How a Turbine Put The Brakes on NY Offshore Wind Projects

(Bloomberg) -- The fledgling US offshore wind industry took another blow Friday — but for a new reason: a desired turbine isn’t available.

The absence of 18-megawatt turbines set off a chain of events leading to New York State ending negotiations for three major projects that would have totaled 4 gigawatts. The cancellation represents about two-thirds of projects in development there.

The decision is a big step back for an industry that had thought it was inching forward after sustaining repeated disappointments in the past year due to inflation, higher interest rates and supply-chain kinks. It reinforces the challenge for President Joe Biden to meet his target of 30 gigawatts of offshore wind nationwide by 2030 — as well as for New York’s goal.

New York’s decision means the state now has 1.7 gigawatts of offshore projects in development, said Atin Jain, an analyst at BloombergNEF. “That’s not enough to reach New York’s 9 gigawatt by 2035 goal,” he said.

The New York State Energy Research and Development Authority said the decision to cancel negotiations came after GE Vernova Inc. said it wouldn’t be able to deliver 18-megawatt turbines to the projects. Their owners include units of Copenhagen Infrastructure Partners P/S, TotalEnergies SE, Rise Light & Power LLC, National Grid Plc and RWE AG.

GE said in late 2022 it would make an 18-megawatt turbine, then decided in late 2023 that reliability concerns meant it shouldn’t go bigger than 16.5 megawatts, according to a representative.

Both turbines have 250-meter rotors, and wind farms built with the smaller ones would actually produce more electricity, according to the representative, who cited the tough market conditions as a big reason the contract talks ended.

Lack of the larger turbine forced developers to redesign their projects with smaller ones, which meant more foundations and more cables — and thus higher costs, Jain said.

Still, the end of the contract talks doesn’t necessarily mean the projects are dead. Developers indicated Friday they would work with New York on future bids.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Borouge beats market expectations as Q1 net profit rises by 37% to $273 million

Apr 30, 2024

BHP Mega Bid and $10,000 Copper Expose Mining’s Biggest Problem

Apr 29, 2024

Southeast Asia Heat Wave Shuts Schools, Stokes Power Demand

Apr 28, 2024

Texas Grid Warns of Possible Power Emergency Early Next Week

Apr 26, 2024

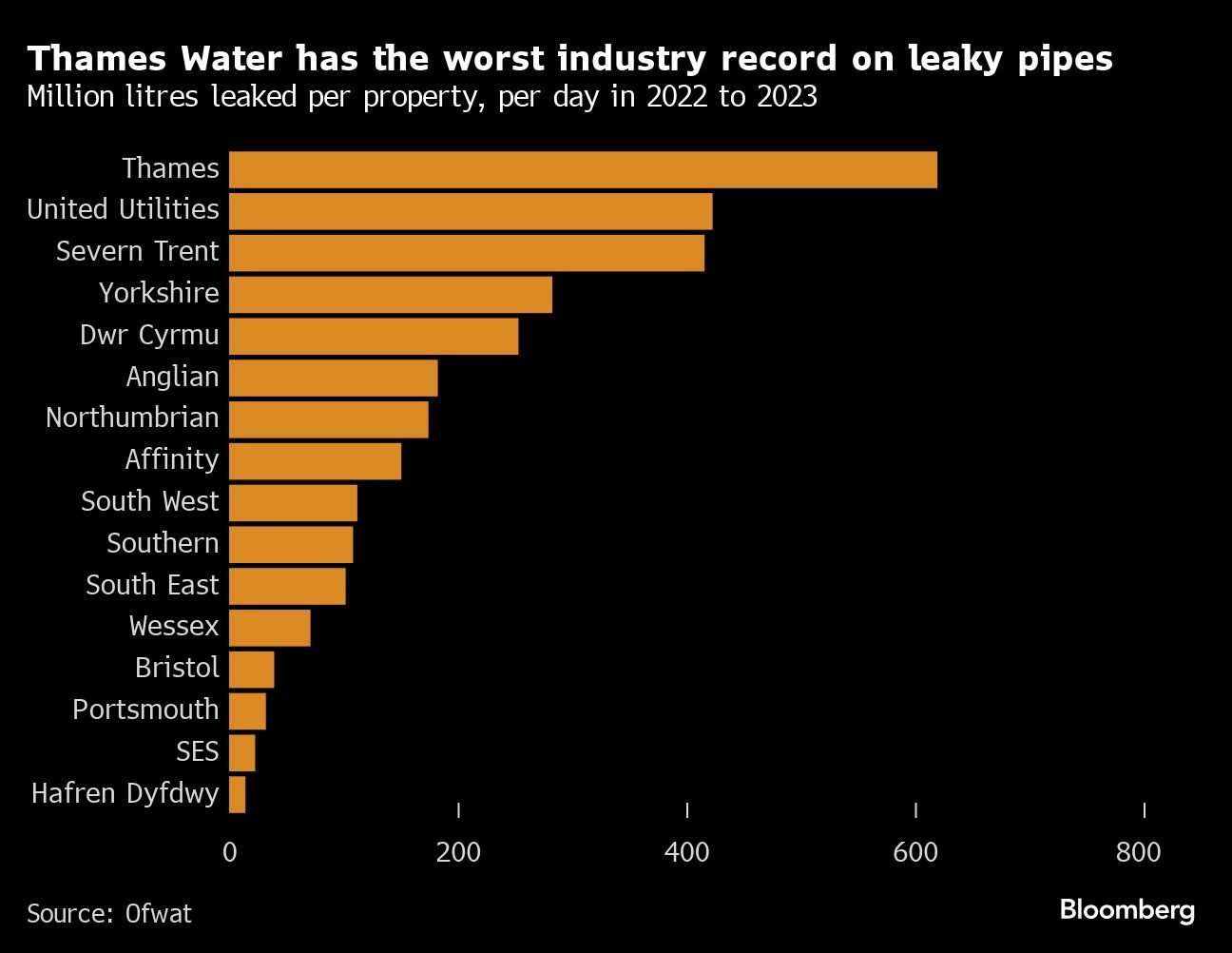

Thames Water Crisis Puts £100 Billion UK Investment Plan at Risk

Apr 26, 2024

TechnipFMC reports a $2 billion start to the year with first quarter results surpassing forecasts

Apr 26, 2024

COP29 Climate Summit Countdown Starts With Finance at Forefront

Apr 25, 2024

AD Ports Group secures 20-year agreement to operate and upgrade Angolan capital’s multipurpose port terminal

Apr 25, 2024

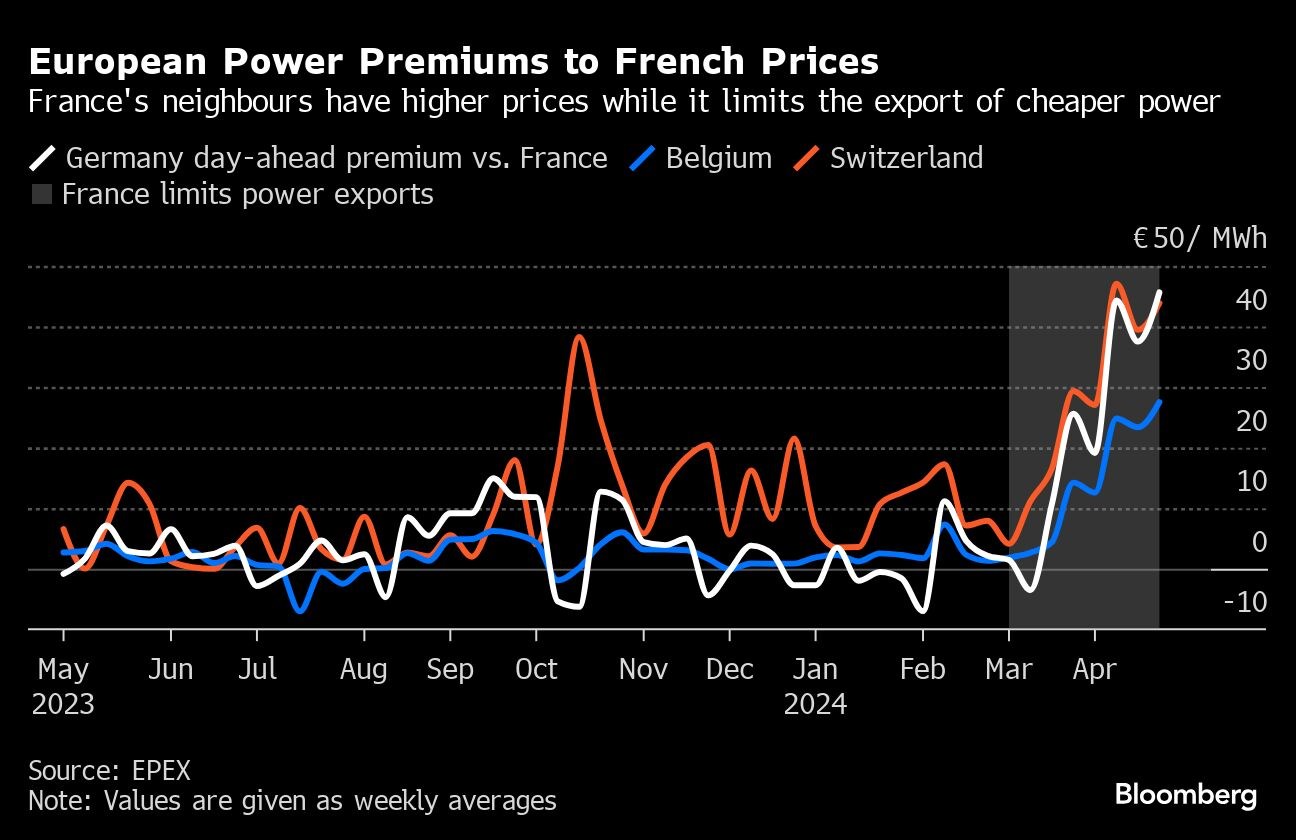

French Grid Issues Are Causing Power Prices to Soar in Europe

Apr 24, 2024

Thames Water Bond Haircut Risks Contagion, Barclays Survey Says

Apr 23, 2024

Why the energy industry is on the cusp of disruptive reinvention

Mar 12, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum