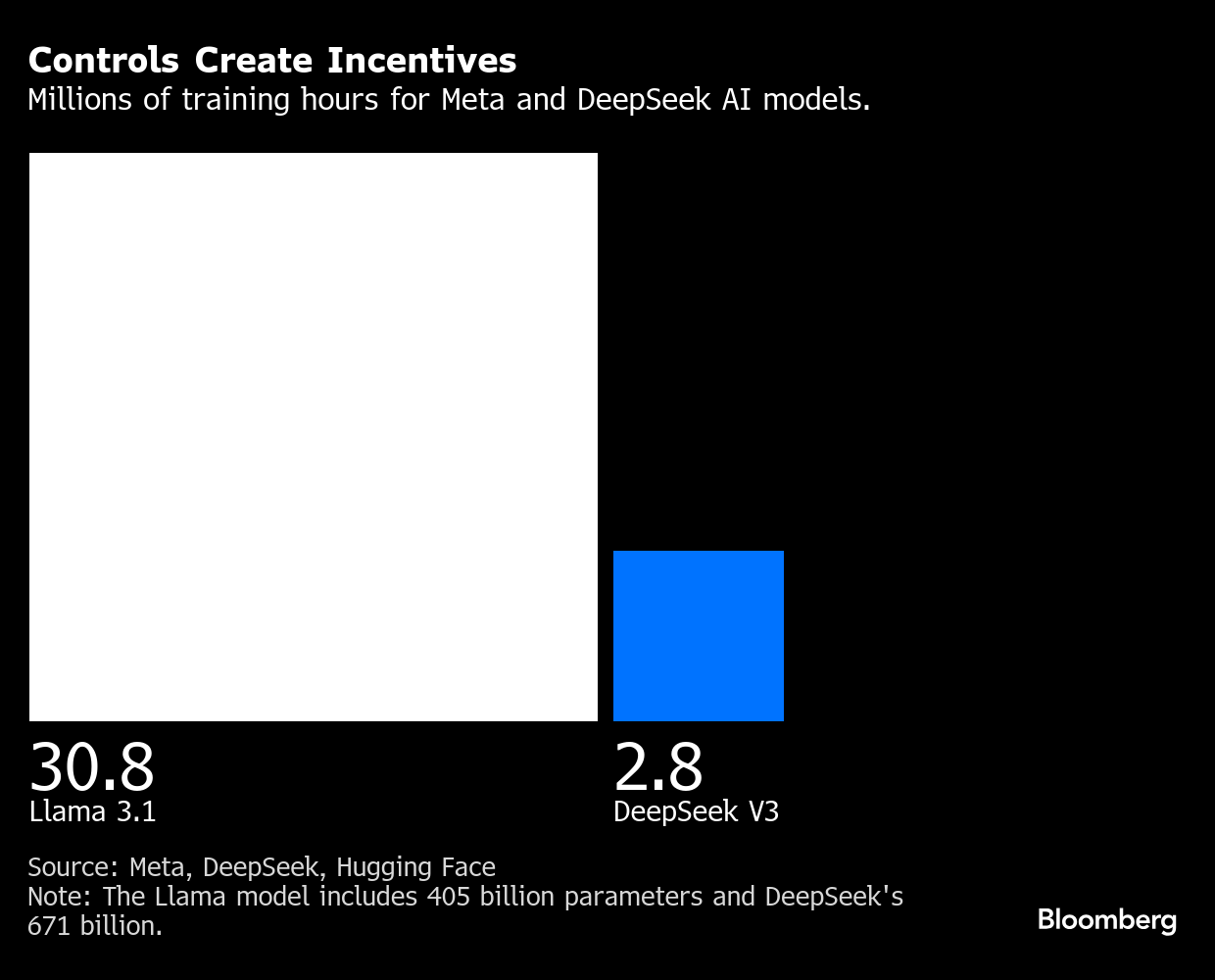

Yet this could all change. Chinese AI startup DeepSeek says its open source foundational models need just a fraction of the training hours required by equivalent US versions.

Bullard says the development likely means that a wave of asset infrastructure like power plants and data centers in the US may crest and then recede.

“We build infrastructure in boom and bust cycles,” he said. “Which, given the DeepSeek news, is one possibility with today's data center construction boom.”

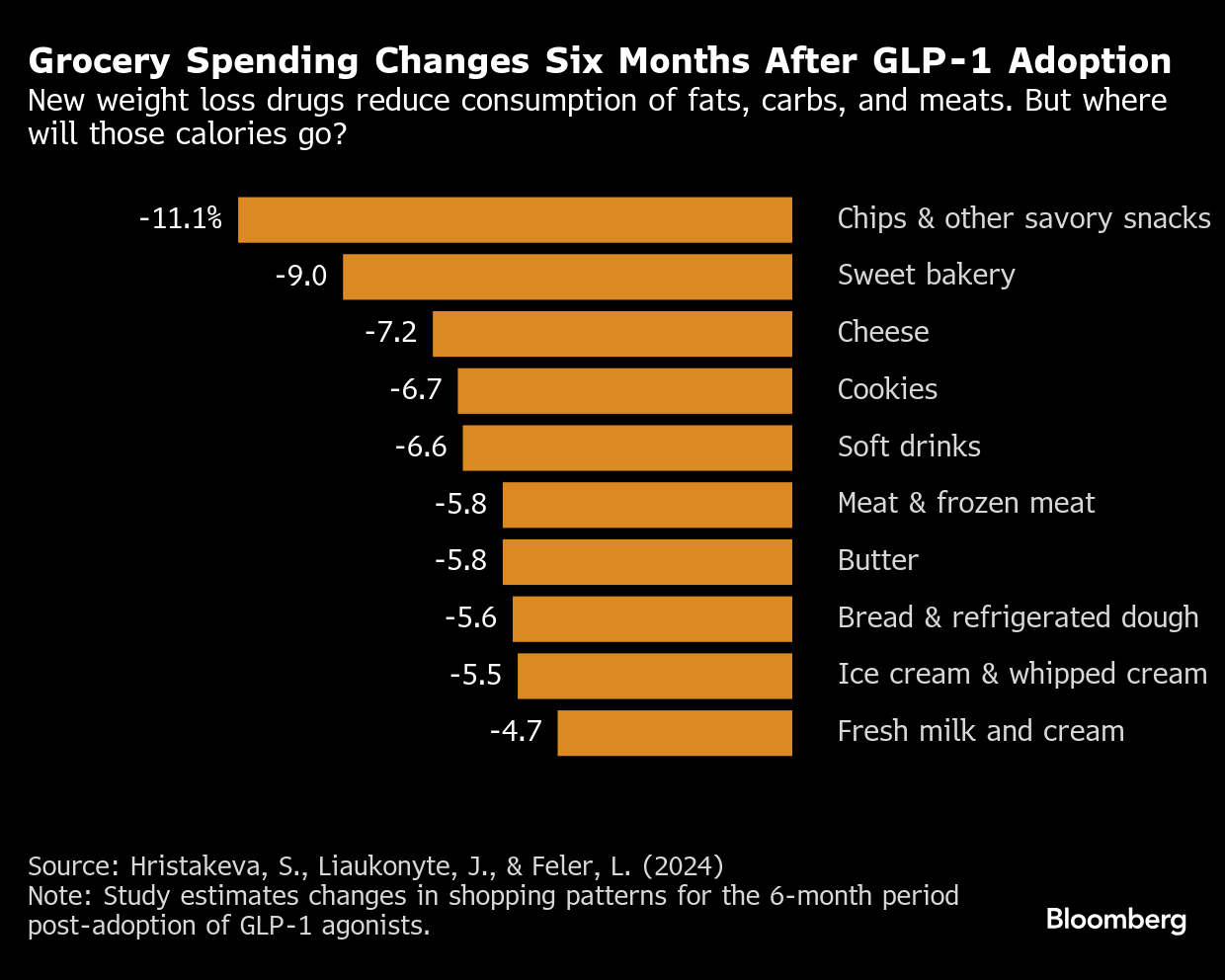

Drugs Can Reduce Oil Demand

Studies have shown that consumers reduced purchases of chips and other savory snacks more than 11% in the six months after starting drugs for diabetes and weight loss, like Ozempic and Wegovy. They also bought 7.2% less cheese and 5.8% less meat. The drugs are creating “profound and durable changes not just in how much people eat but the way they eat,” Bullard says.

If we end up in a world with 10% less craving for fats, sugars and junk calories that are generated from crops like corn or soybeans, Bullard says the question then becomes: Where do those excess calories go?

Biofuels and bioplastics, both made from agricultural products, are two options. This could ultimately lead to a decrease in demand for oil.

Chinese EVs Are Getting Cheaper

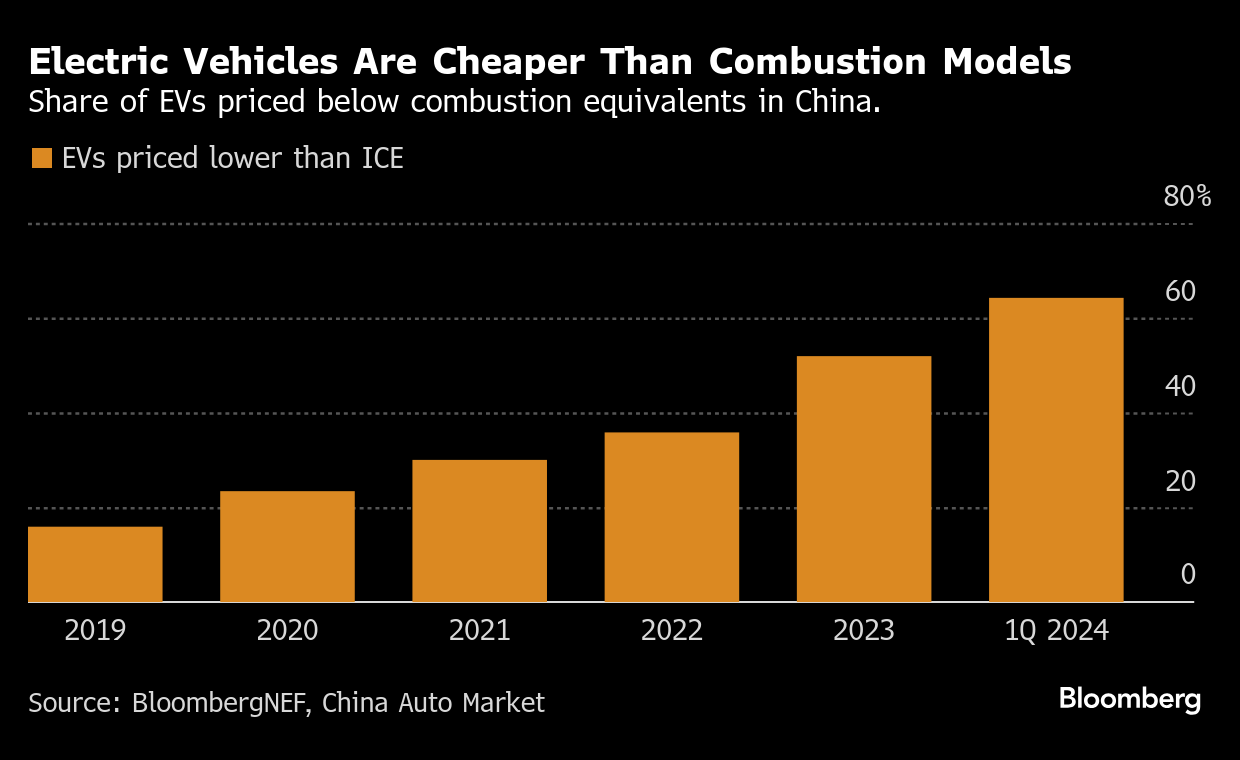

China now manufactures almost 40% of the world’s passenger cars, up from just 3.5% in 2000. Cheap EVs from manufacturers like BYD Co. and Geely Automobile Holdings are now flooding developing markets, eating into market share of companies like Toyota Motor Corp., which have been slower to shift away from internal combustion engine models.

Falling prices of lithium-ion battery packs, which dropped again to $115 per kilowatt hour in 2024, have helped that transition. Almost two-thirds of the nation’s EVs cost less than an equivalent internal combustion engine car in China, data for the first quarter of 2024 shows. Global battery demand surpassed a terawatt-hour for the first time in 2024, yet the deluge of existing and planned production lines means the sector could be oversupplied through at least the end of the decade.

A surplus could have profound implications for newly established trade flows for used EVs, according to Bullard. “If it turns out that there's no market for used electric vehicles to be exported from Europe to West Africa, what happens to all the batteries? Are they recycled? Are they reused?”

Larry’s Letter Says Less About ESG

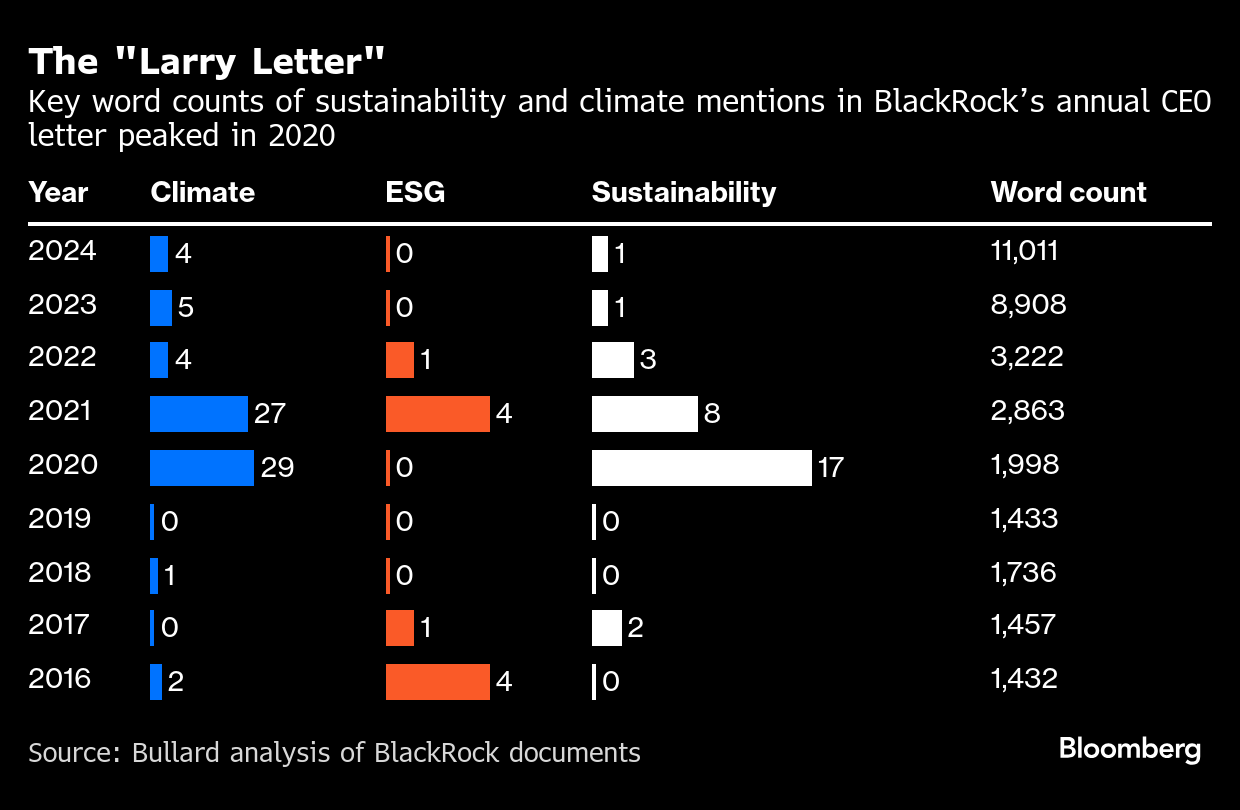

Green finance continues to advance, albeit slowly, with energy transition infrastructure funds under management nearly $1 trillion. But you wouldn’t know that from public Wall Street statements that suggest a wide retreat from green financing. Perhaps no document is more telling than BlackRock Inc. CEO Larry Fink’s annual letter to investors.

The 2020 letter mentions terms like climate, ESG and sustainability 46 times. But executives changed their tune after Texas and other US states launched attacks and legal action on the investment management company.

“Larry Fink used to talk quite a bit (in fairly short letters) about climate, sustainability, and ESG,” says Bullard. “Now he does not.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Spain’s Nuclear Shutdown Set to Test Renewables Success Story

How Climate Tech Investing Is Being Shaped by Trump’s Tariffs and Orders

China Announces Quartz Discovery Vital to Chips to Rival US Mine

Chinese Battery Makers See Tariff Pain Added to Domestic Woes

AI Data Center Growth Means More Coal and Gas Plants, IEA Says

Trump Signs Orders to Expand Coal Power, Invoking AI Boom

Clean Power Offers Safety to China Investors Rattled by Tariffs

US Solar’s Hoarding Habit Will Help Blunt Sting From Trump Tariffs

Trump Team Proposes Ending Clean Energy Office, Cutting Billions