An Energy Company Is About to Manage Water for 28 Million Brazilians

(Bloomberg) -- Brazil’s most populous state is about to sell a strategic stake in Latin America’s largest water utility to a $7 billion energy distributor that only got its start in sanitation two years ago.

The privatization of Sabesp, championed by a rising star of the nation’s right wing, means Equatorial Energia SA will oversee the supply of water to about 28 million people.

At stake is not only the success of Brazil’s biggest equity offering in years, but of the debate over privatization itself.

Governor Tarcisio de Freitas, a potential presidential candidate, is also eyeing Sao Paulo’s train system for conversion into a company, championing the conservative view that the private sector can run things better than the government. That puts him at odds with leftists including President Luiz Inacio Lula da Silva. Much is riding on Equatorial’s ability to show it can quickly improve operations and profits at a 50-year-old state-run entity.

Sabesp’s privatization, which is being conducted by 12 of the biggest banks in Brazil, was expected to see multiple companies compete to be its private-sector partner. Instead, the deal is moving ahead with Equatorial as the sole bidder for that role, though it’s also attracting billions of reais in demand from funds that want to participate.

“The chosen model is new and it has good ideas, but there was no competition,” cautioned Sergio Lazzarini, a professor at Insper in Sao Paulo whose research focuses on public-private partnerships. Privatizations take time, require strong regulation and can be difficult to time perfectly from a market perspective, he said in a phone interview.

“It is becoming increasingly clear that this was done to plant a political flag,” he said, adding that problems could arise if Sao Paulo were to elect an interventionist governor — from the left or right — after Freitas, whose term ends in 2026.

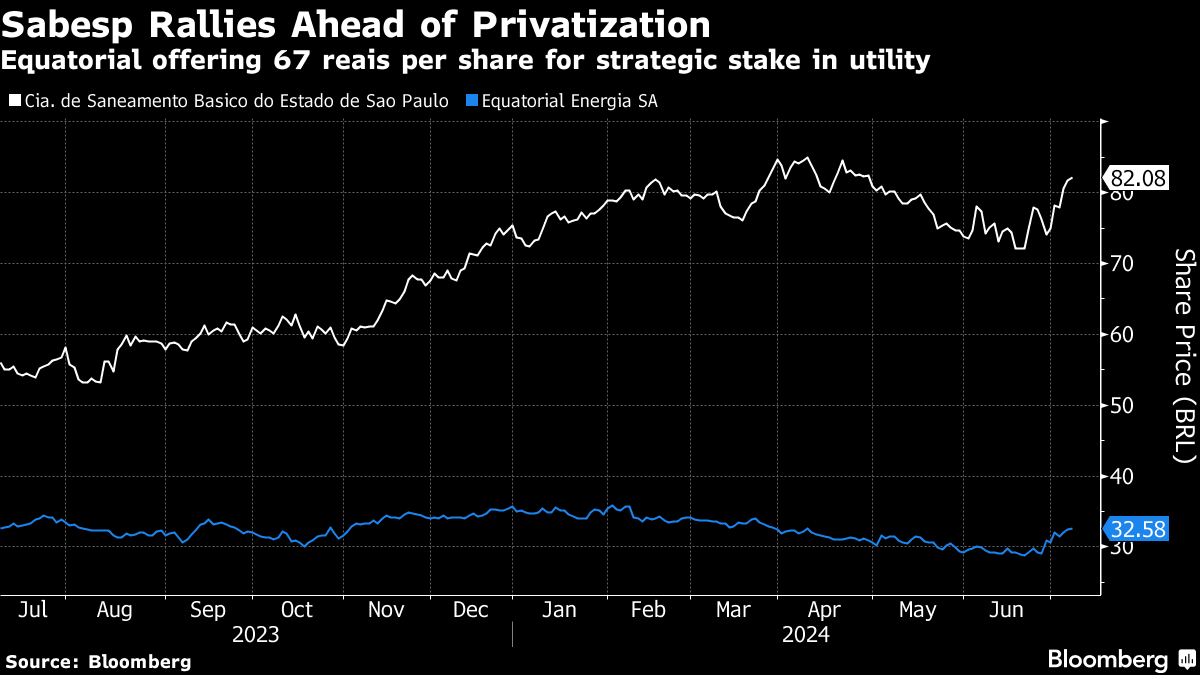

The utility, formally known as Cia. de Saneamento Basico do Estado de Sao Paulo, also handles sewage for 25 million people. Equatorial, which has a single investment in a water concession serving 800,000 inhabitants in the country’s north, is offering 67 reais per share — more than 22% less than current market value.

Sao Paulo’s state government will raise nearly 7 billion reais ($1.3 billion) on the 15% stake it’s handing over to Equatorial. It will also sell another 17% of Sabesp as part of a broader equity offer, through a book-building process in which it expects to raise an additional 9 billion reais.

Demand for that phase of the deal already exceeds the supply of available shares. Without other competitors, investors that participate in the broader share sale on July 18 will have to bid using Equatorial’s offer price or less, which the state has agreed to by moving forward with the process.

“Equatorial is a company with 20 years of history, and transforming infrastructure firms by improving performance and quality is in its DNA,” the company said Friday in an emailed statement. The purchase of a key stake in Sabesp is another step in its “consolidation in the Brazilian sanitation segment” and its geographic expansion in the country’s southeast.

The government’s idea from the start was to look for a partner that would help improve the way the company is run, but not necessarily another water utility, according to Sao Paulo state’s secretary of environment, infrastructure and logistics.

“Sabesp is a good operator, with a very qualified technical staff,” Natalia Resende said in an interview. “What we need is to improve management and governance.”

The government, which will remain the biggest shareholder with an 18% stake but will only hold three board seats, believes the energy distributor will be able to help Sabesp make the necessary investments to expand services to rural areas and the dense, improvised urban outgrowths known as favelas. The goal is to provide access to water and sewage to more than 90% of the state’s population.

“We are pleased to have a profile like Equatorial for what it brings to the deal,” Resende said.

Equatorial announced last week that it will pitch investors on its plans, listing a series of measures to unlock value and boost returns. It cited renegotiation with suppliers and restructuring the corporate team as ways to reduce the utility’s operating expenses.

Sabesp’s new chief executive officer, its chairman and three board members will be chosen by its new strategic shareholder. Equatorial intends to use that position as a vehicle for its growth strategy in water and sewage services, according to its presentation to investors.

The company’s shares are down 6.9% this year. But the stock has rallied nearly 12% to 32.58 reais as of Friday’s close since Bloomberg first reported its emergence as the sole bidder for the anchor stake in Sabesp on June 26.

Founded in 1999, Equatorial is one of Brazil’s largest power companies, with most of its electricity business in the northern and northeastern regions. It was previously owned by Brazilian private equity fund GP Investments, then by PE funds from Vinci Partners Investments Ltd. In 2015, Vinci sold its last stake, leaving Equatorial with no controlling shareholder. It is listed on the so-called New Market, which has the strictest governance requirements on Brazil’s stock exchange.

Opportunity Asset Administradora de Recursos — founded in 1994 by billionaire Daniel Dantas, his sister and a partner — is Equatorial’s biggest shareholder with a 6.3% stake, according to company filings. The second biggest is Capital World Investors, followed by Squadra Investimentos, Canadian Pension Plan Investment Board and Blackrock Inc., all of which hold around 5%.

Some of those investors would be willing to inject money through an equity sale to help Equatorial fulfill its 39 billion-real investment plan through 2029, said a person familiar to the matter, asking not to be named because no formal announcement has been made.

Scrapped Bids

Before Equatorial emerged as the sole contender amid a bout of volatility in Brazilian markets, Sao Paulo’s state government had other suitors for its deal.

Aegea Saneamento e Participacoes SA, a closely held utility backed by Singapore sovereign wealth fund GIC and Brazilian holding company Itausa SA, was a confirmed Sabesp bidder from the start. But it withdrew at the last minute after losing a battle over a clause that limits the anchor investor’s stake to 30% unless it offers a complete buyout to all shareholders, according to people familiar with the matter.

Cosan SA also expressed interest in a strategic stake of Sabesp, but it scrapped its potential bid due to a lack of funds with interest rates forecast to remain higher for longer. Deteriorating market conditions, meanwhile, prompted a consortium that included French giant Veolia Environnement SA and Brazilian alternative asset manager IG4 Capital Investimentos SA to abandon its plan for a bid, people familiar said.

“Some companies — and we respect them — wanted more control,” Resende, the Sao Paulo state secretary, said. “This was a premise that was never open.”

Equatorial’s offer respects the minimum price the government calculated based on “established methodology,” she said. “We are focused on the future. We want our 18% share to increase in value together with the company, but we need to carry out the process as we are doing today,” she added.

©2024 Bloomberg L.P.