How BYD’s Five-Minute Charges Compare With Competitors

(Bloomberg) -- Chinese automaker BYD Co. is turning heads with claims that it’s developed an electric-vehicle platform it says will enable drivers to charge an EV in roughly the same time it takes to refuel a gasoline car.

From “more features for no more price” and “smart driving for all,” BYD can now add “charging as fast as refueling” to its marketing slogans, potentially helping it to capture more share from legacy automakers and more direct rivals like Elon Musk’s Tesla Inc.

How does BYD’s new system work and compare to rivals’ offerings?

BYD showcased the upgrade to its EVs (the Shenzhen-based automaker also makes hybrid cars) at an event Monday evening in China. The so-called Super e-Platform features flash-charging batteries, a 30,000 RPM motor and new silicon carbide power chips.

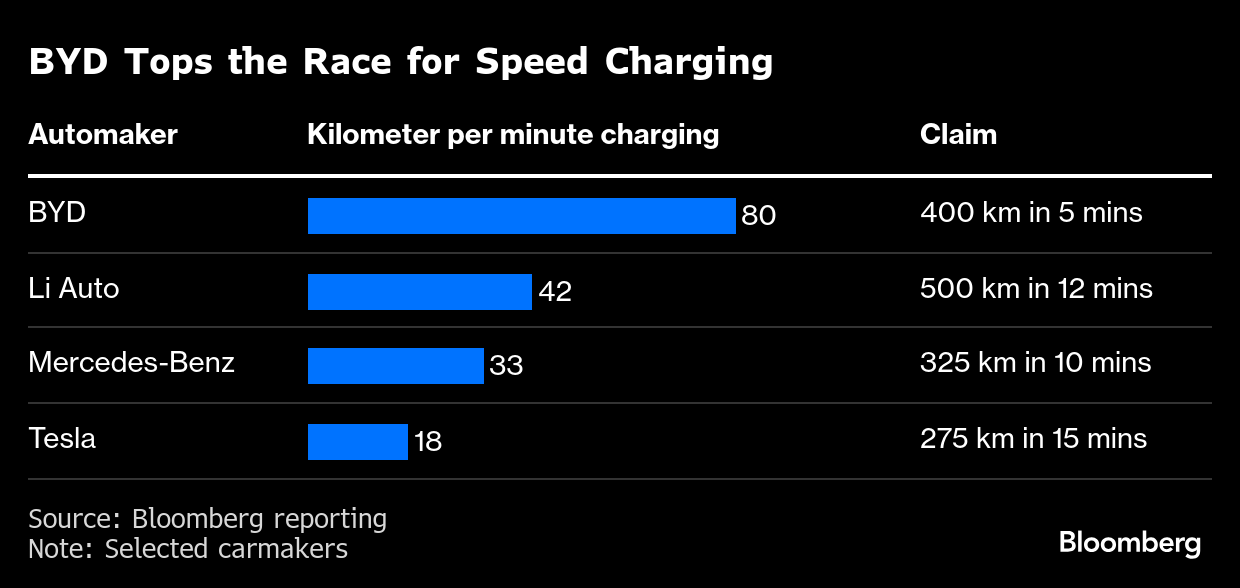

In layman’s terms, what this means is that BYD’s cars can achieve a charging power of one megawatt and a peak charging speed of two kilometers per second, according to the company, making it the fastest system of its type for mass-produced vehicles and allowing for 400 kilometers of range to be added in just five minutes of charging.

That’s more or less analogous to what it takes to drive in and out of a gas station and pay for a full tank.

The capability BYD is claiming outperforms Tesla’s Superchargers, which can do 275 kilometers in 15 minutes, according to the company’s website. Mercedes-Benz Group AG’s new entry-level CLA sedan EV, can achieve 325 kilometers in 10 minutes.

BYD also has plenty of competition closer to home. China’s Li Auto Inc., for example, uses a battery from Contemporary Amperex Technology Co. Ltd., or CATL, in one of its vehicles that offers 500 kilometers of range from a 12-minute charge.

BYD says it’s made such leaps that the Han L, one of the EVs that will now come with the new Super e-Platform, is comparable to a Formula E racing car.

How has BYD made it possible to charge so fast?

BYD cites its “all liquid-cooled megawatt flash charging terminal system.”

In addition, to match the ultra-high power charging, BYD has self-developed a next-generation automotive-grade silicon carbide power chip. The chip has a voltage rating of up to 1500V, the highest to date in the car industry.

In tandem, BYD on Monday launched its flash-charging battery. From the positive to the negative electrode, the cell contains ultra-fast ion channels, which BYD says reduces the battery’s internal resistance by 50%.

There’s also a mass-produced 30,000 RPM motor. Luo Hongbin, BYD senior vice president, said the motor “not only significantly boosts a vehicle’s speed, but also greatly reduces the motor’s weight and size, enhancing power density.”

Is it safe?

That’s a complicated question. For super-fast charging, there may be some impact to the safety of a battery and its lifetime durability. Older batteries may be not suited to such quick charging. At the same time, large charging currents can lead to severe overheating, Tsinghua University professor Ouyang Minggao wrote in a 2024 paper.

There could be added costs, too. Guotai Junan Securities Co. has estimated that to upgrade an EV from a 400-volt to 800-volt architecture may add a cost of about 4,000 yuan ($550) per vehicle. BYD’s latest platform goes up to 1,000 volts, which fires up the battery, motor, air conditioning and other components.

Separately, electricity grids may not be able to sustain the load from such high-intensity charging, meaning these super-fast charging stations — BYD says it plans to build more than 4,000 of them in China — may not be able to draw power from the grid directly, according to Ouyang.

Some EV makers, like Xpeng Inc., which is also working on super-fast charging technologies, have unique energy-storage units at their charging stations to help manage the elevated power demand.

Where can BYD’s new five-minute charging system be used? Can it help solve range anxiety?

BYD Chairman Wang Chuanfu said on Monday that “charging anxiety” is still a major concern, despite advances in EV technology. People don’t want to wait for hours while their car powers up, or worse, drive to a charging point only to find it broken or occupied.

BYD’s ultra-fast charging cars could therefore go a long way to ease charging anxiety. Fast-charging batteries are “another step toward reducing consumer hesitancy for EVs,” said Vincent Sun, an analyst at Morningstar Inc. But he adds that the high voltage requirements on charging poles “aren’t widely supported yet.”

For the time being, BYD’s system will only be available in China. The first models to feature its Super e-Platform will be the Han L and Tang L. Those have officially started pre-sales in China and are set to launch in April.

Automakers building out their own charging infrastructure, which include BYD and Tesla, are raising questions about the value of battery swapping, especially for those carmakers with closed ecosystems like Nio Inc. Rather than charging up an EV battery, battery swapping is where a driver physically swaps out their spent battery for a new one. Nio has now built out more than 3,200 swapping stations globally, with most located in China.

What about other battery technologies, like solid state? Would they be better?

Solid-state batteries are generally considered safer than traditional lithium-ion batteries because they use a solid electrolyte instead of a liquid or gel electrolyte.

That matters for a few reasons. There’s a lower risk of dendrite formation — needle-like lithium metal structures that can form over time and pierce the separator between electrodes, causing short circuits. Solid-state batteries operate more safely at higher temperatures, reducing the risk of overheating, and there’s less risk of leakage, limiting the risk of hazardous chemical exposure.

But solid-state batteries are much costlier to manufacture, leading to issues with scalability and mass production, and several prototypes still experience cracking and degradation due to repeated charging cycles. Solid-state cells also have limited performance at low temperatures, making them problematic in colder areas during winter.

How much will BYD’s models using this new technology cost?

The Han L starts from 270,000 yuan, while the Tang L sport utility vehicle starts from 280,000 yuan. Both also boast the company’s latest God’s Eye smart-driving features.

(Corrects duration of Tesla charging claim in the sixth paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Blaze Triggers Alarm Over Rapid Growth of Big Batteries

Musk Buyouts Poised to Hit US’s $400 Billion Green Energy Bank

Spain’s Nuclear Shutdown Set to Test Renewables Success Story

How Climate Tech Investing Is Being Shaped by Trump’s Tariffs and Orders

China Announces Quartz Discovery Vital to Chips to Rival US Mine

Chinese Battery Makers See Tariff Pain Added to Domestic Woes

AI Data Center Growth Means More Coal and Gas Plants, IEA Says

Trump Signs Orders to Expand Coal Power, Invoking AI Boom

Clean Power Offers Safety to China Investors Rattled by Tariffs