Europe’s Nuclear Plants Are Being Sidelined by Green Power Surge

(Bloomberg) -- The days have only just started to get longer, but renewables output is already so strong that it’s forcing Europe’s nuclear reactors to make costly adjustments.

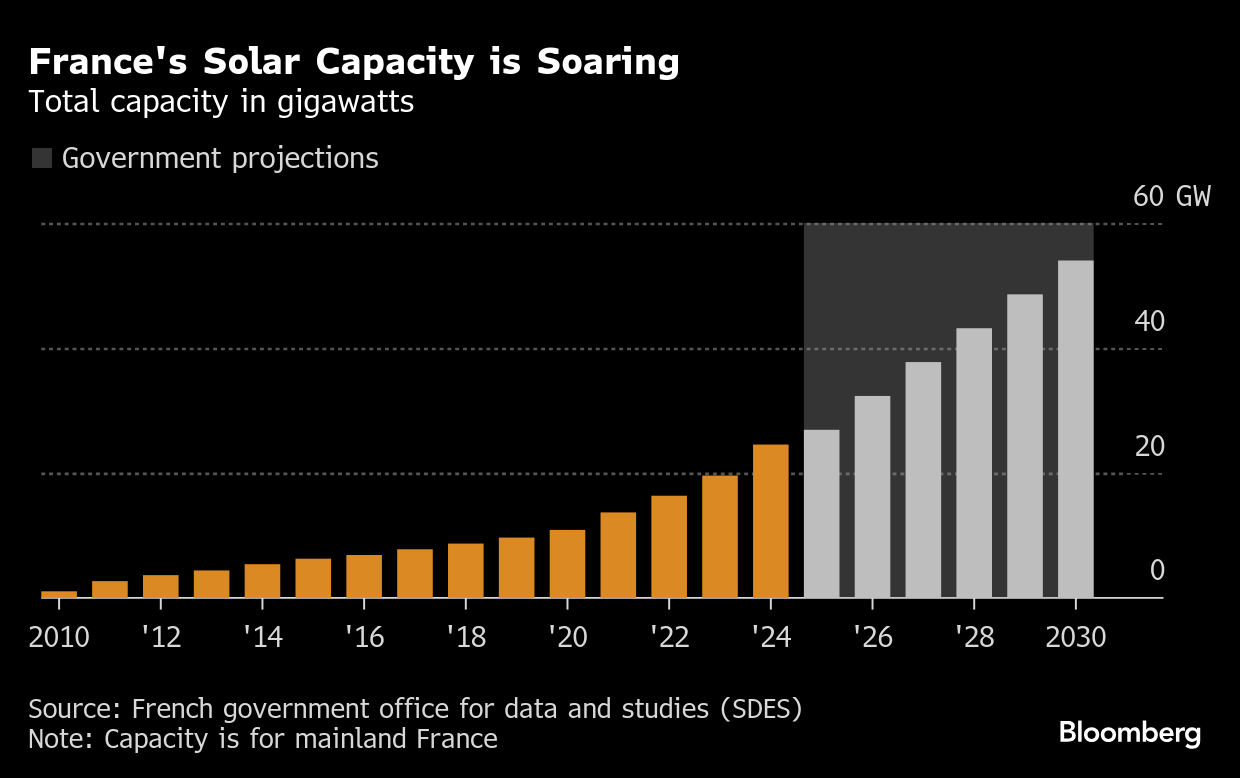

Solar is set to flood the region’s grid and send power prices plunging in the coming months, forcing atomic plants to dial back. France, which has the continent’s largest fleet, cut output at some reactors in recent days, adding to a debate about whether renewables generation needs to be curbed to safeguard the viability of other critical energy sources.

Nuclear plants were built to be the work horses of the power system, always on, providing a big chunk of stable capacity. For decades they’ve done that, but with so much green power sloshing around they’re not able to sell electricity during as many hours as they used to. That makes them less profitable to run and risks them shutting, despite being strategic assets in most countries that are needed for net zero goals.

“Renewables will likely have a much bigger impact on European nuclear operations over the coming months than in the past,” said Staffan Bergh, head of analysis at Bodecker Partners AB, an adviser to utilities and investors. “We’re going to see far more hours with negative prices and they will only increase during the spring.”

The European Union’s installed solar capacity roughly doubled between 2021 and 2024, particularly after the energy crisis highlighted the danger of relying on imported fossil fuels. Weather patterns, meanwhile, are pointing to strong solar production in the coming months, after record-breaking sunshine in the UK in March.

But renewables aren’t always available, and a severe wind lull this winter served as a reminder of why stable generation from other sources such as nuclear is still needed.

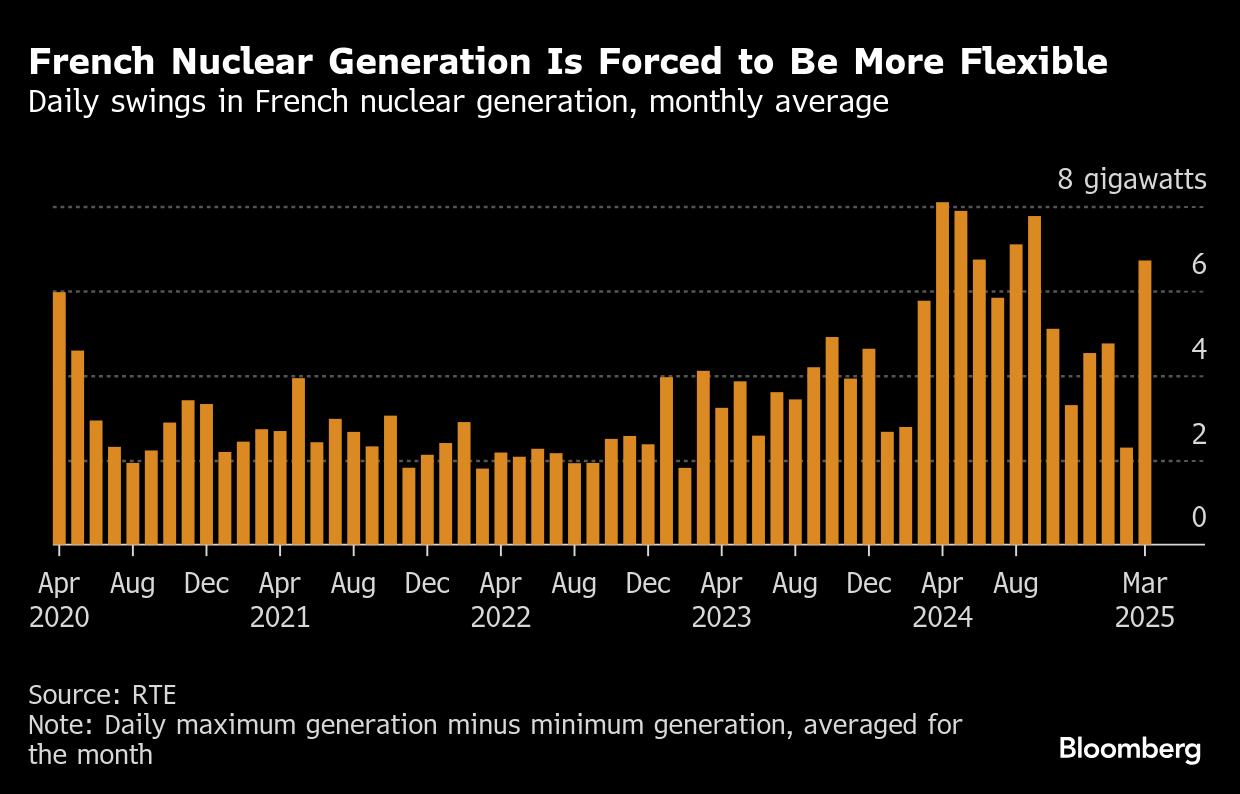

Nowhere is the impact felt harder than in France, where about 70% of electricity still comes from 57 atomic reactors. While reactors have been adapted to be able to respond to demand fluctuations, increasing swings are fueling a political debate over the need to curb renewables generation. The nation’s watchdog is investigating whether increased use of solar and wind power is adding to physical damage of its aging plants.

In March, the number of hourly power prices below zero rose 88% in France from a year earlier, while also doubling in Germany, according to Epex Spot SE data. At the same time, the spread between highs and lows within the same day is also set to increase.

“A power variation is not a trivial event,” according to a report by Jean Casabianca, inspector general for nuclear safety and radiation protection at state-owned nuclear operator Electricite de France. “The unpredictability and short notice of these strong modulations disrupt the planning of activities, scheduled maintenance and periodic tests.”

It’s when demand is low, mainly in spring and summer and even more so on weekends, that the surge in solar output causes the most disruptions. The slump in power prices triggered by those periods eats into EDF’s revenue at a critical time when it needs to boost investment in power grids and new reactors.

“We’re already seeing massive price differences within the same day now and that’s really hard for nuclear operators to navigate. It’s a growing problem for them,” said Bergh.

According to industry consultant Kpler SAS, which tracks power plants and other energy infrastructure, EDF had to lower atomic output by an average of 4 gigawatts per day in March, twice as much as a year earlier.

Further north in Sweden, nuclear accounts for about 30% of the nation’s electricity. State-owned operator Vattenfall AB said in its 2024 sustainability report that reactors “face a rise in competition from renewable production” and nuclear owners now routinely adjust output if prices go below the production cost.

In Spain, which has seven reactors, utility Endesa SA cut output to 70% in early April at its Asco-1 unit to compensate for a surge in solar production and low weekend demand, a spokesperson said. As renewables weigh on power prices, reactors at times struggle to be competitive because of an increasing tax burden, according to the spokesperson.

The French government is trying to combat the development by curbing subsidies for new rooftop photovoltaic projects and widening incentives for solar and wind farms to stop producing when prices turn negative. France’s power grid operator sent a letter to suppliers, producers and traders in recent days outlining the tense situation.

“Significant development must be carried out in the field of flexibility of production and demand,” Sophie Mourlon, head of energy and climate at France’s Environment Ministry, said this month. “If needed, we can adjust the support for renewable energies and for some flexibilities.”

©2025 Bloomberg L.P.