EDF Swings Back to Profit as French Nuclear Power Output Rebounds

(Bloomberg) -- Electricite de France SA swung back to profit last year after a record loss in 2022 as the state-owned company benefited from rebounding nuclear output and higher power prices.

The dramatic reversal provides some relief for the debt-laden utility. The company needs to cope with the ballooning cost of its Hinkley Point C nuclear project in the UK, and the prospect of soaring capital expenditure to build new atomic plants in France.

“EDF has managed a turnaround in 2023, notably thanks to a rebound of its nuclear output,” Chief Executive Officer Luc Remont said in a statement on Friday. “With these good results, EDF has met its financial targets and reduced its financial debt.”

Current net income, which excludes one-time items including a €12.9 billion writedown tied to the Hinkley Point setback and the group’s wider operations in the UK, was a record €18.5 billion ($19.9 billion) last year, the company said the statement. Net income was €10 billion compared with a loss of €17.9 billion in 2022 due to prolonged atomic plant outages and government measures to curb soaring energy bills.

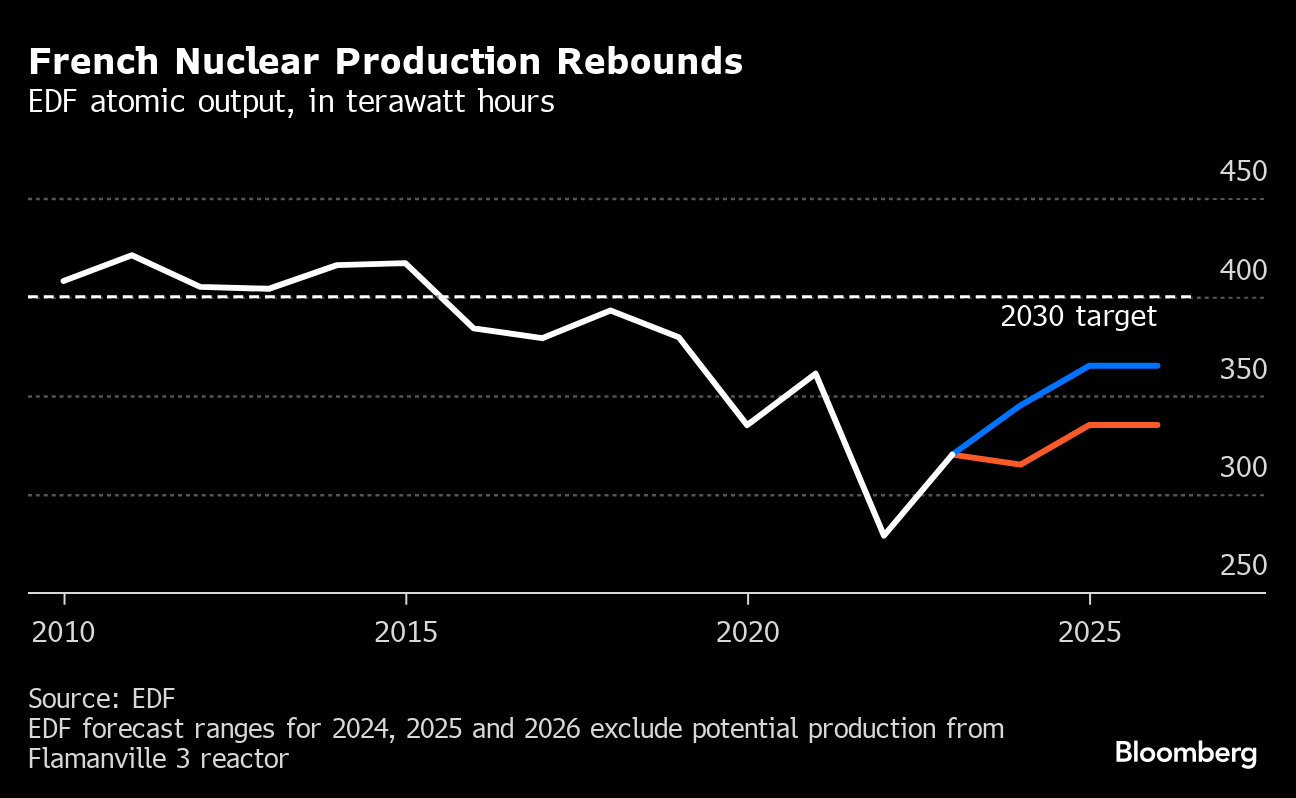

EDF may benefit from a further rebound in its French nuclear production in the coming years as it progresses with checks and repairs of its reactor fleet. Stress corrosion cracks first uncovered in late 2021 have affected pipes at more than a dozen of its 56 atomic units. Output is also due to get a boost in coming months from the startup of a much-delayed new reactor at Flamanville in northwestern France.

Net financial debt fell to €54.4 billion at the end of 2023 from €64.5 billion a year earlier. However, Remont has warned that the group’s cash flows will come under pressure again as annual investment rises to about €25 billion in a few years, up from €19.1 billion last year, while electricity prices are receding. That’s because the French government wants it to build at least six new nuclear plants and to adapt the country’s grid to rising solar and wind generation.

In 2024, falling power prices may trim the group’s earnings before interest taxes, depreciation and amortization by as much as €11 billion compared with last year, EDF said. Rising atomic output may partially offset this, giving a boost of as much as €5 billion.

If a recent slump in CO2 prices were to continue, that could jeopardize investments by EDF and other companies in assets needed for Europe’s energy transition, the CEO said. This may eventually force public authorities to take action on the carbon market, he said.

“If power prices were to be lastingly low, one would have to look into the state of demand and into the electricity economics to know how to fund investments,” he said.

EDF’s funding challenge is also related to the spiraling cost of the two reactors that EDF is building at Hinkley Point C in the UK. It raised the budget of that project last month to as much as £47.9 billion ($60.3 billion), citing labor shortages, supply chain issues, and longer-than-expected cable and pipe-fitting works. The company estimates that the pair of reactors, which will provide enough power for 6 million households, will be completed around the end of the decade.

- EDF’s UK Hinkley Nuclear Costs Balloon as Plant Delayed Anew

- EDF Is Holding Talks With UK on Funding of Nuclear Projects

- EDF Seeks to Mitigate Rising Cost of New French Nuclear Plants

The bill for EDF also jumped as China General Nuclear Power Corp stopped funding its share of the Hinkley Point project in the last quarter after having fulfilled its contractual commitment. As as result, EDF’s share of the project rose to 67.7% at the end of 2023, up from 66.5% previously, while the Chinese group’s stake declined. CGN’s decision came a year after UK authorities took over the Chinese group’s stake in EDF’s second UK nuclear plant project at Sizewell C.

The French state, which took back full ownership of EDF last year, has been pressing the UK government to further help the utility finance its British nuclear plant projects. While the UK increased its investment in Sizewell C last month with an additional £1.3 billion in a bid to lure private investors and reach a final investment decision later this year, it has refused so far to invest in Hinkley Point C.

(Updates with CEO comments on power and CO2 prices in ninth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog