Billionaire Tykac Bucks ESG Push With Global Bet on Dirty Coal

(Bloomberg) -- As most investors turn away from coal, Czech billionaire Pavel Tykac is doubling down on the dirty fuel — just not in his home country.

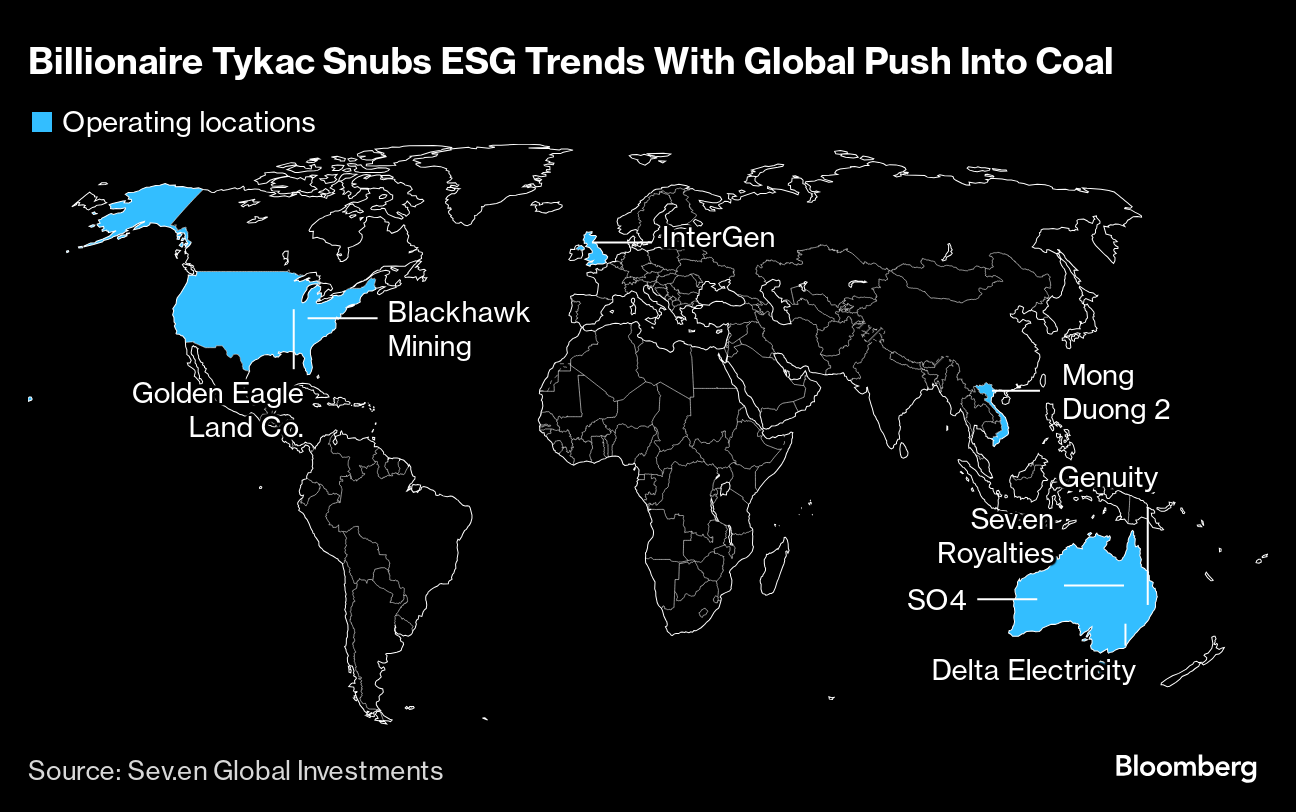

Tykac’s Sev.en Group has taken advantage of cheap valuations to buy up coal power stations and mines in the US, Australia and Vietnam, as well as gas-fired plants in the UK. After building his fortune in the Czech Republic, Tykac is using the expansion to shield his wealth from European Union efforts to lead the world in giving up fossil fuels.

It’s also a bet that delays and snags in the transition to renewable energy will keep coal in the mix for years to come, at least outside Europe.

Having amassed foreign assets worth an estimated €3 billion ($3.3 billion) in the past five years, Sev.en is preparing for more and bigger deals, according to Alan Svoboda, chief executive officer of the group’s international business.

“We have much more in the pipeline than in the past, and we’re hoping to grow even faster than we have so far,” he said in an interview at the Prague headquarters of Sev.en Global Investments AS. “We look at hundreds of opportunities every year and submit dozens of binding bids.”

The Vales Point power station outside Sydney is one such example. The Czech company bought the coal-fired facility, which has a license to operate until 2029, two years ago. Yet looming electricity shortages might prompt Australian authorities to extend its lifespan until 2033, according to Svoboda. If that were to happen, it could boost profits, even if it requires additional investment.

“The entire energy sector can’t change overnight, as some people hoped,” the CEO said. “The Australians have realized that it is not totally safe to force a speedy decommissioning of coal plants, and that it is better to let market forces determine when their operation will no longer make business sense.”

As institutional shareholders, lenders and insurers flee environmentally harmful industries in droves, it remains unclear whether the company’s push into coal will pay off. Revenue at Sev.en Global Investments, which now accounts for over 70% of Tykac’s empire, jumped 23% last year to €1.85 billion. Still, adjusted earnings before interest, taxes, depreciation and amortization fell 53% to €432 million as energy prices slid from the record levels notched in 2022.

Including his original Czech company, Sev.en Ceska Energie AS, Tykac now has about 6,000 employees worldwide and a net worth of around $3 billion, according to estimates from the Bloomberg Billionaires Index.

Tykac, who declined to personally comment for this article, started out in business after the Velvet Revolution in 1989, when then-Czechoslovakia ditched communism. His first company was a computer manufacturer, and he later began investing in other local businesses and banks.

After 2006, Tykac transitioned into coal mines and power and heating plants around the Czech Republic. His Pocerady station, near the country’s northern border with Germany, is one of the country’s biggest polluters and has been a frequent target of environmental activists since it went online in the 1970s.

Unlike many peers, Tykac is not trying to greenwash his image. Sev.en Global Investment’s website describes its business model as focused on risky, high-return projects. It quotes Tykac as saying that his investments are “crucial for our economies” even as others might avoid them for ethical reasons.

“Sufficiency of reliable, safe and affordable electricity,” it reads, “is one of the basic conditions for the existence of today’s civilization.”

Svoboda joined Sev.en in 2018 to take care of its overseas expansion. The 52-year-old former executive at Czech utility CEZ AS says the EU effort to phase out coal is posing “elevated regulatory risk” to companies such as Sev.en.

“We are largely losing interest in Europe, except for the UK,” Svoboda said. “We are drawn to America and Australia.”

While the focus remains on developed nations with stable political systems, Tykac’s empire is also expanding into communist-ruled Vietnam, where it has agreed to buy 70% of a coal plant from American and Chinese investors. The 1.2 gigawatt facility outside Hanoi comes with a supply contract that hedges the owner against swings in exchange rates and coal prices until 2055.

Sev.en is hoping that the investment could be followed by expansion into places like India, Indonesia and Malaysia, according to Svoboda. Many countries in the region aren’t planning to ditch coal anytime soon, and their governments are often willing to compensate foreign owners with long-term guarantees.

“We thought it was time to try something new,” said Svoboda. “We would like to replicate our investment in Vietnam in other places across South-East Asia.”

It does remain easier to secure funding for green projects, which is one reason why the group is also seeking to diversify into industries such as electricity storage and mining minerals, including those used in batteries. In Australia, it is about to start producing potassium-sulfate fertilizer made via an environmentally friendly process.

Over the past 18 months, Sev.en has opened offices in New York, London and Sydney in an effort to expand its global footprint. “We’ve been looking at bigger and bigger transactions,” said Svoboda, adding that the “sweet spot” for acquisitions is currently between €500 million and €1 billion.

Despite the rising appetite, Sev.en remains selective, according to Svoboda.

“Rather than having a broad portfolio of many smaller items,” he said, “our goal is to own a limited number of crown jewels that we go all-in on.”

©2024 Bloomberg L.P.