Sabesp Privatized in Year’s Biggest Latin America Stock Deal

(Bloomberg) -- The state of Sao Paulo, Brazil’s richest and most populous, gave up control of Sabesp in a jumbo stock offering that raised about 14.8 billion reais ($2.7 billion), according to people familiar with the matter.

The state government sold 191,713,044 existing shares of the water utility at 67 reais apiece, said the people, asking not to be named because the information isn’t public yet. An additional allotment of 28,756,956 shares was also fully sold at the same price, the people said.

The price represents a 18% discount from current levels — Sabesp shares ended the day at 82.02 reais on Thursday.

The company didn’t immediately reply to a request for comment, neither did the Sao Paulo state government. Local media reported on the pricing earlier Thursday.

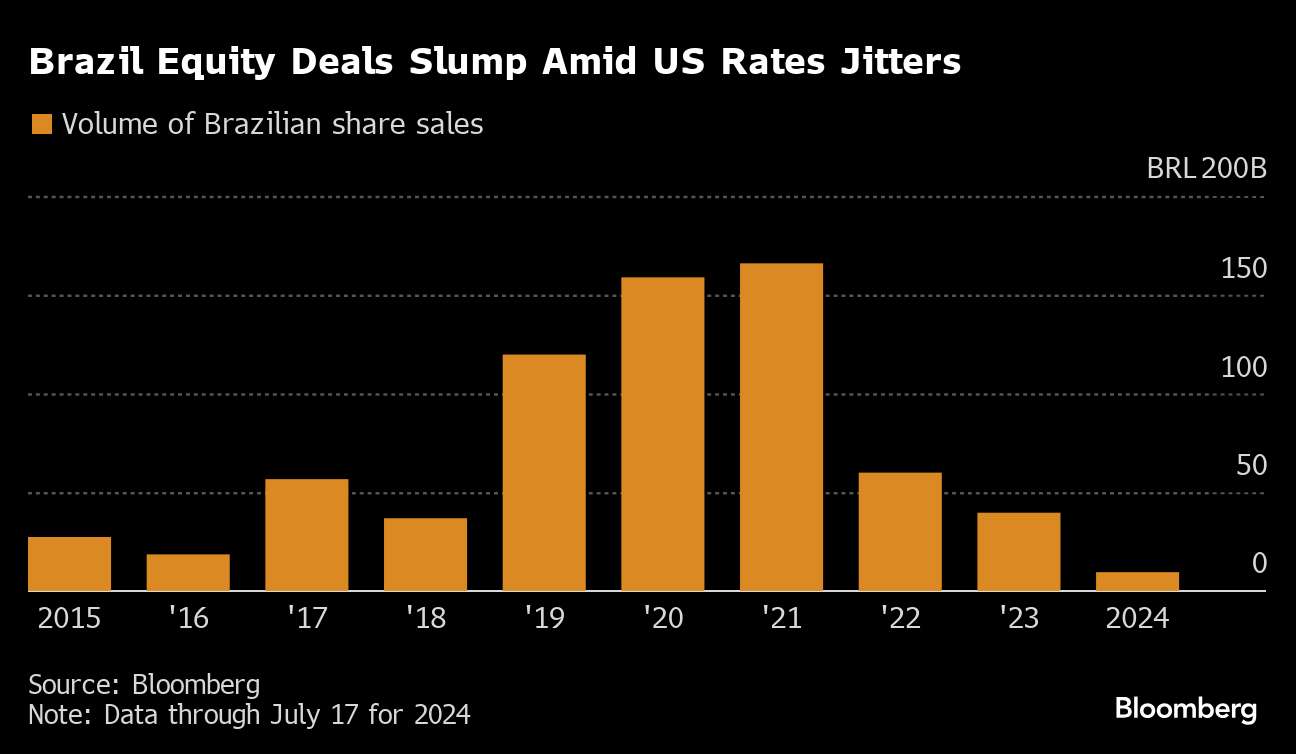

The transaction is Latin America’s biggest share sale since the offering that privatized Eletrobras, another utility, in mid-2022. It comes as activity in local equity capital markets slumps and Brazilian stocks lag most major global indexes this year amid high interest rates and persistent concerns about the country’s fiscal outlook.

Sole bidder

Equatorial Energia SA, a Brazilian power company that expanded into sanitation two years ago, now has a 15% stake in Sabesp. Investors snapped up another 17% of the utility, formally known as Cia. de Saneamento Basico do Estado de Sao Paulo.

Equatorial emerged as the sole bidder in the first part of the offering, which was supposed to select two key shareholders that would offer investors competing books to complete the sale.

Offshore funds scooped up little over 50% of the tranche dedicated to general institutional investors, and no individual fund got more than about 200 million reais worth of shares, the people said.

The lack of competition for a so-called anchor stake was a setback for Sao Paulo Governor Tarcisio de Freitas, who has vowed to privatize companies to reduce public debt and improve service. The governor, who served as infrastructure minister during Jair Bolsonaro’s government, is seen as a potential presidential candidate in Brazil’s 2026 elections.

The sale, which was fully secondary, was handled by Banco BTG Pactual SA, UBS BB Investment Bank, Bank of America Corp., Citigroup Inc. and Banco Itau BBA SA. Joint bookrunners included Bradesco BBI, Goldman Sachs Group Inc., JPMorgan Chase & Co., J. Safra, Morgan Stanley, Santander and XP Inc.

(Updates with details on demand in the eighth paragraph.)

©2024 Bloomberg L.P.