NTPC Green Jumps in Mumbai Debut on Demand for Renewables

(Bloomberg) -- Shares of NTPC Green Energy Ltd. rallied in their trading debut, driven by investor demand for India’s rapidly expanding renewable power sector while the country remains among the global hotspots for raising fresh capital.

The shares of the renewable-energy arm of top Indian power producer NTPC Ltd. surged almost 13% over their initial share sale price of 108 rupees. The offering raised $1.2 billion for the firm in one of the biggest Indian listings this year.

Valued at over $12 billion at Wednesday’s close, the firm raised funds via new shares to invest in its renewable energy unit and repay loans. Its IPO was fully sold last week, driven by strong demand for renewable energy stocks from investors betting on a sharp rise in India’s power consumption.

Retail investors bid at least three times the shares reserved for them, likely encouraged by the huge listing day pops for recent offers. Waaree Energy Ltd.’s $514 million offering last month surged 56% on debut, and Premier Energies Ltd.’s shares gained 87% when they were listed in August.

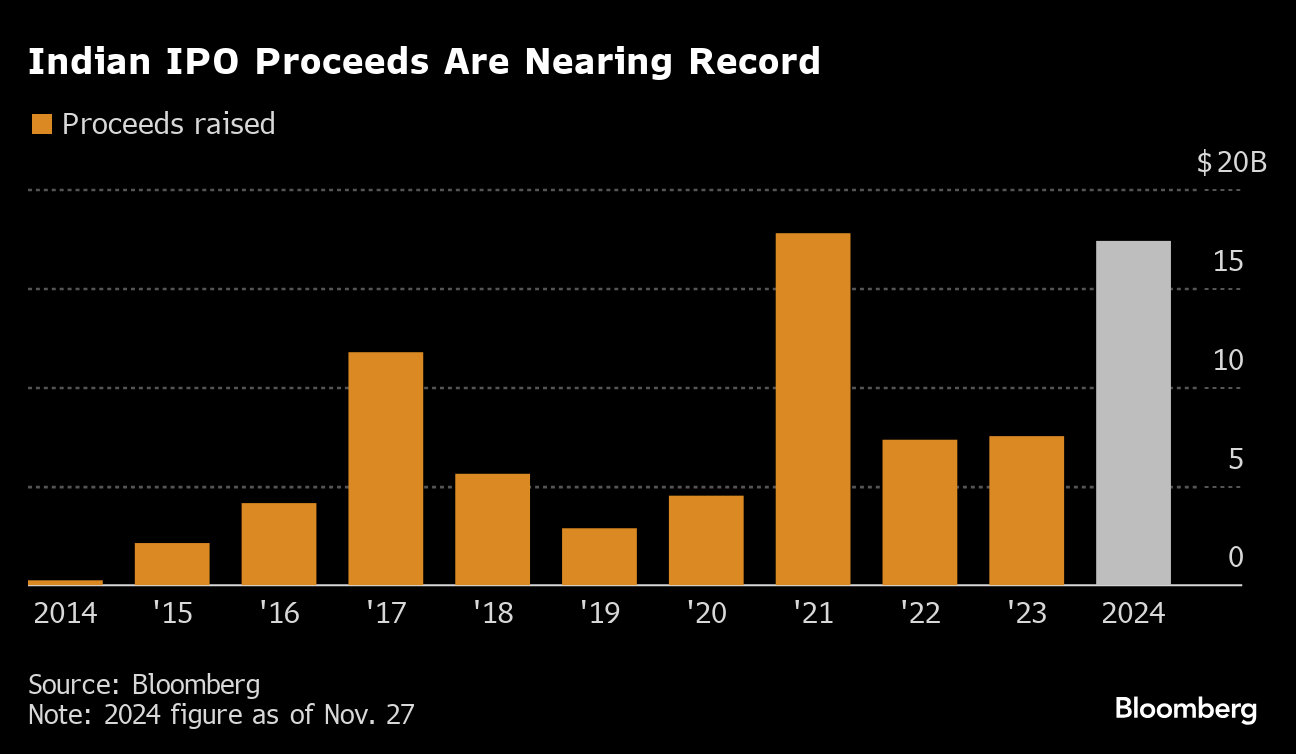

India has been a global hotspot for dealmaking in recent months with large listings such as Hyundai Motor India Ltd. and food delivery firm Swiggy Ltd. IPOs have been witnessing participation across investor categories.

The strong response for listings comes as foreign funds offload local shares amid pricey valuations, while the indictment of billionaire Gautam Adani by US prosecutors weighs on investor sentiment.

“This IPO shows that despite the overhang of the Adani controversy and any volatility in the Indian market there continues to be a strong appetite for Indian IPOs,” said Nirgunan Tiruchelvam, an analyst at Aletheia Capital in Singapore.

Initial public offerings by 12 companies in the renewables space raised more than $1.2 billion this year in India before the NTPC Green debut. Except for Acme Solar Holdings Ltd., all issues rallied on their debut.

(Updates with closing prices)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Interocean secures four-year extension with Vattenfall

JPMorgan Pursues Deals to Fund Shutdown of Coal-Fired Power

European Gas Prices Fluctuate With More Cold Weather on the Way

ADNOC L&S takes delivery of first new-build LNG carrier from Jiangnan Shipyard ahead of schedule

Egypt Reviewing LNG Import Needs as Domestic Power Demand Dips

Europe Is Already Facing Its Next Energy Crisis

Northvolt CEO Peter Carlsson Quits After Bankruptcy Filing

Nearly 50 countries sign Baku Declaration on Water for Climate Action at COP29

Thames Water Blocked From Using Customer Cash to Pay Bonuses