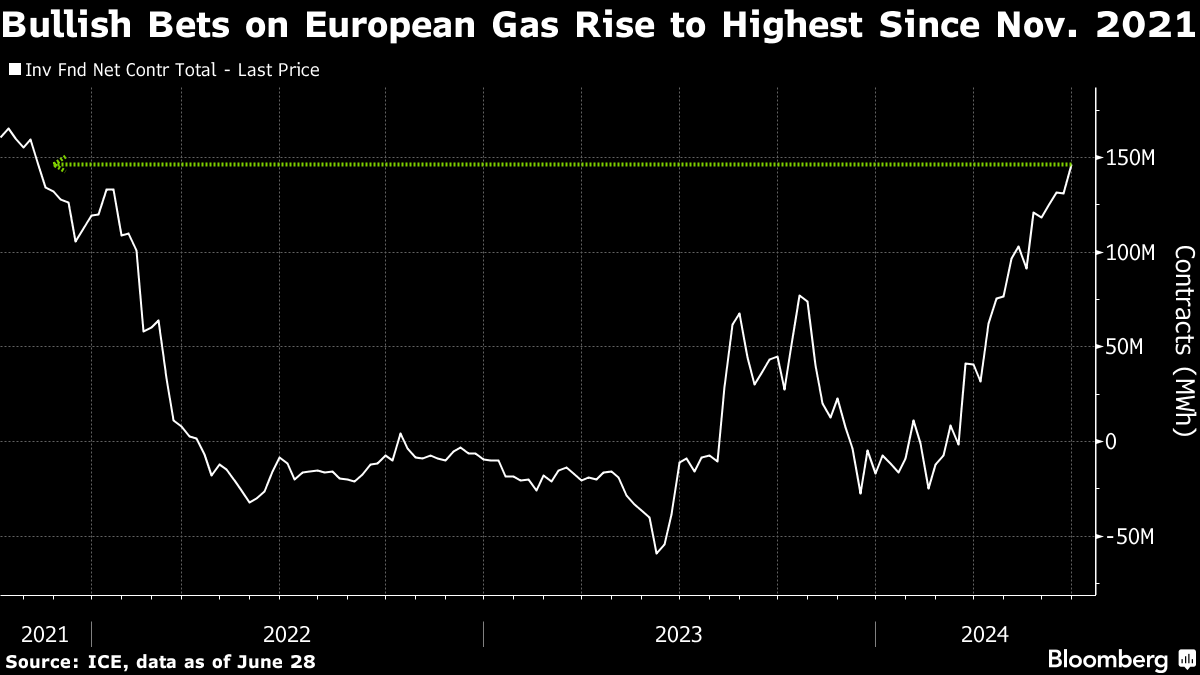

Funds Pile Into Bullish European Gas Bets as Supply Fears Mount

(Bloomberg) -- Investment funds are the most bullish on European gas prices since November 2021, signaling strong conviction in the market that supplies are set to tighten.

The net-long position in benchmark Dutch gas futures held by investment funds surged 12% as of Friday, according to Intercontinental Exchange Inc. They are now at the highest since early November 2021, when the region was receiving lower-than-anticipated flows from Russia for weeks, triggering the first price spikes that led to the continent’s energy crisis.

The bullish wagers indicate that the market remains extremely sensitive to potential supply disruptions, including widespread maintenance at facilities in top supplier Norway as well as the potential fragility of Russian gas flows through Ukraine. Increased competition with Asia for liquefied natural gas cargoes could also hamper ambitions to rebuild inventories ahead of the winter.

The latest weekly data coincided with the end of a month that saw price swings in Europe’s gas market. While volatility is nowhere near the highs of summer 2022, Europe’s market has been quick to react to drivers that could make it more difficult to build up fuel inventories in time for winter.

©2024 Bloomberg L.P.