China’s Energy Transition at Odds With Solar Glut, Cheap Power

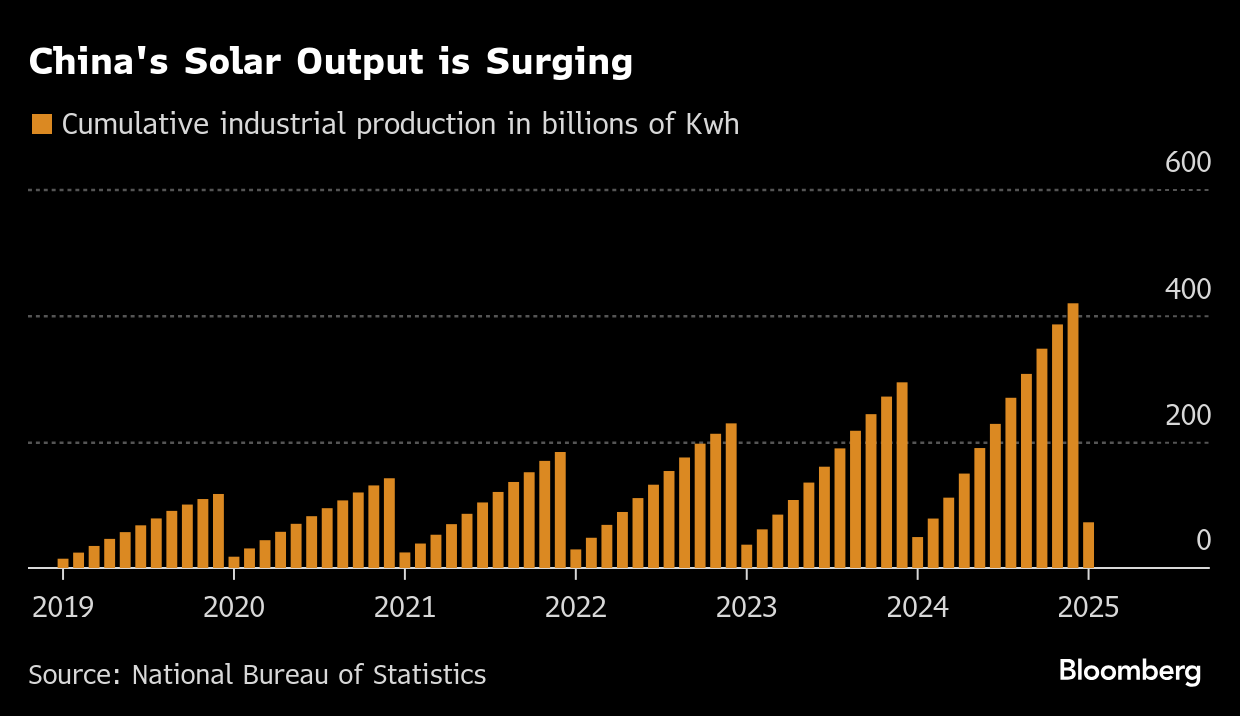

(Bloomberg) -- The green energy transition in China is at a critical juncture, as oversupply in the solar sector, declining power prices, and continued reliance on fossil fuels threaten to derail progress.

Chinese spending on renewable energy dwarfs its rivals, with over $800 billion — or 4.5% of its GDP — invested last year, according to BloombergNEF. But the country still faces significant hurdles in balancing its ambitious climate goals with delivering energy security, according to experts at BNEF’s summit in Beijing last week.

It’s uncertain whether existing infrastructure can support the surge in wind and solar, said Yong Zhao, president of the Energy Research Institute at China Huaneng Group, a major electricity supplier. “We are in uncharted territory for the power transition,” he said.

The decades-long boom in clean energy is straining the grid, and cuts in output of solar equipment are “too late and too little” to end the industry’s slump this year, said BNEF analyst Youru Tan. BNEF now expects a longer trough in prices rather than a V-shaped recovery, he said, pointing to a failure to eliminate smaller, inefficient factories.

China is still expected to keep installing renewables at pace, with annual additions of around 300 gigawatts over the next decade, said Zhongying Wang, a senior researcher at a government-affiliated think tank. That would help deliver over 9,000 gigawatts by 2060, President Xi Jinping’s net zero deadline, which would be six times current levels.

But such a rapid expansion will require massive investment in long-distance transmission lines, energy storage, and flexible peak-loading to make up for clean energy’s intermittency.

“Coal and gas remain the most accessible balancing tools for grid stability,” said Huaneng’s Zhao.

The deluge of solar power has thrust electricity prices into negative territory in regions with liberalized energy markets, which bodes ill for the economics of further expansion.

Shandong province, home to China’s largest solar fleet, has been forced to curtail rooftop projects due to grid constraints. Its three-year-old spot market saw prices settle below zero for over 1,000 hours last year, an occurrence that will become more frequent, said BNEF analyst Sisi Tang.

On the Wire

To maximize the impact of the fiscal stimulus announced at the National People’s Congress, China must front-load spending in 2025 — breaking an old habit that’s hard on the economy, said Bloomberg Economics.

A proposed US trade measure to impose million-dollar levies on Chinese ships docking in the US risks a ‘Trade Apocalypse.’

Copper bull Kostas Bintas predicts prices will surge to record highs as the US draws huge amounts of metal, leaving the rest of the world, including top consumer China, short.

Chinese Premier Li Qiang said the country is prepared for “shocks that exceed expectations” as the world braces for US President Donald Trump to announce more tariffs on its trading partners next month.

Sinopec’s full-year profit tumbled 16% amid sluggish demand, with China’s oil consumption likely nearing a peak.

This Week’s Diary

(All times Beijing unless noted.)

Monday, March 24:

- China Development Forum in Beijing, day 2

- China’s monthly medium-term lending rate

- Sinopec online earnings Q&A at 12:15 and briefing in HK at 15:00

- EARNINGS: BYD, Anhui Conch

Tuesday, March 25:

- Boao Forum, day 1

- EARNINGS: WH Group, China Modern Dairy, China Oilfield Services, Kunlun Energy, Huaneng Power, Datang Intl Power

Wednesday, March 26:

- Clean Energy Expo China in Beijing, day 1

- Boao Forum, day 2

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

- EARNINGS: CGN Power, Beijing Gas, Chalco, Tianqi Lithium, China Mengniu Dairy

Thursday, March 27:

- Clean Energy Expo China in Beijing, day 2

- Boao Forum, day 3

- China’s industrial profits for February, 09:30

- Beijing Gas earnings briefing in HK, 10:00

- CSIA’s weekly solar wafer price assessment

- EARNINGS: Cnooc, Jiangxi Copper, China Natl Building

- Cnooc earnings briefing in HK, 17:00

Friday, March 28:

- Clean Energy Expo China in Beijing, day 3

- Boao Forum, day 4

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Maanshan Steel, Angang Steel, Citic Ltd., Ganfeng Lithium, Goldwind, GCL-Poly, Datang Renewable Power

Saturday, March 29

- Nothing major scheduled

Sunday, March 30

- EARNINGS: PetroChina

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

New Jersey Wildfire Is Tied to Arson as Firefighters Make Gains

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

Nissan Commits Another $1.4 Billion to China With EVs in Focus

NextEra Energy reports 9% rise in adjusted earnings for Q1 2025 as solar and storage backlog grows

US Imposes Tariffs Up to 3,521% on Asian Solar Imports

India Battery-Swapping Boom Hinges on Deliveries and Rickshaws

China Reining In Smart Driving Tech Weeks After Fatal Crash

Japan Embraces Lab-Made Fuels Despite Costs, Climate Concerns