EU Power Market Reform Is About to Take a Delicate Step Forward

(Bloomberg) -- A year into an unprecedented energy crisis that rocked the European Union, officials in Brussels are ready to unveil their plan to prevent consumers from facing huge swings in electricity prices in the future.

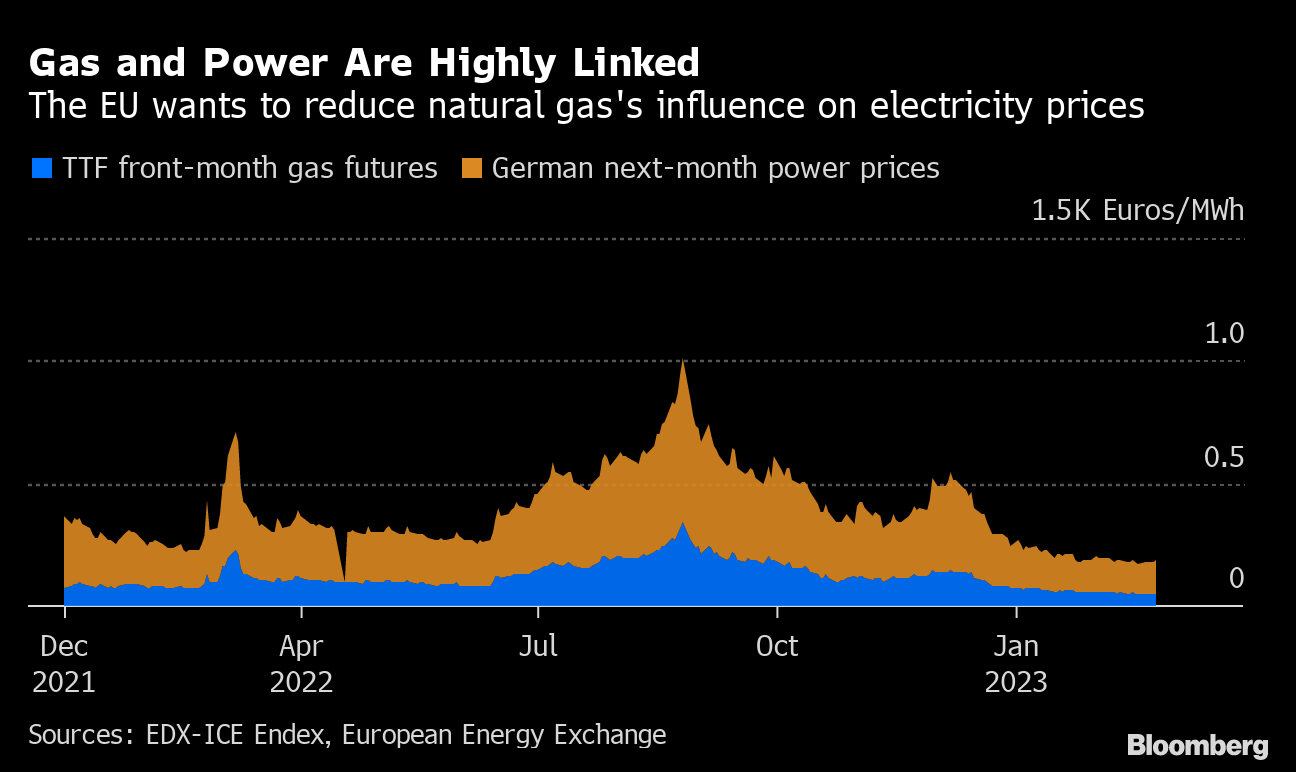

While some EU leaders pledged massive overhaul, what’s likely to emerge is anything but radical. Power and natural gas prices have slumped to a fraction of the record levels at the height of the crisis last summer, removing some of the political pressure for deep intervention.

After months of deliberation, the European Commission — the bloc’s executive arm — is set to release its proposal on March 14. The goal is to make the region’s energy market more resilient when emergency tools expire. Among the top aims: shield consumers from soaring prices, weaken the link between electricity and natural gas, and spur the development of renewable energy.

And don’t break anything in the process.

“The market is very complex, and you don’t want to be intervening in the market in a hasty way,” Catherine MacGregor, chief executive officer of utility Engie SA said at an event last week in London. “You really have to make sure you understand the consequences because we need to have a market that works, that functions.”

Dealing with the energy crisis has been top of the political agenda, and it’s a task fraught with challenges. Critics of an aggressive overhaul say too much intervention could disrupt the flow of energy across the region, drain market liquidity in the short-term and potentially deter the roll-out of renewables.

“This crisis was saved by the power market design and not vice versa,” Luxembourg Energy Minister Claude Turmes said last week. “We have to create trust.”

Time is of the essence if any change is to take effect. After being unveiled, the measure will need support from national governments and the European Parliament, a potentially lengthy process that will involve amendments. The reform needs to be palatable enough to win approval before the parliament’s next elections in May 2024 and the end of the current commission’s term later that year.

There’s also a global twist. The EU is currently trying to respond to concerns that green industries could emigrate to the US and China, with the price that Europe pays for its energy a driving factor. Benchmark gas prices are seven times higher on the continent than in the US, while electricity prices are three times higher than in China, according to the International Energy Agency.

‘Targeted Reform’

With limited room for the EU’s regulatory arm to maneuver, the reform will most likely focus on tools to help the region reap the benefits of cheaper renewables in the mid- to longer-term, such as expanding fixed-price contracts. That could also accelerate the deployment of clean energy, in line with Europe’s ambitious Green Deal climate strategy, according to diplomats with knowledge of the issue.

“The Commission is working towards a targeted reform of the Electricity Market Design,” EU Energy Commissioner Kadri Simson told Bloomberg News. “The priority will be to better protect consumers from price volatility and to enable them to benefit more from the growth and low operational costs of renewables.”

Under the current EU electricity market design, gas sets the price for all power that’s sold into the market. That means consumers are bearing the brunt of Russia’s supply cuts to the continent after its invasion of Ukraine, and their bills don’t reflect the growing share of low-cost renewables like wind farms that get to sell at big margins.

The EU doesn’t plan to change its marginal pricing model — doing so wouldn’t have received approval from national governments.

“Some member states wanted to have a deep reform on the marginal pricing system. But this discussion has, with prices coming down again, shifted a bit,” said Klaus-Dieter Borchardt, senior energy advisor at consultancy Baker McKenzie and a former senior official at the commission. “All-in-all, I do not expect a very profound reform.”

Also See: How Europe Ditched Russian Fossil Fuels With Spectacular Speed

The commission is planning to weaken the link between gas and power by an increased use of power purchase agreements and so-called Contracts for Difference, where governments can guarantee investors a fixed price.

The EU is considering whether the CfDs should cover only new low-carbon capacity or also certain existing types of generation. Morgan Stanley said it expects the Commission to take a “soft” approach, covering only new sources, rather than a full revamp that could prolong negotiations.

Contracts for Difference, if appropriately designed, could effectively cap prices of electricity from clean technologies, according to Sven Kaiser, an official at the Council of European Energy Regulators.

“The prices we have seen, particularly last year, are clearly a burden for European citizens and the economy,” he said. “It’s fully understandable that something needs to be done — it’s just important to do it as targeted as possible.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog