Europe Gas Drops as Rising Stockpiles Take Edge Off Supply Risk

(Bloomberg) -- Natural gas prices in Europe declined as rebounding stockpiles helped soothe supply concerns, even after Russia’s decision to cut flows to Finland this weekend.

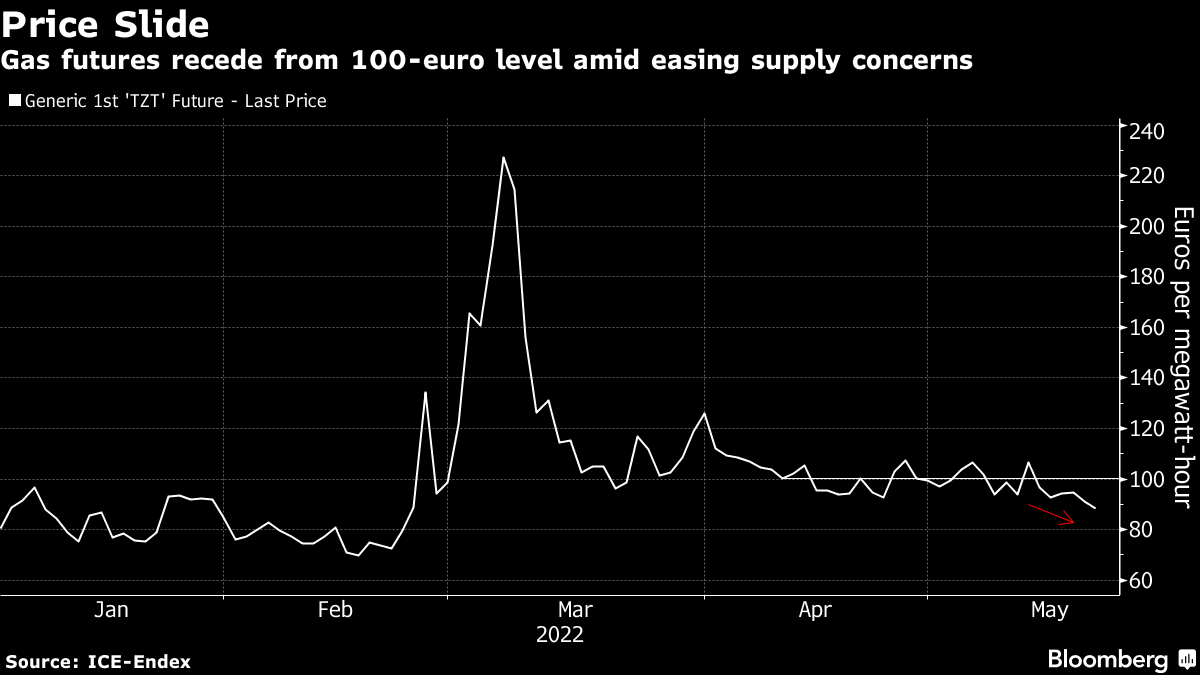

Benchmark futures fell 3.4% on Friday, extending this week’s loss to 9.3%, the most for the period since March. Europe’s gas inventories are recovering to near-seasonal levels as companies prepare for any potential disruption from Russia, the continent’s top provider.

Those supply worries flared up this week on Russia’s plans to cut off Finland’s gas supplies Saturday for refusing to comply with Moscow’s demand for payment in rubles. Finland will be the third European country to be disconnected after Poland and Bulgaria had their taps turned off last month for not agreeing to the new terms.

Still, some buyers, including Austria and Slovakia, said they’ve made their gas payments to new accounts and expect Russian supplies to continue.

Read more: Finland Loses Main Gas Supply as Russia Set to Turn Off Taps

The European Union wants to keep gas stockpiles high to guarantee energy security, given the risk of curtailments spreading over the continent amid the war, sanctions on Russia and the payment dispute.

The bloc reached a deal on Thursday to set a minimum inventory threshold of 80% before Nov. 1, with that level rising for subsequent winters. Storage levels on the continent have jumped this month and are close to the 45% five-year average, according to Gas Infrastructure Europe.

Dutch front-month gas, the European benchmark, closed at 87.90 euros per megawatt-hour, the lowest since Feb. 22. The U.K. equivalent plunged 12%, erasing its weekly gain.

Russian Flows

Russian gas flows to Europe somewhat steadied in the past couple of days, although supplies transiting Ukraine are still below normal. They dropped last week with one of the two key entry points on the border with Russia put out of service because of the fighting in the eastern part of Ukraine.

Under the new payment system, demanded by Moscow, Gazprom’s clients need to open two accounts, one in euros or dollars and the other in rubles. Gas bills would be paid into the foreign-currency account in Gazprombank, and the bank would transfer the funds into the Russian currency. Russian Deputy Prime Minister Alexander Novak said Thursday that about half of the 54 buyers of gas have done the required steps.

Read also: Ruble Hits 7-Year High as Gazprom Clients Heed Putin on Gas

Austria’s OMV AG said Friday that it’s made its gas payment to a newly-opened account in euros and considers contractual obligations fulfilled. That followed a similar announcement from Slovakia. The nation’s importer paid earlier this week, Deputy Economy Minister Karol Galek told the Slovak Spectator on Thursday.

Some European companies are also moving ahead with plans to buy Russian gas using new accounts, as it appears this would be allowed without breaching sanctions. Yet, EU guidance on the matter has left room for interpretation.

“A compromise between Gazprom and the majority of EU buyers on the new ruble payment scheme is more likely than not,” consultant Energy Aspects said in a research report. But “some firms with smaller contracts that are easier to replace may weigh up the costs of potential future legal challenges against the benefits of maintaining Russian supply,” it said.

The lost supplies in Finland will likely have a limited impact on the country’s economy, with the fuel accounting for about 5% of the energy mix. It’s mainly used by factories rather than for heating like in many other European nations.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog