Coal Miners Brace for ‘Awful Spring’ as Mild Weather Crimps Demand

(Bloomberg) -- The dramatic turnaround of the US coal industry that’s sent share prices soaring and provided a lifeline for miners is running out of steam.

Milder-than-expected weather that weakened demand has allowed stockpiles to swell, and coal prices are falling. The power-plant fuel also is facing competition from natural gas, which hasn’t been this cheap since late 2020. There are concerns that coal-fired US utilities will seek to delay contracted deliveries this year.

“It’s going to be an awful spring, if you’re looking at it from a coal perspective,” said Andrew Blumenfeld, director of data analytics at McCloskey by Opis. “There’s just no demand.”

It’s a stark reversal for the industry, which saw prices triple in both 2021 and 2022 amid a global energy crunch that sparked fossil-fuel demand. Coal miners already are sold out for the year and have locked in strong prices and boosted dividends. But those same companies also are starting to see potential cracks in the market.

“We have seen significant volatility in the energy markets, beginning in late 2022 and continuing through the start of 2023,” Jimmy Brock, chief executive officer of Consol Energy Inc., said during an earnings call Tuesday.

To be sure, miners are in a strong position, at least for now. Consol expects to boost production about 8% this year, and already has contracts to sell about 90% of it at prices as much as 20% higher than it got for 2022. The Canonsburg, Pennsylvania-based company posted record fourth-quarter profit of $5.39 a share, well above analysts’ expectation of $3.31. Consol also increased its dividend.

That mirrored the performance of Alliance Resource Partners LP, which posted record earnings last week, raised its payout to investors and said it’s already sold almost all of its expected 2023 production. Investors will learn even more next week, when coal giants Peabody Energy Corp. and Arch Resources Inc. report results.

This all comes on the heels of two strong years for the industry. As the world started to emerge from pandemic lockdowns in 2021, electricity consumption surged, driving up demand and prices for coal around the world. The war in Ukraine further upended global markets last year. Going into 2023, there were concerns that stockpiles would run short in Europe, potentially triggering blackouts during cold spells.

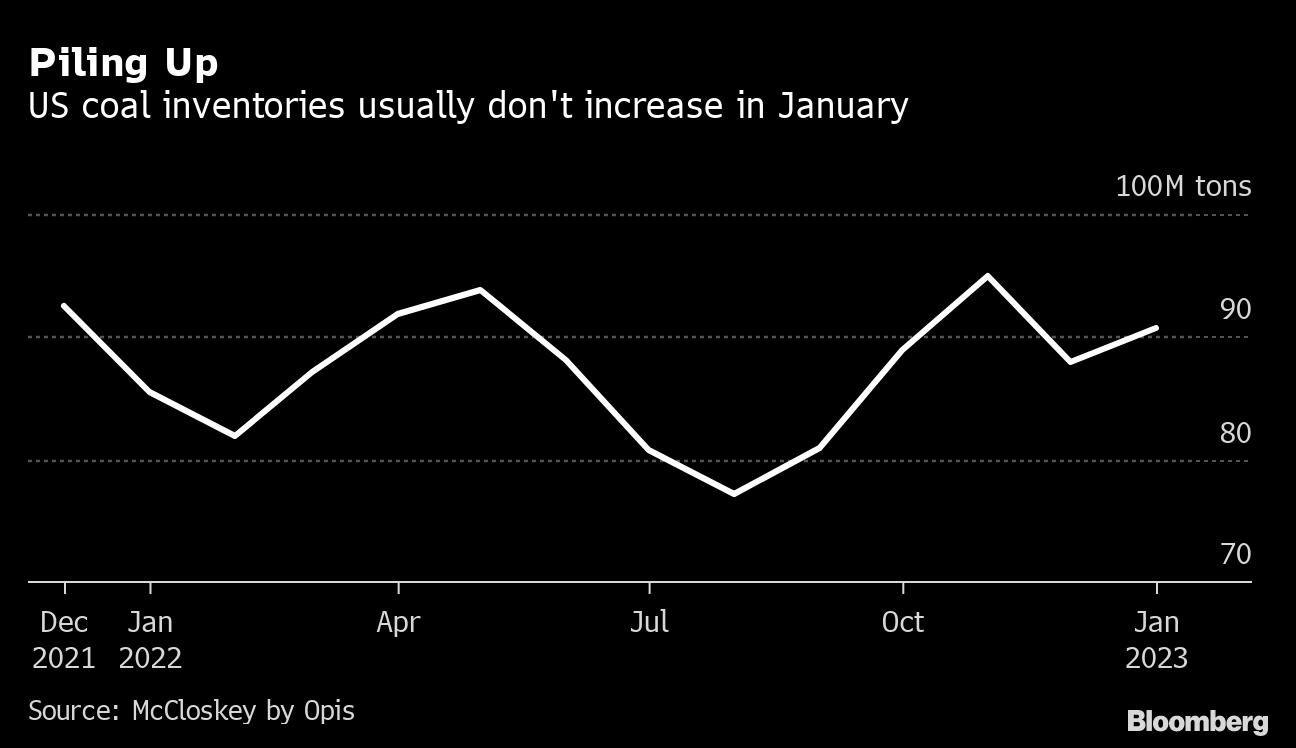

Instead, mild temperatures becalmed demand. Prices in the US have slumped for both coal and gas since the start of the year. Domestic coal stockpiles controlled by utilities increased 3.2% in January from the prior month. Meanwhile, usage plunged 20% at a time when cold weather typically prompts utilities to burn reserves, according to Blumenfeld.

The reversal has come on swiftly. Coal consumption by US utilities is expected to slide 16% in 2023, according to government data released Tuesday. That’s down from last month’s forecast decline of 11%, with the shift tied in part to mild January weather.

“Warmer-than-normal weather has gripped much of the US and Europe, leading to increased gas storage levels and coal inventories,” Brock said.

While he’s confident that demand will remain strong for the foreseeable future, others aren’t so sure.

“If I were a coal executive, I’d be pretty concerned,” Lucas Pipes, an analyst with B Riley Securities, said in an interview.

While miners have locked in orders, utilities may soon be stuck with more fuel than they need and some may seek to renegotiate contracts or postpone deliveries. While Consol said it hasn’t happened yet, Pipes expects miners’ phones to start ringing soon.

“In three months, I would be surprised if we don’t hear about deferrals,” he said. “I’m expecting it. The question is when.”

(Disclaimer: Michael Bloomberg, the founder and majority owner of Bloomberg LP — the parent company of Bloomberg News — committed $500 million to Beyond Carbon, a campaign aimed at closing the remaining coal-fired power plants in the U.S. by 2030 and halting the development of new natural gas-fired plants. He also started a campaign to close a quarter of the world’s remaining coal plants and cancel all proposed coal plants by 2025.)

(Updates with timing of earnings reports in seventh paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog