Sweden’s Nuclear Revival Questioned as Green Projects Falter

(Bloomberg) -- Sweden’s nuclear revival risks being undermined as more companies pull the brakes on large power-hungry green projects designed to clean up some of the world’s dirtiest industries.

A policy U-turn that would entail a massive buildout of reactors, the first to come online in more than 40 years, now appears more unlikely as uncertainty grows over how much electricity the Nordic region’s biggest economy will actually need in the coming decades.

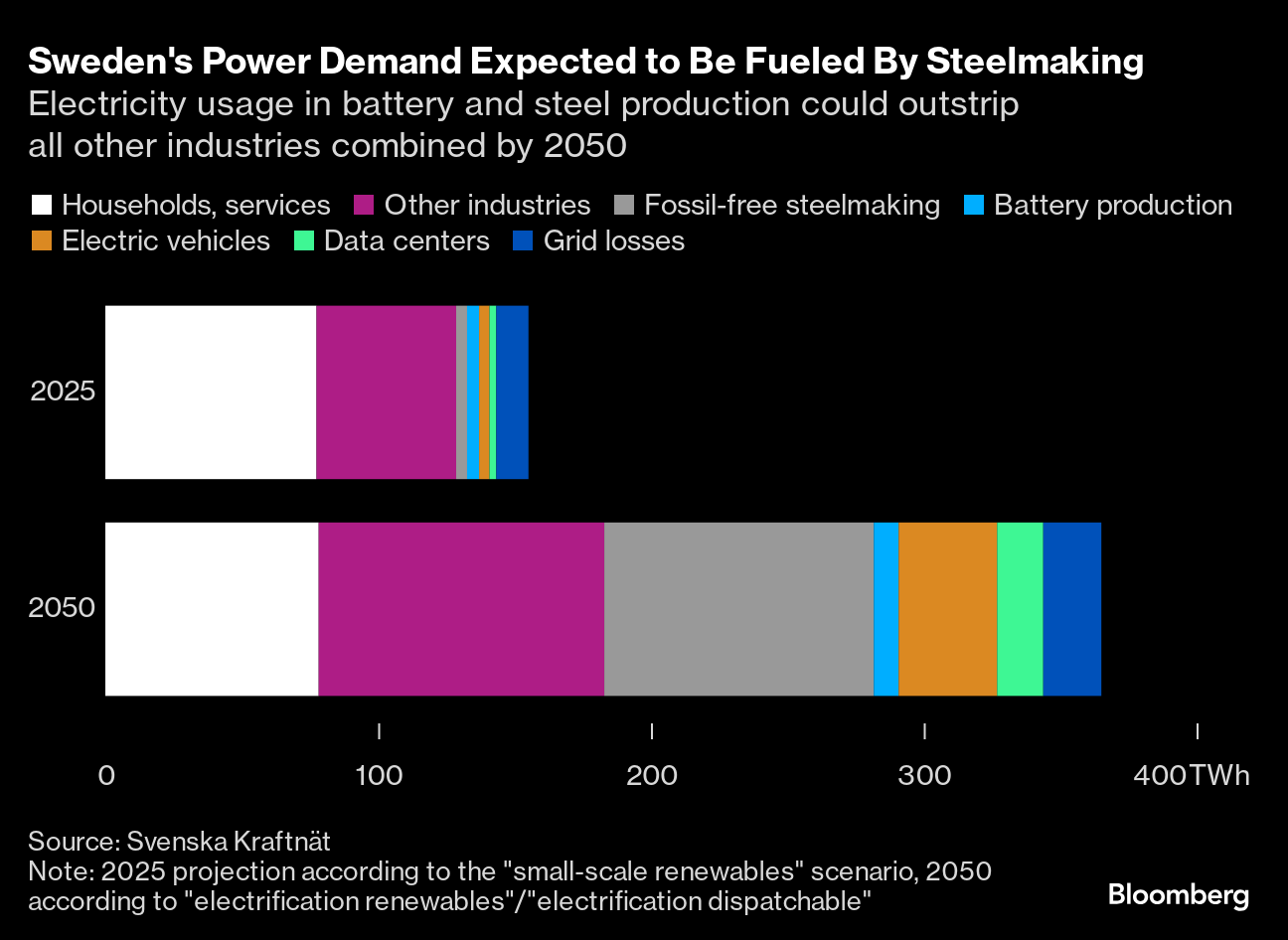

Tremendously costly and time consuming to build, the government’s plan has nuclear reactors becoming the main building blocks of the energy system way into the next century as everything from transport to heavy industries gets electrified. Makers of fossil-free steel, electric vehicle batteries, green hydrogen and potential marine fuel e-methanol would contribute to a large slice of the demand increase.

But now, the $100 billion green-tech revolution is wobbling. Europe’s first home-grown battery maker Northvolt AB is fighting for its survival and has scaled back all expansion plans. At the same time, iron-ore giant LKAB is curtailing plans to produce fossil-free sponge iron at a site in northern Sweden, and state-owned utility Vattenfall AB earlier this month halted a project to make sustainable aviation fuel that was initiated in cooperation with Shell Plc.

Those snags are casting doubt on a forecast underpinning the government’s plans, which sees electricity consumption doubling to about 300 terawatt-hours over the next two decades. Energy Minister Ebba Busch is undeterred: at a briefing last week she said she’s not concerned about building too much capacity.

“We have a giant journey to make to catch up, to get electricity production that also enables more consumption,” she said. “And Sweden has gained a lot of investments on the notion that we have a lot of fossil-free electricity at stable prices. We don’t have that anymore.”

New reactors were a central 2022 election pledge and the center-right coalition is going all in. But it’s a huge gamble given how technologies such as solar and wind continue to get cheaper, and critics argue that energy storage and other rapidly developing technologies could balance weather-dependent power sources. At the same time, costs for reactor projects already underway in Europe have surged, amid long delays.

The issue is not easy in Sweden, where people have had a love-hate relationship with atomic energy since the first commercial reactor began operations in 1972. Mounting grassroots opposition in subsequent years culminated in a 1980 referendum calling for the dismantling of all reactors — an effort that ultimately failed.

There are still six units in operation today, providing about a third of the nation’s power. Hydro generation is the biggest with almost half. However, a growing share of weather-dependent renewables has led to price volatility, imbalances and a lack of available grid capacity. The solution, according to the center-right cabinet, has to be nuclear.

The head of Fortum Oyj, the Finnish utility which is also one of Sweden’s biggest power producers, agrees. The firm is studying whether to invest in new reactors there.

“It’s clearly an advantage to have more alternatives available,” Chief Executive Officer Markus Rauramo said in an interview on Tuesday. “For countries that have opted not to pursue a future with nuclear, that just means they have fewer tools in the toolbox.”

The government wants ten reactors, with four planned for a first wave of buildouts, starting in about a decade, in part to address a lack of generation in the southern part of the country. The initial outlay would be roughly 6% of Sweden’s annual gross domestic product with costs estimated at roughly 100 billion Swedish kronor ($9.4 billion) for just one reactor.

While the proposed plan of subsidized government credit covering 75% of construction costs is estimated to yield a net positive effect in the end, taxpayers will bear a considerable risk. That’s as the state would guarantee a proposed minimum price of 0.8 kronor per kilowatt-hour to companies operating the reactors, for 40 years.

“If you start building ten reactors, you risk ending up with a huge oversupply of electricity,” Arne Kaijser, a professor emeritus of the history of technology from Stockholm’s Royal Institute of Technology said, adding that the price guarantee could “prove very expensive for Swedish tax payers.”

There’s also a possibility the government is building its plans on a flawed demand forecast as it prepares for the electrification of everything.

Instead of doubling, Aurora Energy Research Ltd., which advises governments and utilities, projects a 70% consumption increase by 2045. And Staffan Bergh, head of analysis at industry consultancy Bodecker Partners AB, puts his finger on a 50% growth estimate. That still represents “a monumental shift for Swedish society and the economy,” he said.

While that shift will require generation that helps stabilize output, a new breed of startups believe storage solutions can be combined with other technologies to do that just as well as nuclear power.

“There is nothing wrong with nuclear power, but it comes down to costs,” said John Diklev, founder of Flower, a company that specializes in battery-based storage installations. “While the public debate has focused on nuclear energy and wind, Sweden has added almost one gigawatt of energy storage over the last 12 months. In that period, no nuclear reactors have been built, of course, and almost no wind projects have been started.”

His company’s modeling shows that storage, flexibility services and optimization can provide the same benefits to the grid as nuclear power. The government’s hurry to start building reactors, meanwhile, is partly predicated on an observation that it’s not alone in wanting to grow in nuclear, with suppliers around the world scarce. Many are already building, although projects in Europe have been fraught with delays and cost overruns.

At the same time, investment decisions in Sweden are still years away, and Busch, the energy minister, says any wavering now would put the country last in line of prospective buyers.

“If Sweden waits we will miss this train,” she said. “It always feels safer to wait and see, but Sweden’s prosperity wasn’t built by pessimists who preferred to stay on the sidelines.”

(Updates with context and chart from fourth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog