German Power Prices to Stay High as Link to Gas Seen Stronger

(Bloomberg) -- Electricity prices in Germany will remain elevated as their link to natural gas is poised to strengthen over the coming years.

Despite a strong start to the solar season in Europe, and record amounts of cheap new renewable capacity in Germany since the energy crisis, it’s natural gas that will increasingly decide how much households and factories in Europe’s biggest economy pay for electricity.

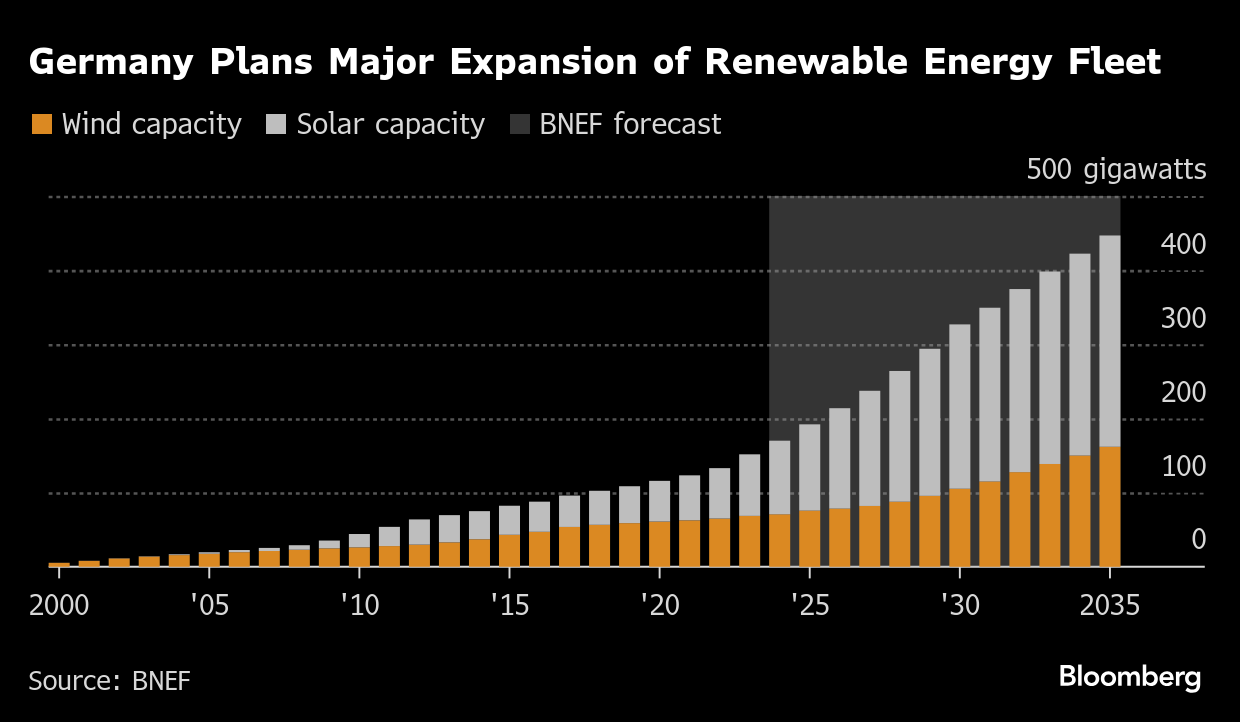

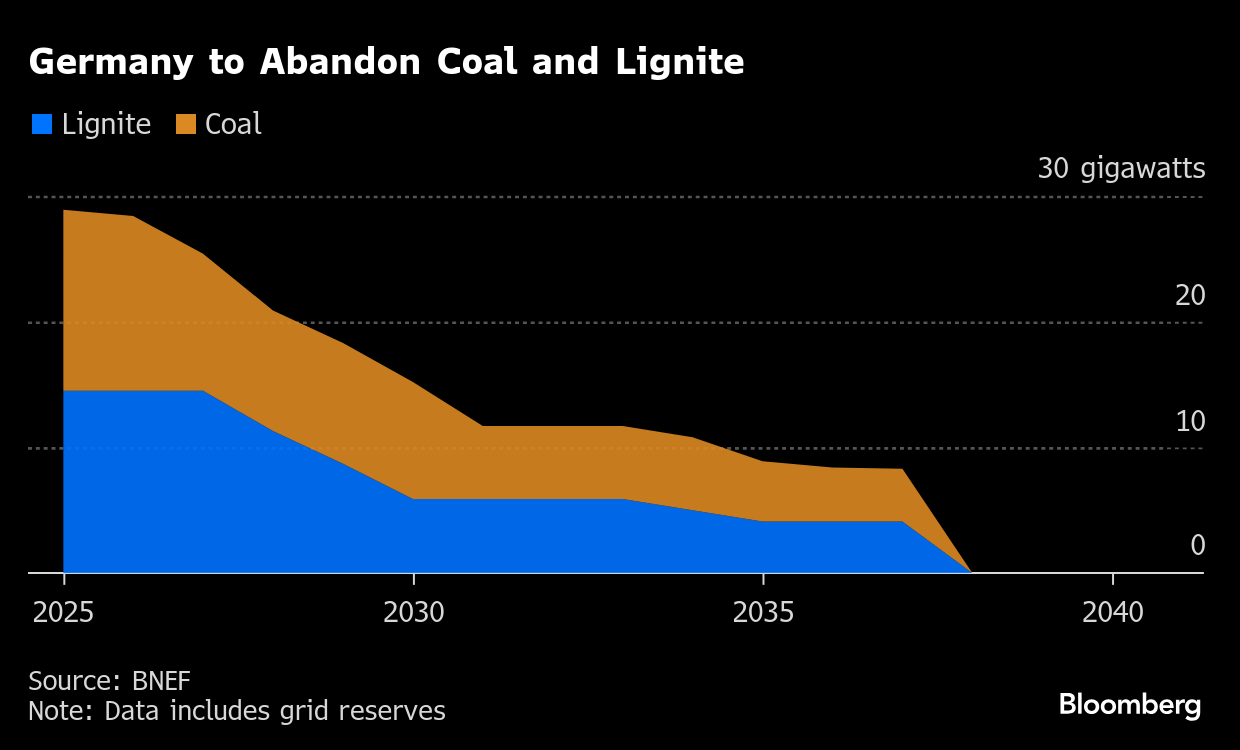

The reason is the way the European power market is designed, where it’s the last amount of electricity needed to meet demand that sets the price. After Germany’s exit from nuclear and the rapid closing of coal plants in the past five years, stations burning natural gas will increasingly play that role, according to analysts.

Gas will set German power prices almost 85% of the time by 2028, up from around 55% in this year, according to Energy Aspects Ltd. ICIS has a slightly more moderate forecast, seeing the role of gas rising to 50% of the time by 2028 from about 45% now.

“Renewables will still be able to cover a high proportion of German electricity demand, but fossil fuels, and increasingly gas-fired power generation, will still be needed to cover the last few kilowatt-hours, and will therefore set the price,” said Energy Aspects analyst Sabrina Kernbichler.

She expects a wholesale power price of €88.9 per megawatt-hour in 2026, dropping to €80.7 in 2027. That compares with a forecast of €103.6 for this year.

“The situation remains problematic for energy-intensive industries with disadvantages compared to the USA and China,” said Eric Heymann, a senior economist at Deutsche Bank AG. “Private households and many non-energy-intensive companies have come to terms with the current electricity prices to a certain extent.”

The role of gas as a power price-setter will largely depend on the pace of the coal phase-out, which is scheduled to be completed by 2038. According to a draft agreement between political parties that aim to form Germany’s next government, coal-fired power plants won’t be closed until enough gas-fired power plants have been built. They’re also eyeing drawing on reserve facilities to dampen prices, as well as cutting energy taxes.

“In addition to tax cuts, more supply through gas contracts with other supplier countries could also provide relief,” said Heymann.

The previous government had planned tenders for gas-fired power plants, but those plans fell through after the coalition collapsed late last year. The new government intends to revive a similar strategy, targeting 20 gigawatts of gas capacity, according to preliminary negotiation documents.

That would compensate for the 22 gigawatts of coal and nuclear plants that have been shuttered since 2020.

Not everyone agrees gas will tighten its grip on the market. “The influence of gas on power prices, assuming renewables grow as expected, will in fact decline until 2030 as solar and wind gradually reduce the share of thermal power demand,” said Kesavarthiniy Savarimuthu, an analyst at BloombergNEF.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Edison to Bury More Than 150 Miles of Lines in LA Fire Area

EU Nations Support More Leeway to Fill Gas Storage Before Winter

Texas Is Ground Zero for the US Battery Boom

Volkswagen Capitalizes on Tesla Weakness With EV Sales Jump

Australian Leader Unveils $1.4 Billion Plan to Reduce Power Bills

Tariff Anxiety Spurs Carmakers to Freeze Prices, Offer Discounts

South Africa Targets Development Finance Giants for Funds to Revive Cities

Exxon Sees Up to $2.7 Billion Profit Gain on Prices, Margins

Rimac Mulls Buying Porsche’s Stake in Hypercar Joint Venture Bugatti