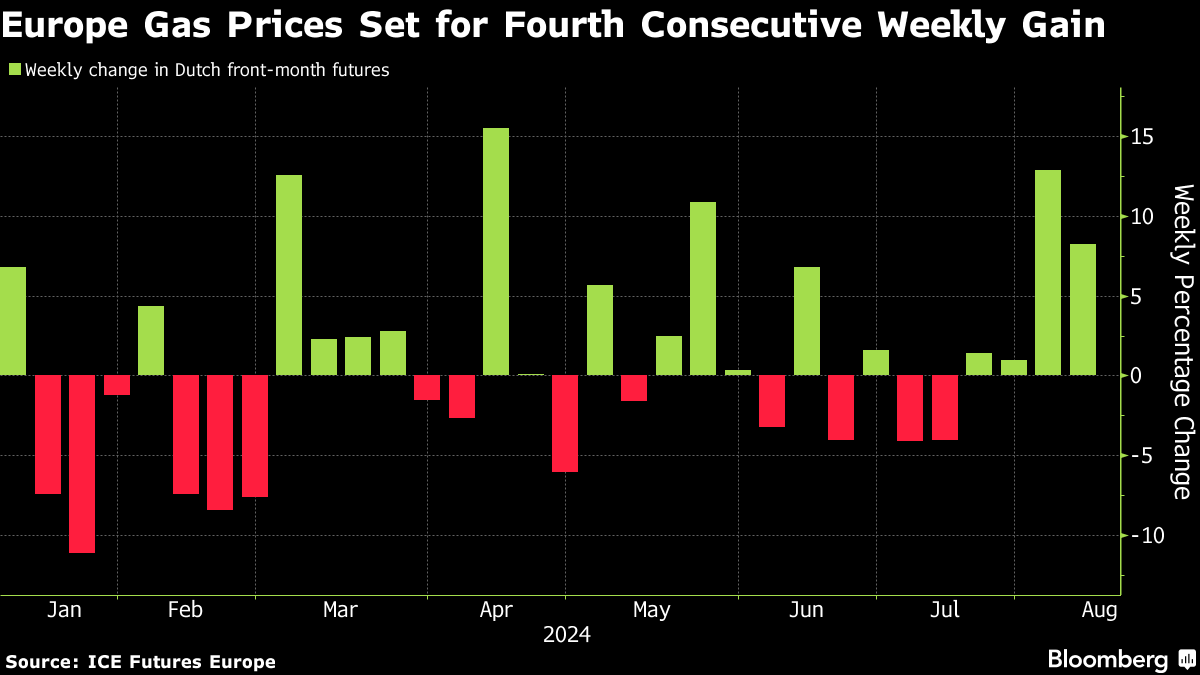

European Gas Set for Weekly Jump on Ukraine Transit Risks

(Bloomberg) -- European natural gas prices are set for a weekly jump as fears over possible disruptions to Russian fuel crossing Ukraine dominated the market.

Benchmark futures hovered near €40 a megawatt-hour on Friday, trading around the highest levels since December. Prices have risen more than 45% since the beginning of the stockpiling season, as numerous disruptions have coincided with traders’ efforts to source fuel for winter.

This week, an incursion by Ukraine into Russia’s bordering Kursk region put a key gas transit point at risk. While Russian flows through the Sudzha point are continuing for now, traders are bracing for a possible halt, which would hurt European economies that still depend on the fuel. Moldova put its gas sector on “early alert” on Thursday.

The summer has been volatile for Europe’s gas market even before the latest developments, as heat waves boosted global competition for liquefied natural gas and numerous producers have faced disruptions.

“Fears of supply shortages continued to shape gas price developments this week,” Rystad Energy analyst Christoph Halser wrote in a note. “The latest attack could jeopardize ongoing talks between Azerbaijan, Ukraine and the European Union for the continued flow of gas through Ukraine after the current transit agreement expires at the end of the year.”

While Kyiv has said it won’t allow Russian gas to continue flowing through Ukraine after an agreement governing its transit expires at the end of 2024, European officials have been searching for possible alternatives, including sourcing fuel from Azerbaijan.

A sudden and earlier halt would come as a shock for nations such as Slovakia and Austria, which still rely on that supply and could see higher gas prices for companies and consumers if it’s cut off.

The bullish sentiment this week has also played out in options contracts. Implied volatility — a measure of how expensive the derivatives are — rose since the end of July, signaling traders rushed to protect themselves against a potential tightening of supply.

For now, a seasonal slowdown in demand and lower injections to the region’s already very full stockpiles may limit fuel needs. Recent data from S&P Global Commodity Insights show that despite more recent signs of recovery, gas consumption in European industry continues to lag behind expectations and remained more than 26% below the historical average in July 2024.

Dutch front-month futures, Europe’s gas benchmark, fell to € a megawatt-hour at 11:26 a.m. in Amsterdam.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog