Germany’s Record-Beating Stocks Head for Further Gains in 2025

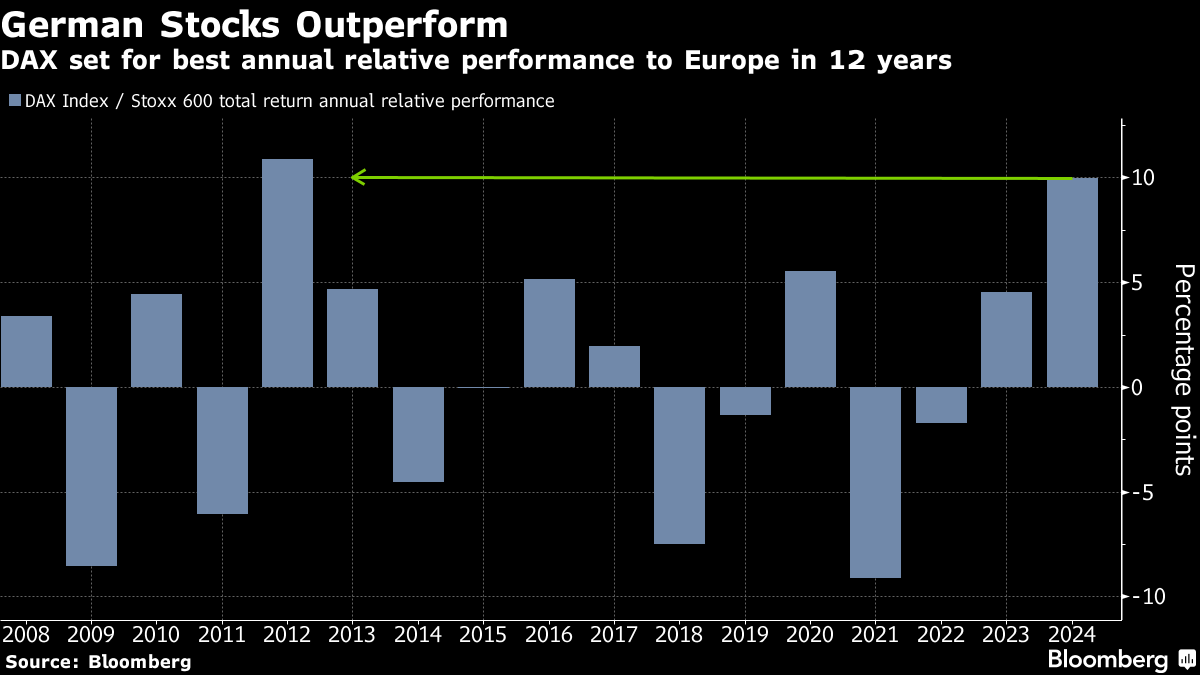

(Bloomberg) -- Germany’s biggest stocks have left European peers trailing this year as they escaped the grips of a dour domestic economy. There’s optimism the country’s hot streak can continue in 2025 amid an expected boost in government spending and the resurgence of Chinese demand.

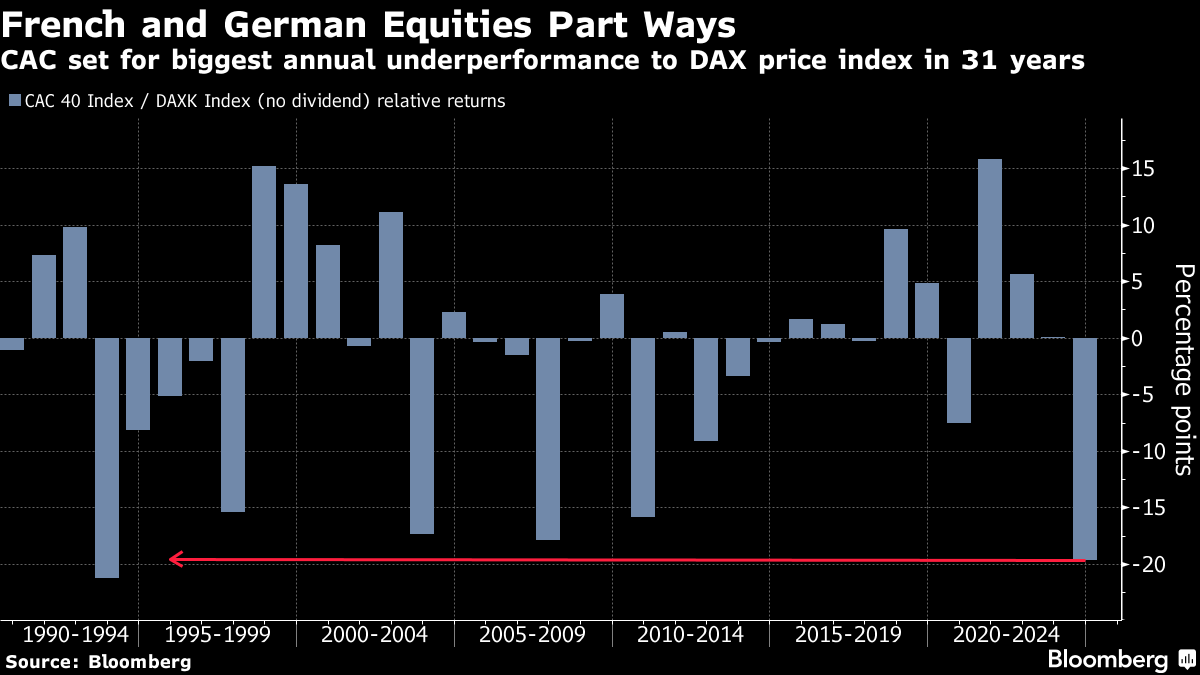

Boosted to a large extent by a surge in software giant SAP SE, the exporter-heavy DAX index is up 22% this year, smashing through the 20,000 points level for the first time this month. While it lags the S&P 500’s 28% rally, it far outpaces European peers including a 7.4% gain in the UK’s FTSE 100 Index and a 1.6% decline in France’s CAC 40.

Expectations of a stronger global economy and a revival of demand from China have powered gains in stocks from Adidas AG to cement company Heidelberg Materials AG. Those factors are likely to remain in play during 2025, along with an anticipated boost in government spending after an election set for February.

“We are bullish on German stocks next year as the eurozone economy likely sees some improvement,” said Susana Cruz, a strategist at Panmure Liberum. She sees some relief from lower borrowing costs in the second half of the year, while noting that geopolitical risks will continue to weigh on the industrial sector.

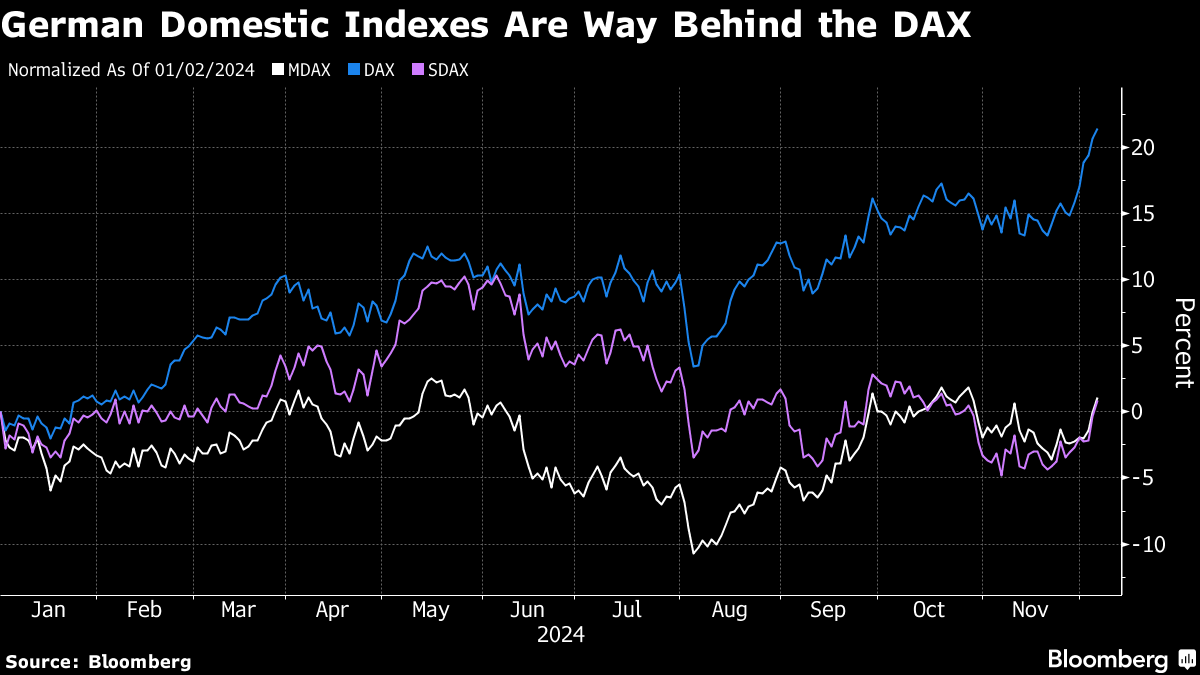

Key to the DAX’s strength this year has been the global earnings potential of its biggest companies. More than 80% of sales for the 40 largest stocks listed in Frankfurt is derived abroad, making them more exposed to global demand than domestic factors.

As a team at Deutsche Bank AG’s private bank put it in their 2025 outlook, “the German economy is stagnating, the German stock market is flourishing.”

Overseas, the US economy continues to be strong and Beijing has said it will embrace a “moderately loose” monetary policy in 2025, already providing a lift to China-exposed sectors. President Xi Jinping’s decision-making Politburo vowed to implement economic reforms to support growth and elevated the importance of boosting consumption, making it a top goal.

At home, German Chancellor Olaf Scholz kick-started the process that should lead to snap election in February. The next chancellor will need to secure the funds to cover the massive investments required for Germany’s transformation into a more technologically advanced and climate-friendly economy — and to pay for a military capable of defending the nation. Increased spending and fiscal stimulus would likely provide further boost to the country’s stocks.

Tech-Driven Rally

SAP alone has contributed more than a third of the DAX’s rally by index points in 2024, according to Bloomberg calculations. Europe’s biggest software company has soared over 70% this year as worldwide demand for cloud and artificial intelligence products surges.

Without this boost from Germany’s own mini-version of a Wall Street “Magnificent Seven” technology megacap, the DAX would have gained about 12%, more in line with the rest of the region. The benchmark has also become more expensive than the broader European market, where it used to trade at a discount, based on forward earnings estimates.

Other key gainers this year included renewable-energy firm Siemens Energy AG, which has rallied over 300% on demand for its grid technologies. Rheinmetall AG has more than doubled as geopolitical tensions boost defense stocks, while lenders such as Deutsche Bank and Commerzbank AG have added around 40%.

One outlier has been the automotive sector, the worst performer in Europe this year, with German giants such as BMW AG and Volkswagen AG among those leading losses, falling over 22% each.

“We remain cautious on the auto sector given the continued disruption from the shift to EVs and the threat of tariffs,” said Charlotte Ryland, head of investments at CCLA Investment Management.

The risk from political turmoil, a key factor in the underperformance of French stocks this year, is unlikely, but shouldn’t be disregarded, according to Jochen Stanzl, chief market analyst at CMC Markets. “Investors would do well to keep a close eye,” especially with Germany’s own elections fast approaching, Stanzl said.

February’s vote is largely seen as potentially positive for equities. Last month, Citigroup Inc. strategist Beata Manthey said a possible cut in corporate tax to 25% from 30% would boost earnings per share by about 2% for DAX members and 3% for constituents of the mid-cap MDAX Index.

Not everyone is optimistic, also given the prospect of fresh US import tariffs.

“The earnings backdrop is quite challenging,” said Marija Veitmane, a senior multi-asset strategist at State Street Global Markets. “I would actually use relatively strong performance of DAX as a selling opportunity.”

Strategists at Pictet Asset Management see opportunities away from Frankfurt’s blue-chip stocks.

“The potential lies more in the smaller and medium-sized companies,” said Luca Paolini, chief strategist at Pictet. A sentiment-led recovery, if it comes, would benefit the MDAX more, he said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Crippling Power Outage in Spain Likely Caused by Generation Loss

Japan’s Top Gas Importer Considers Buying From Alaska LNG

China Approves 10 New Reactors in Nuclear Power Ramp-Up

Borouge announces strategic expansion to boost production capacity

BW Group and Nordea Bank sign largest ever battery storage financing in the Nordics

Eni and UK to go ahead with flagship carbon capture project in Liverpool

Vestas Warns UK Wind-Auction Change Threatens Factory Investment

Valero Energy reports first-quarter loss amid challenging market conditions

Shell agrees to sell Colonial Enterprises stake to Brookfield subsidiary for $1.45 billion