BYD Sales Top Tesla as Tech Focus Wins Over Chinese Drivers

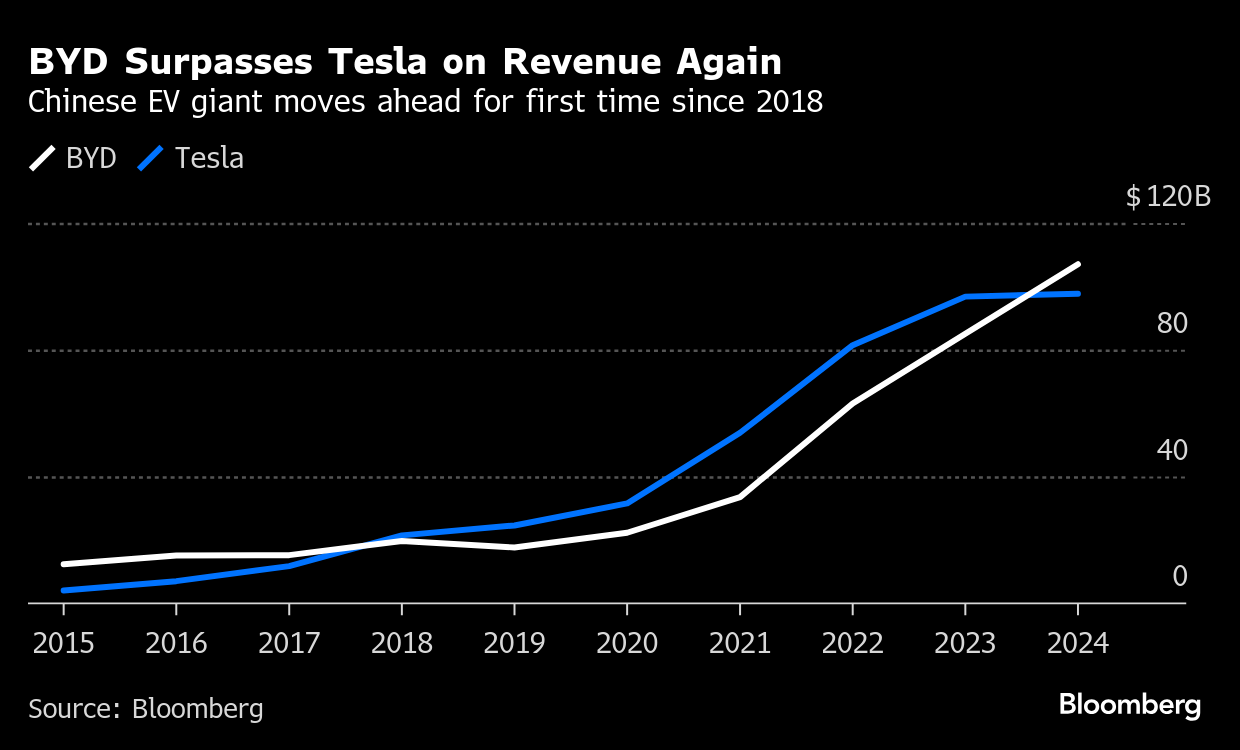

(Bloomberg) -- BYD Co.’s sales last year surpassed the $100 billion mark, leapfrogging Elon Musk’s Tesla Inc., as the Chinese auto giant wows consumers with a range of electric and hybrid cars packed with high-tech features.

Shenzhen-based BYD reported revenue of 777 billion yuan ($107 billion) for the 12 months ended Dec. 31, up 29%, according to a filing late Monday, beating estimates for 766 billion yuan. Tesla’s 2024 revenue was $97.7 billion. The Chinese EV maker’s net income rose 34% to 40.3 billion yuan, beating analyst estimates for 39.5 billion yuan.

During an analyst briefing on Tuesday in Hong Kong, Chairman and founder Wang Chuanfu narrowed the company’s 2025 sales target, saying BYD is now aiming to sell around 5.5 million vehicles this year, including 800,000 units overseas, according to people familiar with the matter. That’s a more specific target than the five to six million BYD had earlier touted, including about one million exports.

BYD shares fell as much as 4.1% in Hong Kong trading Tuesday. Even so, the stock is up around 46% this year and last week hit a record high.

In the fourth quarter of 2024, BYD delivered 73% growth year-on-year in net income of 15 billion yuan on 275 billion yuan in sales. Analysts at Citibank and Morgan Stanley said BYD’s performance in the final quarter of the year was in line with expectations.

“This was a good set of results with very-high earnings quality,” Citi analyst Jeff Chung said.

BYD has risen quickly to the top of China’s car market — the world’s biggest and most competitive in terms of electric vehicles. This year alone, BYD has unveiled a new ecosystem that allows EVs to charge for 400 kilometers in just five minutes and introduced advanced driver assistance technology in even its most basic models.

While BYD also sells about the same number of EVs as Tesla — 1.76 million in 2024 versus 1.79 million — when all of its other passenger hybrid car sales are included, it’s much larger. BYD’s total deliveries last year climbed to 4.27 million, almost as much as Ford Motor Co.

BYD’s 2025 is off to a strong start, with sales in the first two months up 93% year-on-year to 623,300 units.

Cathie Wood, the ARK Investment Management LLC founder and long-time Tesla bull said the US automaker is still very competitive compared to BYD, and said she’s excited about the impending launch of a low-cost model.

“We are looking at the BYD cars and they’re fabulous from what we can see,” she said in a Bloomberg TV interview in Hong Kong on Tuesday. “Fit, finish and design.”

One area where Tesla still clearly leads however is market valuation. The US carmaker is worth about $800 billion despite a share-price rout that’s seen the stock plunge 38% this year. BYD has a market capitalization closer to $157 billion.

Musk’s EV maker also makes more money on an absolute basis; Tesla’s net income last year was $7.6 billion.

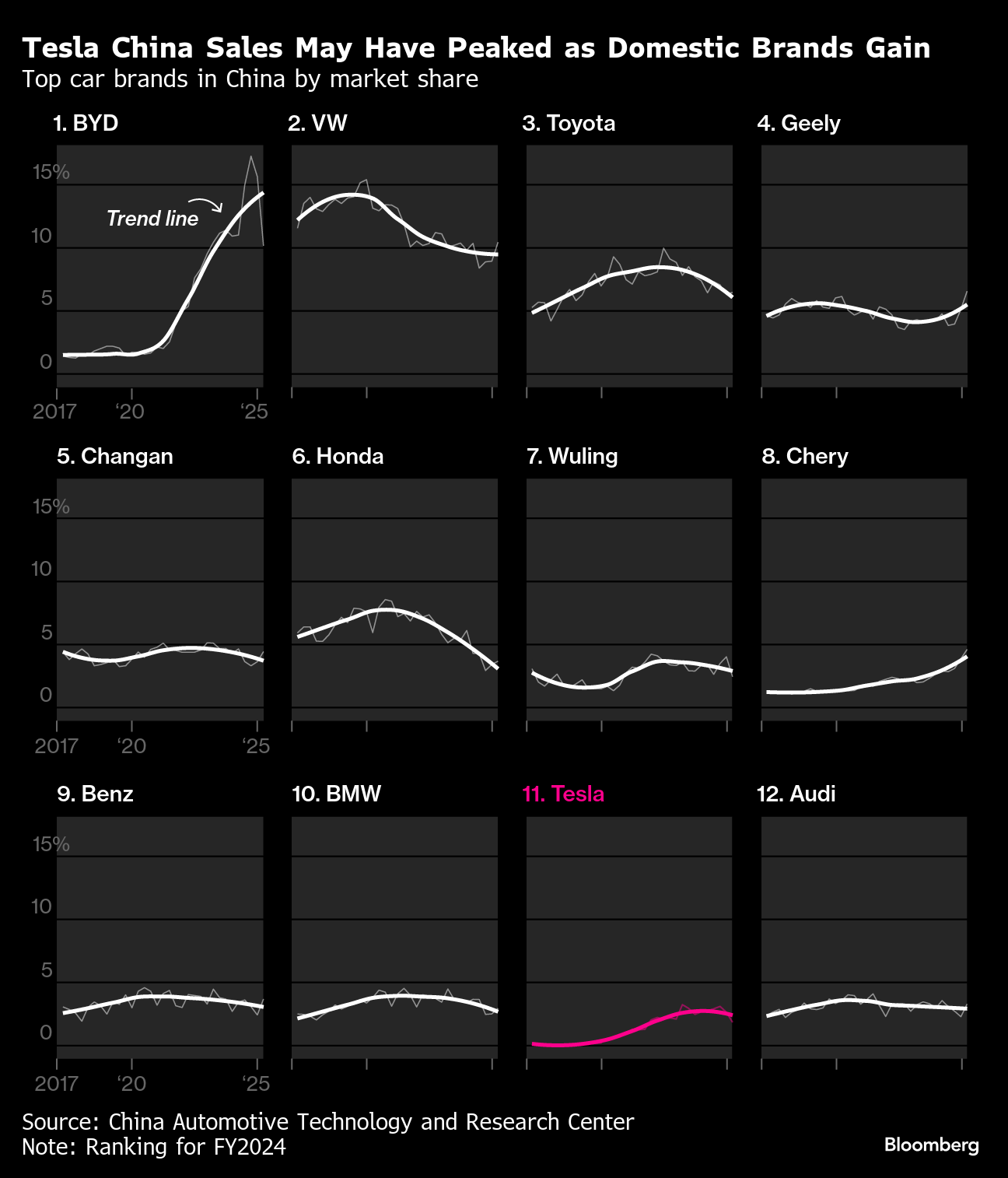

But whereas Tesla is losing in China — shipments have been backsliding there for the past five consecutive months on a year-on-year basis — BYD is winning. China is still far and away BYD’s biggest market, where it commands a share of almost 15%, not just for new-energy vehicles but any sort of passenger car.

BYD doesn’t sell passenger cars in the US yet due to punitive tariffs on made-in-China automobiles, but it’s made big inroads into markets in Europe, places in Asia like Singapore and Thailand, as well as Australia.

Chairman Wang said in a statement the company planned to keep boosting research and development while bolstering its product competitiveness, including in its focus of succeeding outside of China.

He also said that Chinese auto brands in the era of intelligence-led vehicles were no longer merely followers, but rather at the forefront of the trend. They’re “daring” to be first in the world and are collaborating with other domestic brands to go global and move up the value chain, he said.

(Adds details from analyst briefing in 3rd paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

Nissan Commits Another $1.4 Billion to China With EVs in Focus

NextEra Energy reports 9% rise in adjusted earnings for Q1 2025 as solar and storage backlog grows

US Imposes Tariffs Up to 3,521% on Asian Solar Imports

India Battery-Swapping Boom Hinges on Deliveries and Rickshaws

China Reining In Smart Driving Tech Weeks After Fatal Crash

Japan Embraces Lab-Made Fuels Despite Costs, Climate Concerns

GE Vernova’s HA-powered Goi Thermal Power Station adds 2.3 GW to Japan

Used Solar Panels Sold on Facebook and eBay Have Cult Following