European Car Sales Stagnate as EV Demand Plummets in Germany

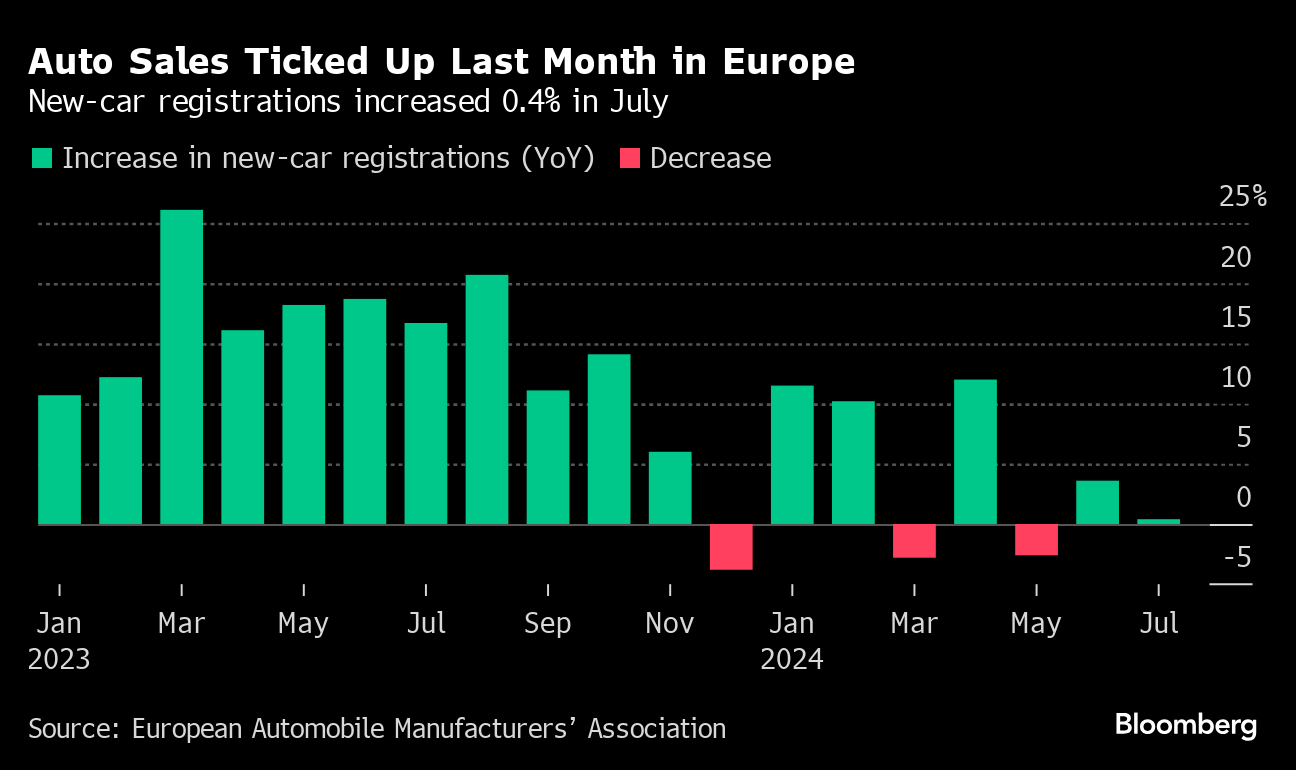

(Bloomberg) -- Auto sales in Europe were roughly flat in July as demand for electric vehicles weakened further in Germany, the region’s biggest car market.

New-car registrations ticked up just 0.4% compared to a year ago to 1.03 million units last month, the European Automobile Manufacturers’ Association said Thursday. Plug-in vehicles made up a smaller part of overall sales, as more consumers opted for less expensive hybrid cars.

EV sales have slumped for months in Europe, in part due to governments paring back financial incentives to purchase battery-powered cars. Germany abruptly ended EV subsidies in mid-December, and the country’s persistent economic downtrend has weighed on consumer spending. Sales of fully electric cars dropped 37% there in July.

“The decisive factor limiting a wider adoption of EVs is the high price,” Constantin Gall, a managing partner at EY in Munich, said in a note. “Manufacturers are forcibly extending the costly coexistence of combustion engines and electric cars.”

The broader decline in EV demand is leading carmakers to scale back and slow down plans to scrap the internal combustion engine.

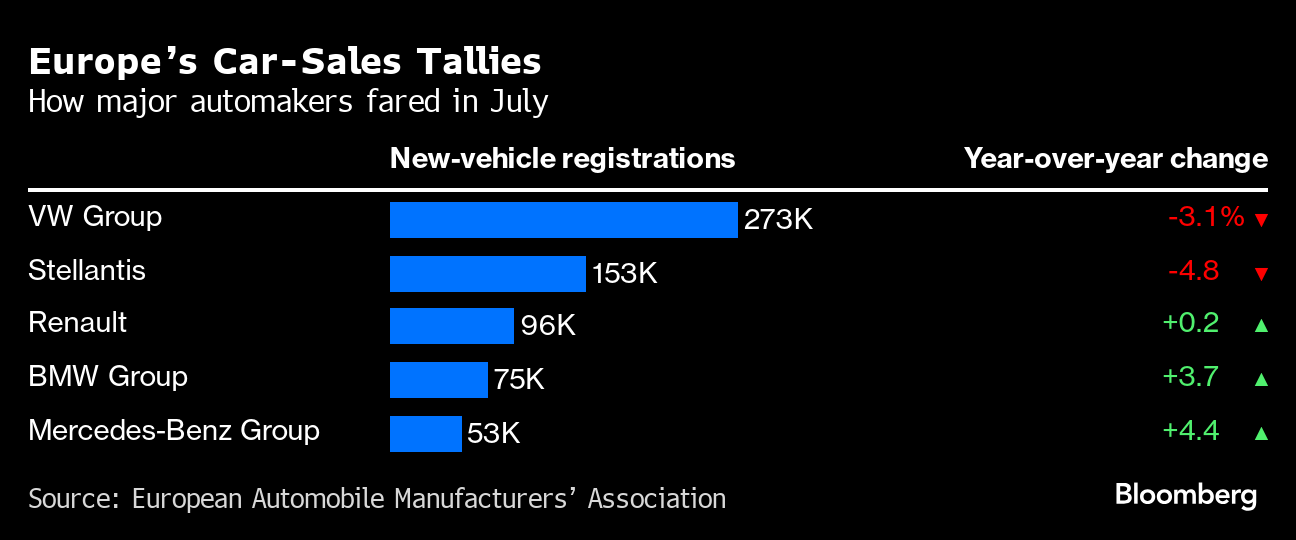

Volkswagen AG is seeking deeper cost cuts beyond potentially closing an Audi EV plant near Brussels. The chief executive of Stellantis NV, the region’s second-biggest manufacturer, put the company’s underperforming brands on notice after net income almost halved in the first six months of the year.

Mercedes-Benz Group AG also trimmed its margin forecast for the year and has walked backed medium-term goals for EV sales, saying the transition from combustion cars will take longer than expected.

With demand for EVs cooling in Europe, sales of hybrid vehicles rose 24% and are up about 22% for the first seven months of the year. But that’s a broad category that includes cars that simply use batteries to boost performance or run the vehicle’s electrical systems. The market share for plug-in hybrids, which operate like true EVs for a limited range before handing over to a combustion engine, has declined year on year.

The outlook for Europe’s EV market is complicated further by trade tensions with China. The European Union has accused Beijing of unfairly subsidizing its electric-car industry and announced additional levies on EVs imported from the country. Those tariffs are slated to kick in by November.

EVs were 13.6% of total sales in the region last month, down from 14.5% last year. Sales of gas-powered cars declined 8.4%, while diesel vehicles dropped 11%. Hybrids were the big gainer for the month, with registrations jumping 24%.

Tesla Inc.’s sales continued to fall off across the region, with a 15% decline in July. Sales dropped 12% during the first seven months of the year.

(Updates with analyst comment in fourth paragraph.)

©2024 Bloomberg L.P.