OMV Says Russia May Cut Gas on Arbitration Win Over Gazprom

(Bloomberg) -- OMV AG warned Russian natural gas supplies may be disrupted as the company intends to stop paying for imports from Gazprom PJSC to recoup damages it won in arbitration. European futures surged to the highest in a year.

Russian piped flows across Ukraine are expected to end Dec. 31 unless an alternative arrangement is made with Kyiv. OMV doesn’t expect Gazprom to pay the €230 million ($242 million) award, which could prompt the Kremlin-controlled company to halt supplies. And that may boost reliance on costly liquefied natural gas.

Europe’s gas market has been particularly sensitive to disruptions since the 2022 energy crisis, with any outages liable to jolt prices. Futures have climbed in recent months on gathering risks to supply, and the threat of an imminent Russian cutoff increases the strain just as the heating season gets underway.

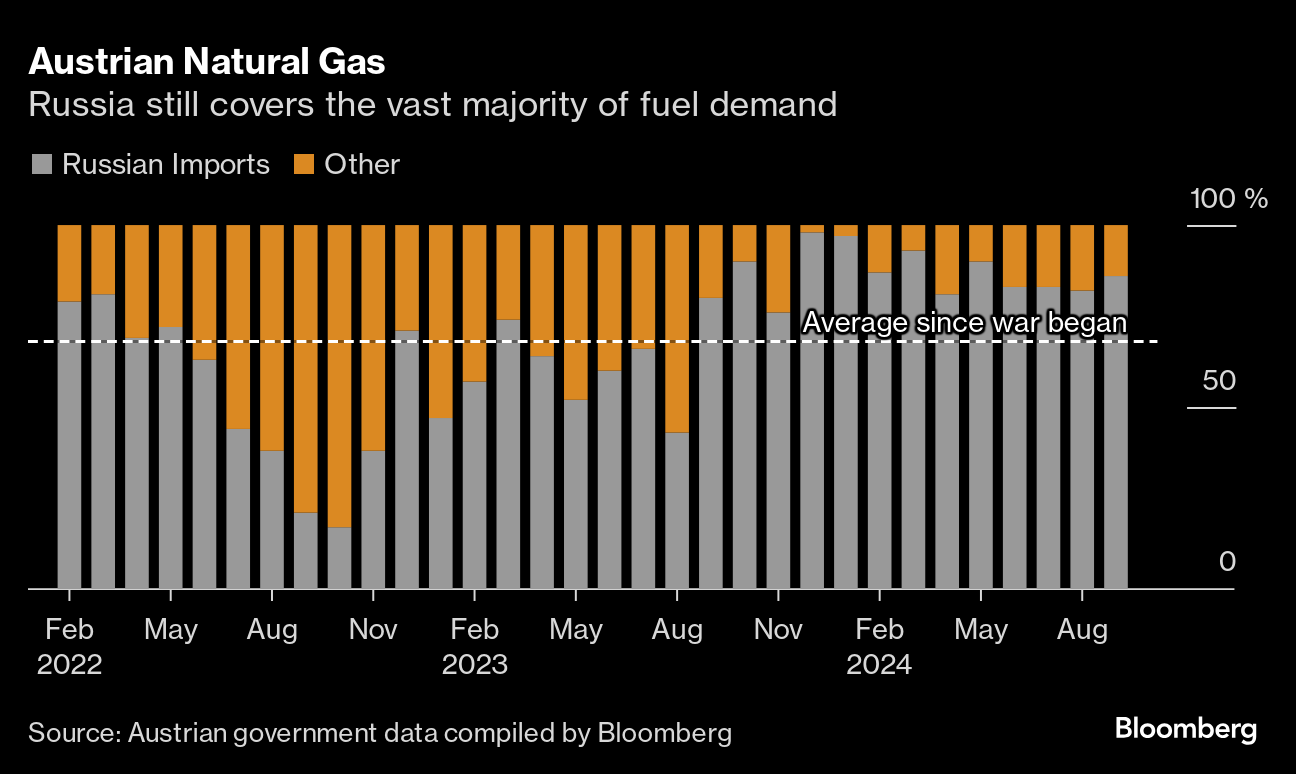

Much of the region has weaned itself off Moscow’s flows in recent years, with Austria — OMV’s home market — and Slovakia the main remaining importers of gas piped via Ukraine. While Gazprom has also been involved in arbitration with other European clients such as Uniper SE and Eni SpA, this is the first time a company has said it could divert its payments to recover arbitration awards.

Payments for supplies are likely due by the 20th of the month, if previous deadlines are any guide.

“Given that OMV has said it will immediately seek to recoup the award, it’s possible it will withhold its payment to Gazprom for the deliveries it received in October,” said Tom Marzec-Manser, head of gas analytics at ICIS. “It’s a tense time.”

OMV said it can meet supply obligations via alternative sources in the event that Russian deliveries under its long-term contract are obstructed. Gazprom declined to comment.

“Austria can and will manage without Russian gas,” Energy Minister Leonore Gewessler wrote on X. “Nevertheless, it is clear that a sudden interruption in supply could cause tension on the gas markets.”

Benchmark futures jumped as much as 5.4%, the highest since November last year, and were up 3.7% at €45.27 a megawatt-hour as of 10:51 a.m. in Amsterdam.

OMV said supply of 5 terawatt-hours a month could be affected. That’s roughly 1% of the European Union’s total gas needs during peak-demand season at the start of this year — still enough to make traders nervous given the fragility of the market balance. September was the 10th consecutive month that Russia covered more than 80% of Austrian gas demand.

Austria has maintained one of Europe’s oldest and deepest connections to Russian energy, and in 2018 extended a long-term gas contract to 2040. State-owned OMV, the country’s biggest fossil-fuel company, grew out of its post-World War II independence treaty that handed over Soviet-controlled energy assets in return for the nation’s neutrality.

On Wednesday, Slovakia’s largest energy provider, Slovensky Plynarensky Priemysel AS, outlined alternative routes for gas supplies should a deal fail to secure future flows through Ukraine. In June, German utility Uniper was awarded more than €13 billion in damages for undelivered Gazprom gas.

While landlocked countries in central Europe can access LNG, including via new terminals quickly set up in Germany and the Netherlands at the height of the energy crisis, it’s an expensive option that includes higher costs for fuel, regasification and transit. For Slovakia, it would cost it as much as €220 million more a year in transit fees to replace Russian volumes with LNG.

(Updates with analyst comment in sixth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog