China’s Congress to Chart Course for Global Commodities Prices

(Bloomberg) -- China’s annual congress meets against a backdrop of industrial overcapacity, a still-floundering property market and the prospect of a worsening trade war with the US. Decisions on all these challenges by the world’s biggest consumer of raw materials could be decisive for global commodities markets.

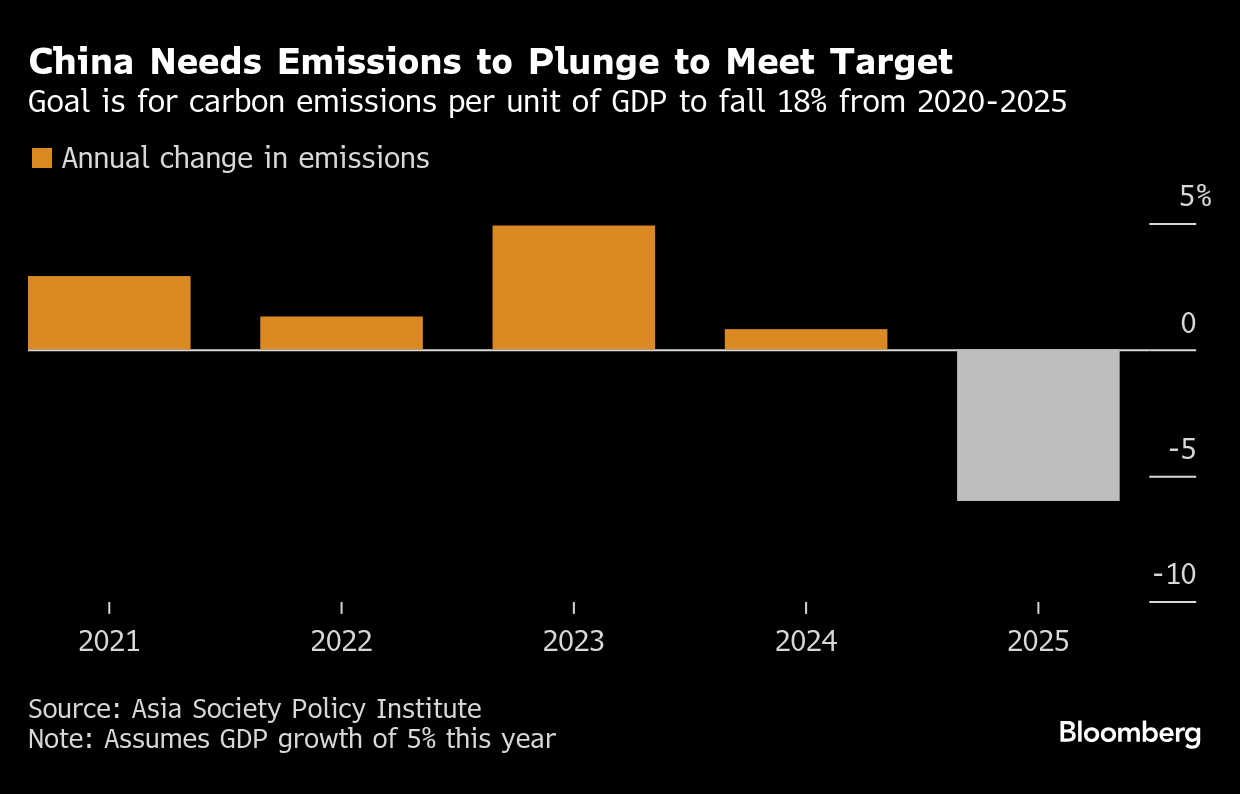

This year also marks Beijing’s last chance to meet the goals laid out in the five-year plan that began in 2021. At present, the scorecard for key metrics around energy and emissions is mixed at best.

Fiscal Stimulus

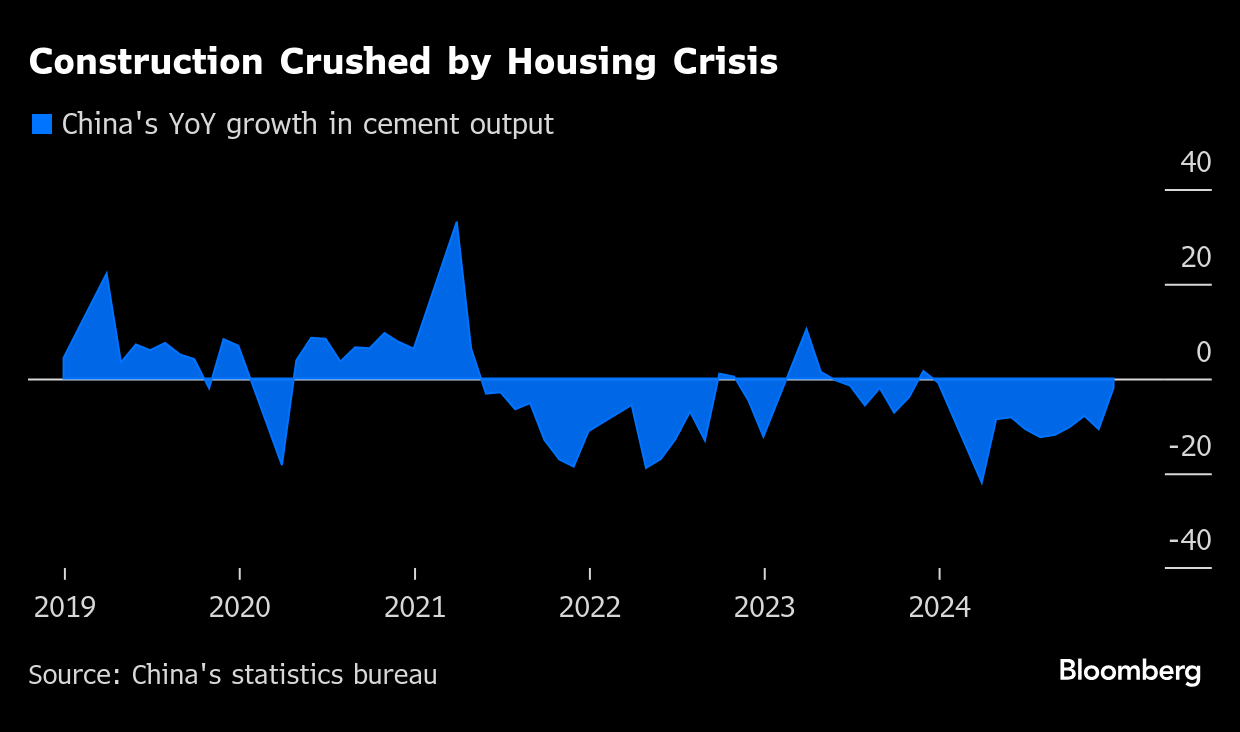

Building materials like steel and cement have been worst hit by China’s construction downturn. Traders will be on the lookout for government spending plans that throw these industries a lifeline, whether through an expansion in the budget deficit or bond issuance that can be deployed on fixing the housing crisis or investment in public works.

However, the likelihood is that Beijing will target consumption with its fiscal policy, as part of a longstanding desire to wean the economy off its traditional growth drivers. That could mean more subsidies for purchases of durable goods or equipment upgrades, which would be a bigger deal for base metals than ferrous. Investment in energy or digital infrastructure is another area that could favor copper and aluminum over steel.

Energy Security

China looks likely to hit its five-year goals for clean power adoption and fossil fuel output by the end of 2025. The portion of energy derived from non-fossil fuels is already close to the 20% promised. The target of raising annual oil output to 200 million tons has been met since 2022. A repeat of the blackouts that struck at the start of the decade has been avoided by a massive expansion in coal supplies.

But the country is falling down on its pledges to become more energy efficient. It’s also likely to miss its mark for reducing the intensity of its carbon emissions. It’s probably too much to expect policymakers to rescue those goals in the final months of the five-year plan, which would set up next year’s congress and its program for 2026-2030 as make-or-break in terms of forcing China back onto a more sustainable track.

Renewable Power

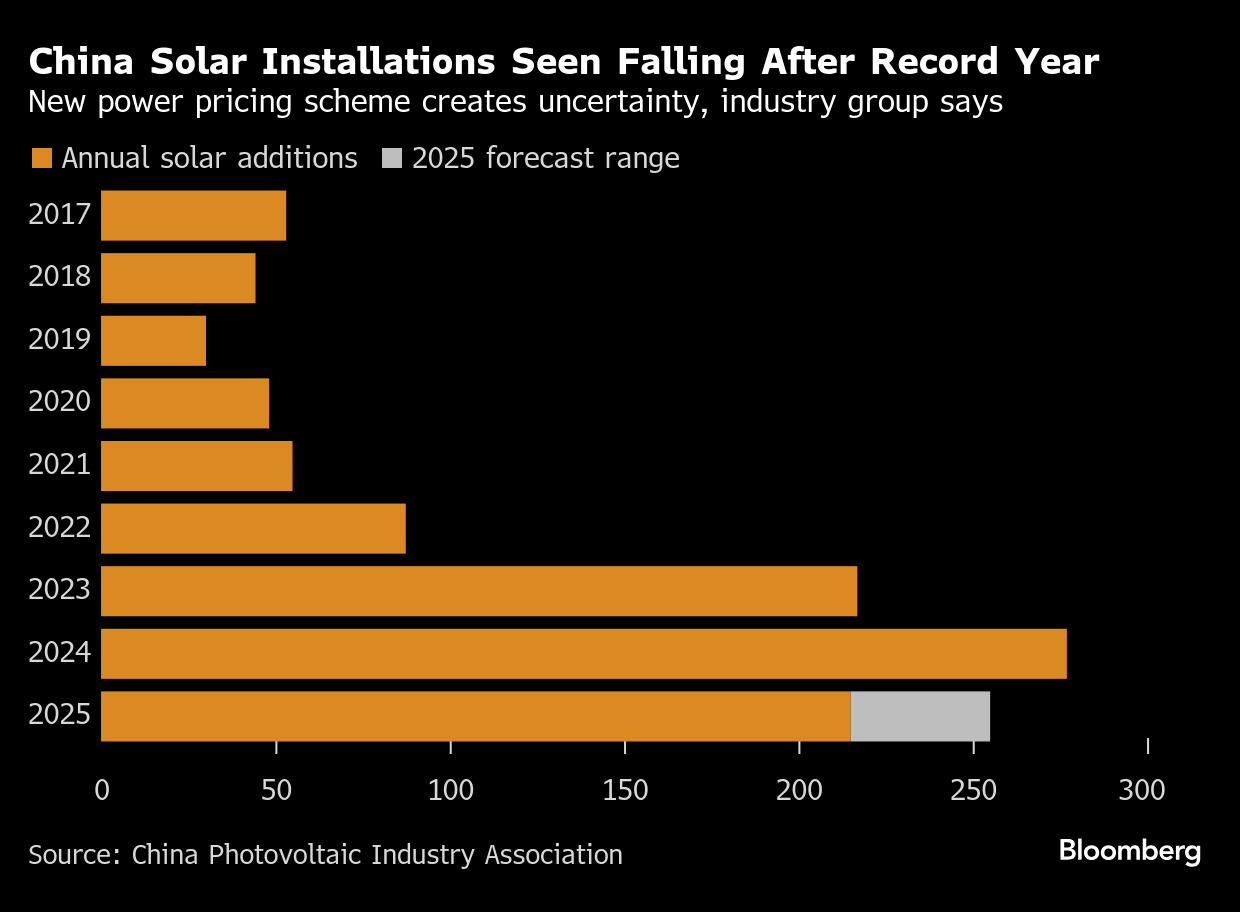

The breakneck growth in renewables could hit a speed bump this year as China adopts market pricing for wind and solar. Developers, as well as the manufacturers of batteries to manage intermittency, face greater uncertainty after June 1, when some existing incentives lapse. Lower electricity prices should benefit some consumers.

Wind and solar have been crucial in stemming the growth in coal-fired power. But the grid continues to demand more investment to accommodate their rising contribution. And to meet the country’s climate goals, policymakers may have to shift more attention to expanding the types of clean energy that can better match coal’s round-the-clock supply, such as nuclear and hydropower, and pumped hydro for energy storage.

Curbing Capacity

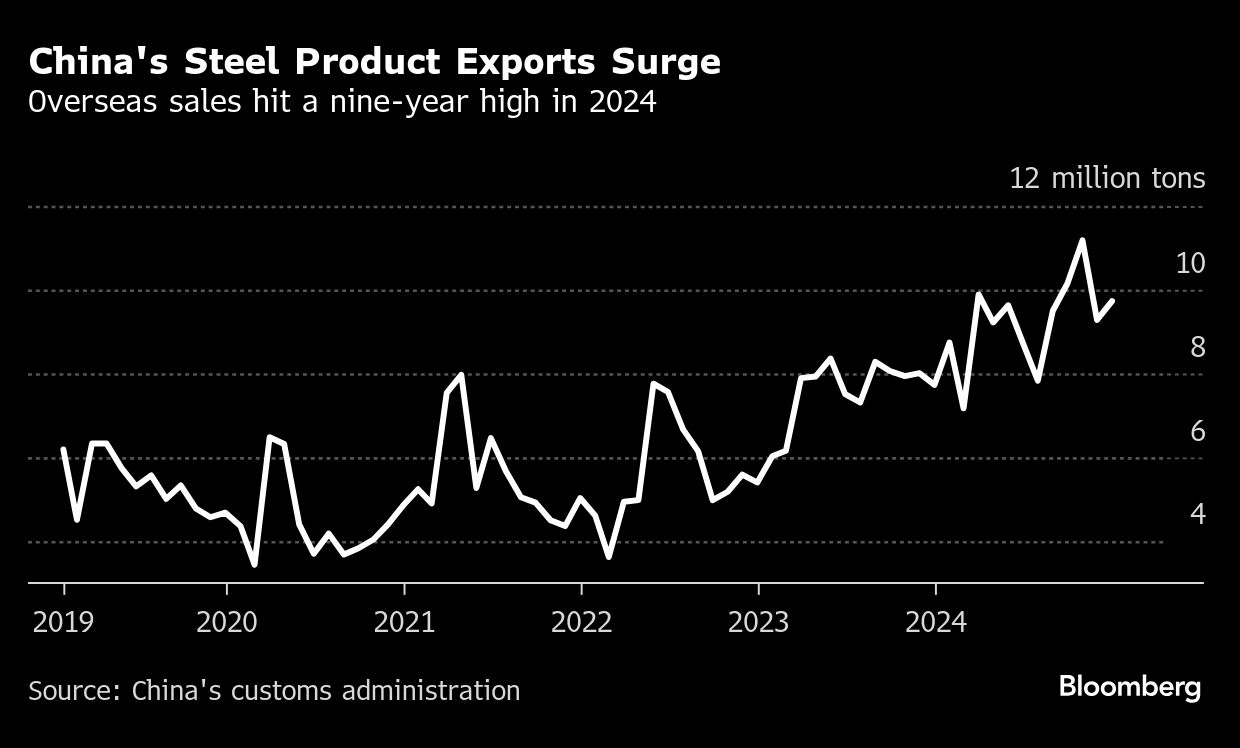

Reining in smokestack industries is one way of getting energy efficiency and emissions back in line, as well as helping break the economy’s deflationary spiral. Beijing’s latest curbs on copper smelting follow measures of varying severity applied to other commodities in recent years. Independent oil refiners are teetering after a tax crackdown, while the steel industry could be headed for another shakeup. Sectors like solar are relying on self-discipline among manufacturers to ease their glut.

Local governments need to be mindful of growth targets from Beijing and employment when managing their biggest industries. But overproduction isn’t just a domestic issue. It’s increasingly a bone of contention for China’s trade partners as the country exports its surplus of items like steel. Any sense that policymakers are prepared to take a tougher line on overcapacity could be bullish for the commodities affected.

Surplus Food

Food security remains non-negotiable and the government is likely to be far more forgiving of some of the agricultural surpluses that have built up as the economy has slowed. The issue for policymakers is how to support rural incomes amid the glut, which has put imports in the firing line in recent months. Trade probes have been launched covering rapeseed, beef, pork and dairy.

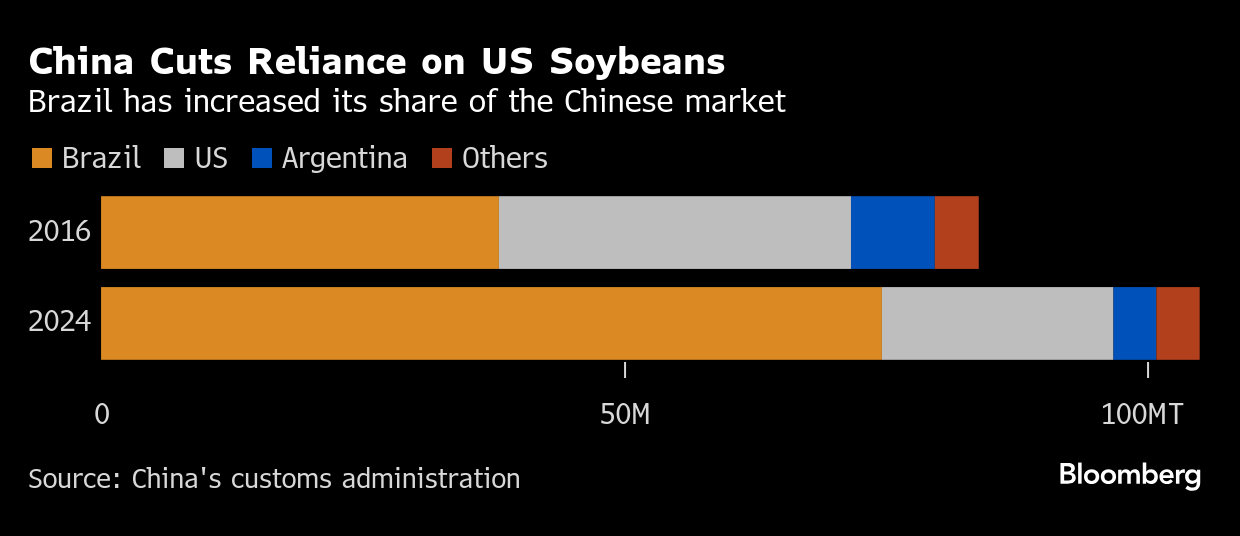

Other efforts to diversify foreign supplies, particularly away from an increasingly antagonistic US, have also borne fruit. But that effort could be challenged if the Trump administration invokes its previous trade deal with Beijing and demands that China opens up more to American produce.

On the Wire

President Xi Jinping heads into China’s biggest political huddle of the year with his economy finally getting back some swagger. Donald Trump’s rising tariffs will test Beijing’s ability to sustain that momentum.

China’s factory activity returned to expansion in February, a sign of resilience in an economy hit by higher US tariffs and suffering from weak domestic demand.

China’s top coal groups have called for companies in the sector to adjust their production to prevent “severe” oversupply amid falling prices. Languishing global prices today mask a very different future for the world’s most-consumed source of power.

This Week’s Diary

(All times Beijing unless noted.)

Monday, March 3:

- Caixin’s China manufacturing PMI, 09:45

Tuesday, March 4:

- First of China’s two legislative sessions, the CPPCC, begins in Beijing

- EARNINGS: MMG

Wednesday, March 5:

- National People’s Congress begins in Beijing

- Caixin’s China services & composite PMIs, 09:45

- CSIA’s weekly polysilicon price assessment

- CCTD’s weekly online briefing on Chinese coal, 15:00

Thursday, March 6:

- CSIA’s weekly solar wafer price assessment

Friday, March 7:

- China’s Jan.-Feb. trade balance and 1st batch of trade data, ~11:00

- Crude oil, natural gas & coal imports; oil products imports & exports

- Iron ore, copper & steel imports; steel, aluminum & rare earth exports

- Soybean, edible oil, rubber and meat imports; fertilizer exports

- China’s foreign reserves for February, including gold

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, March 8

- Nothing major scheduled

Sunday, March 9

- China’s inflation data for February, 09:30

- China to release Feb. aggregate finance & money supply data by March 15

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

EU Set to Recommend Company Cars Take the Lead in EV Shift

Australia’s Green Hydrogen Outlook Seen Souring Before Elections

China Solar Lobby Sees Fewer Installations After Record Year

Tepco Falls on Risk of Delay to Restart World’s Top Atomic Plant

Masdar, TAQA, and Eni sign agreement to support the tripartite initiative

Southwest Airlines Retreats on Clean Fuel and Climate Initiatives

Chinese EVs Make Inroads in Nigeria as Gasoline Prices Rise

Trump Ends US Initiative to Boost Electricity Access in Africa

India Mulls $1 Billion Subsidy Plan to China-Proof Solar Sector