VW, Stellantis Are Big Winners From EU Relaxing CO2 Rules

(Bloomberg) -- Car executives who’ve walked back their electric vehicle ambitions are breathing sighs of relief after the European Commission proposed easing emissions rules that were supposed to get stricter this year.

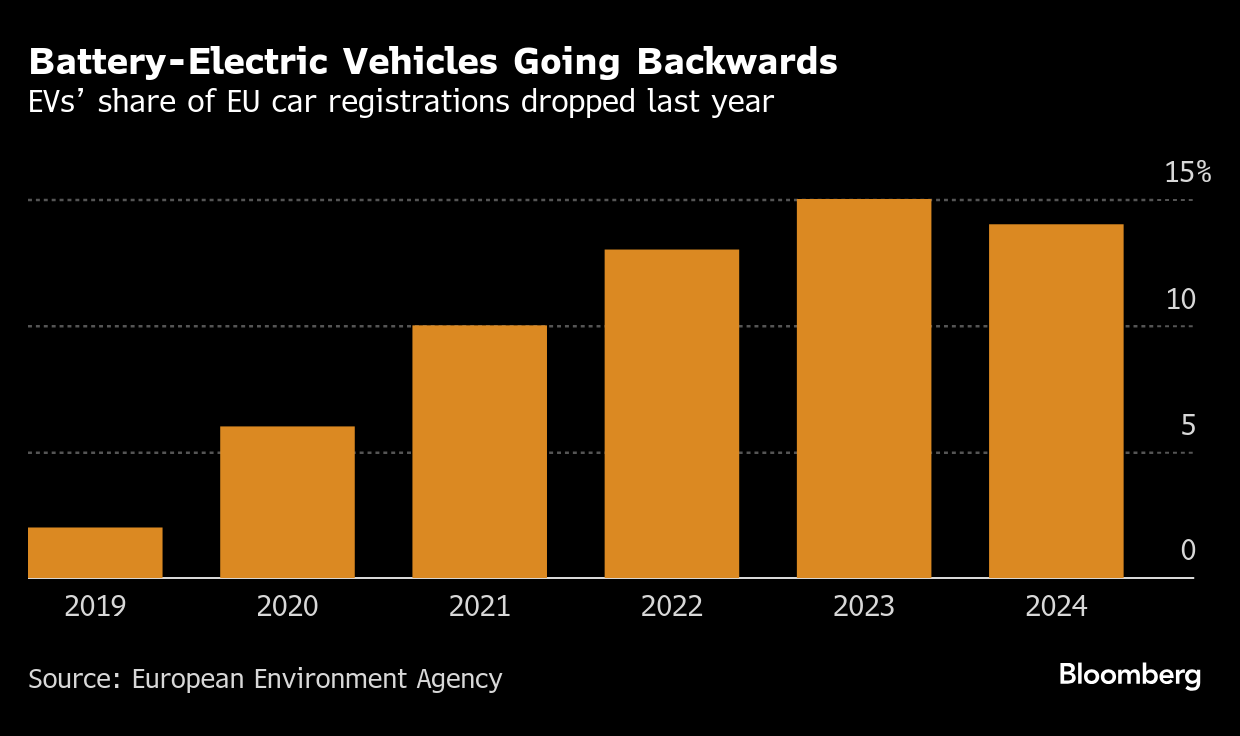

By allowing automakers to exceed tougher targets in 2025 and avoid fines, President Ursula von der Leyen is bowing to months of pressure from an industry that already was wavering on electrification. Volkswagen AG and Stellantis NV, in particular, have recalibrated product plans after ousting chief executives who bet aggressively on EVs that consumers weren’t yet ready to buy.

VW, Stellantis and Renault SA are positioned for the biggest boost from the policy change, which still needs to be approved by member states and the European Parliament. The three combined sell more than half the new vehicles registered in the European Union, and Bloomberg Intelligence was expecting each of them to struggle with CO2 compliance this year.

Removing the emissions burden could lift the companies’ earnings by almost €3 billion ($3.2 billion), BI senior industry analyst Michael Dean estimates.

On Wednesday, the European Union’s executive arm released its plan to help the auto sector compete globally during the green transition, which includes the added flexibility for emissions targets. It also unveiled its vision to turbocharge the EV rollout by overhauling the bloc’s company car market, boost domestic battery makers and spur innovation in autonomous vehicles. The bloc will also offer €1.8 billion over the next two years to boost the supply chain for battery raw materials.

“Europe’s emission standards for new cars and vans provide long-term certainty for investors. So they remain,” Apostolos Tzitzikostas, the bloc’s transport commissioner, told reporters. “But we must also be pragmatic.”

He added that the commission would bring forward its review of the 2035 zero-emissions target from next year to the second half of this year.

Not everybody’s convinced the commission is striking the balance it seeks. Volvo Car AB, which was in position to be compensated by Mercedes-Benz Group AG for helping the German luxury-car maker with CO2 compliance, opposes the action on the grounds that the industry was given years of time to prepare for the stricter standards.

Tesla Inc. also was in line to be paid by rivals wanting to pool their fleets with the EV maker, while BI was expecting BMW AG to hit its emissions target.

The combination of trade war threats and economic difficulties bolstered manufacturers’ case for regulatory flexibility, says William Todts, executive director of advocacy group Transport & Environment. Nevertheless, he criticized the proposal as unnecessary and unjust.

“I don’t think you should change the rules of the game in the middle of the game,” he said.

Volkswagen’s Turnabout

VW began walking back from an EVs-or-bust strategy after pushing out former CEO Herbert Diess in 2022 and replacing him with Oliver Blume, who’d been betting on alternatives including carbon-neutral fuel development as the top executive at Porsche.

Roughly a year after taking over, Blume scrapped plans to build a new €2 billion EV factory in VW’s hometown of Wolfsburg, Germany. The company’s namesake brand then laid plans to introduce more hybrid models as demand for fully electric cars started to slow. While VW is still developing EVs in Europe and China, it doesn’t have a new electric car coming in 2025, with key products pushed back amid delays developing software.

Around this time last year, Blume called for the commission to soften its CO2 targets. “It doesn’t make sense that the industry has to pay penalties when the framework conditions for the EV ramp up aren’t in place,” he said during the company’s presentation of annual results.

Stellantis’ Rethink

Stellantis has similarly backpedaled since former CEO Carlos Tavares resigned in December after falling out with Chairman John Elkann and the board.

Tavares had vowed to comply with Europe’s emissions standards by leveraging the company’s breadth of brands ranging from Peugeot, Fiat and Opel, to Alfa Romeo and Maserati. In the wake of his departure, the manufacturer has been rushing to expand its lineup of hybrids.

Late last year, Maserati informed unions and dealers that it had abandoned plans for an all-electric supercar, saying that its customers were still keen to drive high-performance models powered by beefy combustion engines.

Three-Year Window

The commission sees its proposed three-year window to meet emissions standards as a way of offering carmakers some leeway while keeping its climate goals largely intact. Companies that miss their target for 2025 can make up for it with over-compliance in the following two years.

Regulators also will begin a review this year of the overall goal of selling only emissions-free new cars in Europe from 2035 onward. They’ve already said that they will provide a carve-out for so-called e-fuels, which resemble conventional gasoline but are made using renewable electricity and CO2 captured from the atmosphere.

“In the end, the benefit for the climate will be the same, but we avoid penalties at this particular time,” said Peter Liese, a lawmaker from the center-right EPP group, the largest in the parliament. “Car companies will now focus on their strategy to achieve the target next year and in 2027.”

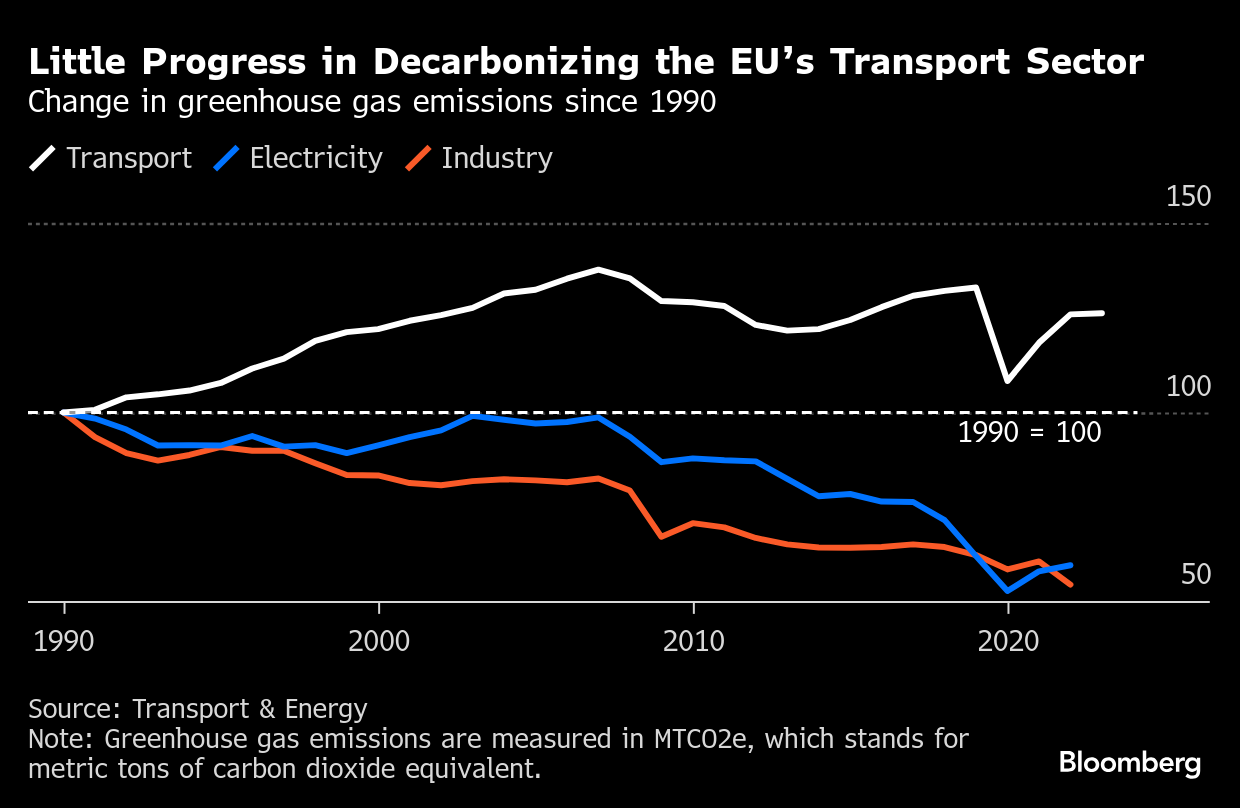

Transport accounts for over a quarter of the EU’s emissions, with road transport the biggest contributor. Unlike other sectors, little progress has been made in reducing pollution and it remains the only one where emissions have risen since 1990.

Climate groups are now concerned that more exemptions and flexibilities could be added to CO2 targets in the future, including for the 2035 goal for a 100% reduction in emissions. If the commission’s rules are no longer seen by manufacturers as credible, it could undermine the EU’s goal to reach climate neutrality by 2050.

“It’s up to the commission and the EU to restore the confidence of investors in the market in the credibility of the Europe strategy to go electric,” T&E’s Todts said. “How certain can we be that the 2035 target is rock-solid?”

(Updates with release of autos plan, news conference starting in fifth paragraph)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Spain’s Toxic Politics Clouds Investigation Into Power Blackout

Trump EPA Approves Sales of High-Ethanol E15 Gasoline for Summer

Want Solar Panels on Your Roof? How to Navigate Market and Tariff Chaos

New Danish Nuclear Power Fund Targets Raising €350 Million

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Spain Signals Openness to Keeping Nuclear Power Plants Open

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

As Tesla Falters, These New EVs Are Picking Up the Pace

Fashion Is the Next Frontier for Clean Tech as Textile Waste Mounts