Pembina Declines to Raise Offer in Battle Over Inter Pipeline

(Bloomberg) -- Pembina Pipeline Corp. said it wasn’t going to sweeten its bid for Inter Pipeline Ltd. one day after a new hostile offer for Canada’s fourth-largest midstream company was made by Brookfield Infrastructure Partners LP as the takeover battle intensifies.

The Canadian pipeline company doesn’t intend to increase or change the 0.5 common Pembina shares offered under its proposed acquisition of all common shares of Inter Pipeline, it said in a statement on Friday.

“Pembina believes that its strategic combination with Inter Pipeline is extremely compelling from an immediate and long-term value perspective and believes shareholders should vote in favour of the transaction,” the company said.

Pembina is standing its ground after Brookfield Infrastructure said it’s increasing the cash component of its offer on July 15 by 2.6% to C$20 ($15.86) for each share of Inter Pipeline, or 0.25 of a Brookfield Infrastructure share, in another push to break up Pembina’s friendly, all-stock takeover. That increased Brookfield Infrastructure’s hostile offer to C$8.6 billion.

In a statement on Friday, Inter Pipeline said it stands by comments it issued the prior day, when the company said no formal revised offer had been made by Brookfield and shareholders needn’t take action yet.

“A formal recommendation by the board will be made to shareholders in due course,” Inter Pipeline said Thursday.

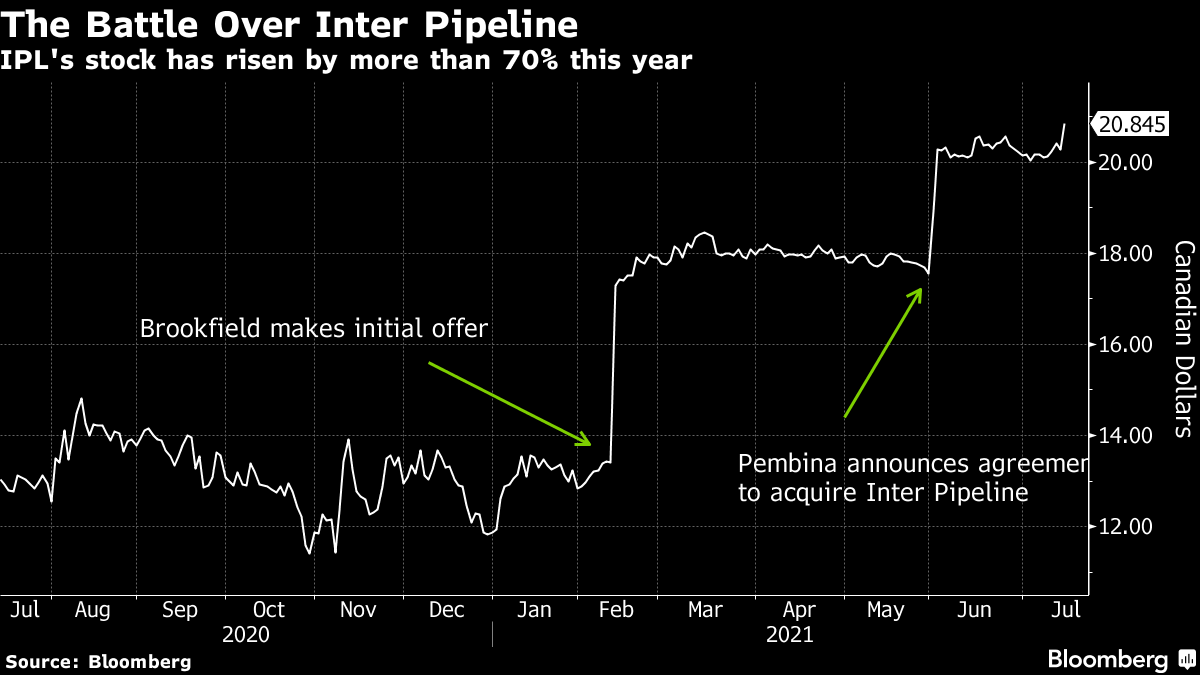

Pembina’s move is the latest twist in a takeover saga that started in February with an unsolicited C$7.1 billion offer by Brookfield Infrastructure that was rejected by Inter Pipeline’s board. Inter Pipeline announced an agreement with Pembina on June 1, and Brookfield has since revised its offer three times.

The fight over Canada’s fourth-largest pipeline company follows years of failed attempts to build major projects like TC Energy Corp.’s Keystone XL and Enbridge Inc.’s Energy East, which may have made existing lines more valuable. Inter Pipeline owns pipeline infrastructure across Western Canada, connecting oil and natural gas producers with domestic and foreign customers, as well as storage assets in Europe.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog