Texas Is Ground Zero for the US Battery Boom

(Bloomberg) -- “Drill, baby, drill” may be Texas’s unofficial motto, but “store, baby, store” is becoming more accurate.

The Lone Star State may be the heart of America’s oil and gas map, but it's quickly becoming the biggest installer of a technology key for renewables development: battery storage.

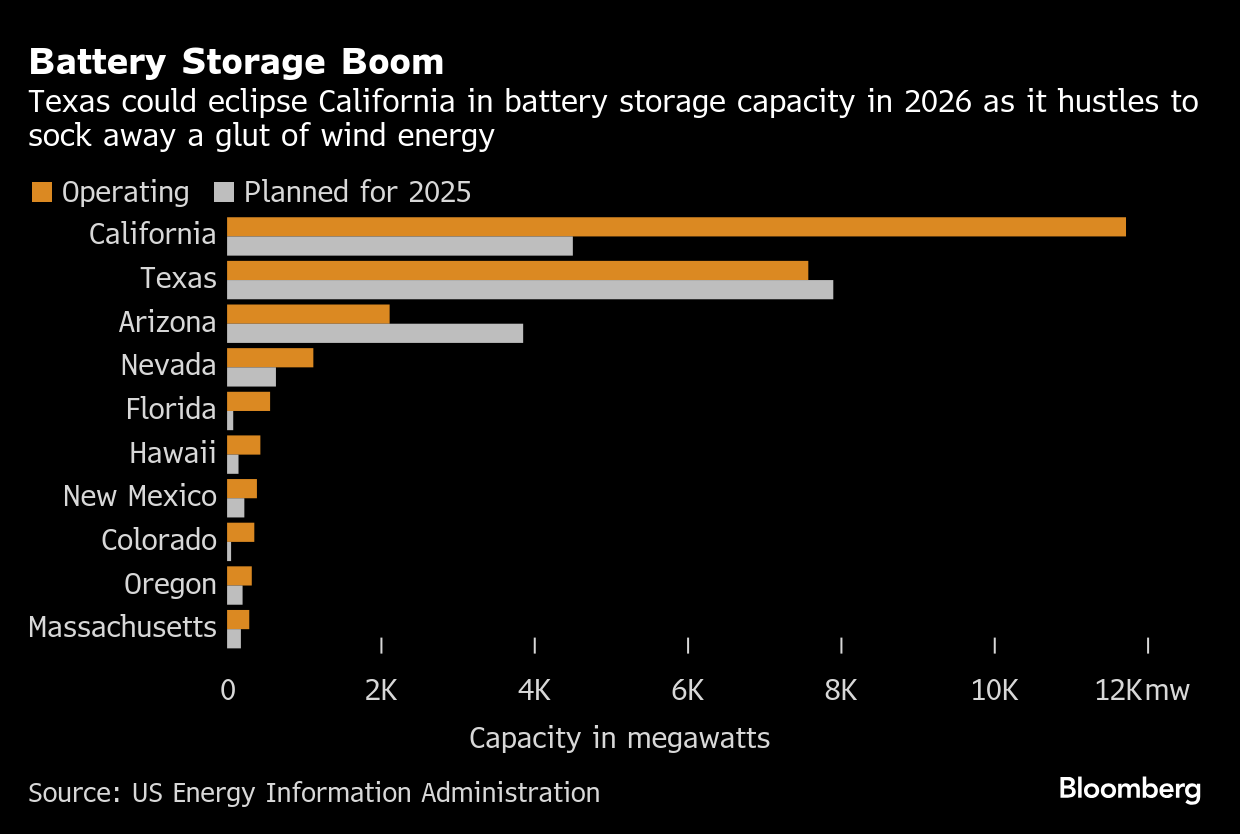

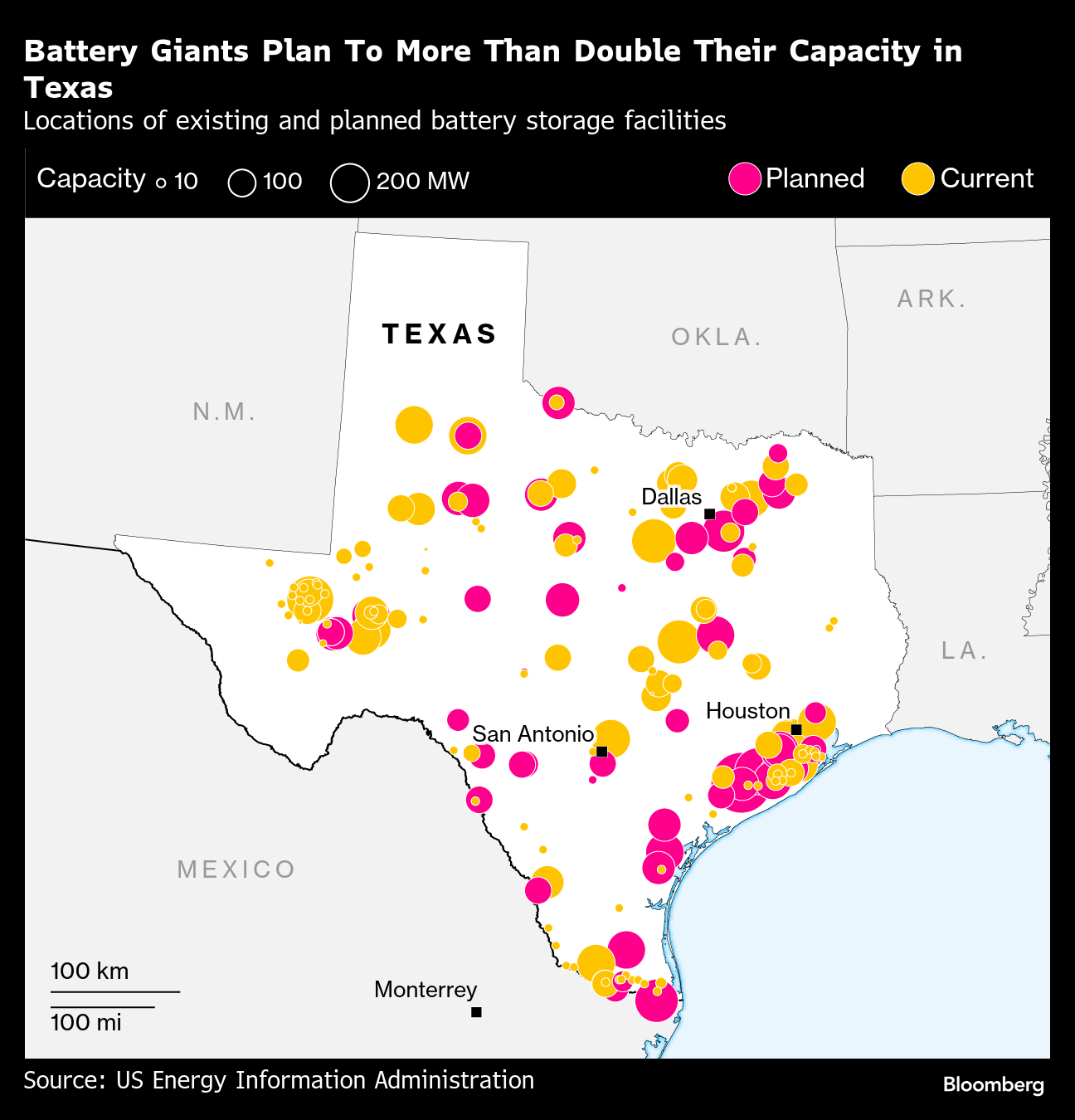

Last year, some 4 gigawatts of battery capacity — enough to power around 3 million homes — switched on in the state, besting the pace of similar projects in California for the first time. Before Donald Trump imposed 125% tariffs on key battery market China, Texas was set to add more than double the state’s total storage capacity in 2025, according to a analysis of federal energy data.

Big batteries are addressing some of the biggest issues facing the electric grid that now has the most renewable capacity in the nation. On the supply side, they can hold the glut of wind and solar power generated across the state. On the demand side, they are helping meet the surging needs of new residents and a growing number of electric vehicles and server stacks in data centers.

“What we’ve done over the past couple years is really build a new industry that has proven it can execute at scale,” said Randolph Mann, chief executive officer of esVolta LP, a battery startup that expects to flip the switch on at three new plants in Texas by July. “We’re doing it in a way that’s environmentally beneficial and we’re able to execute that pretty quickly.”

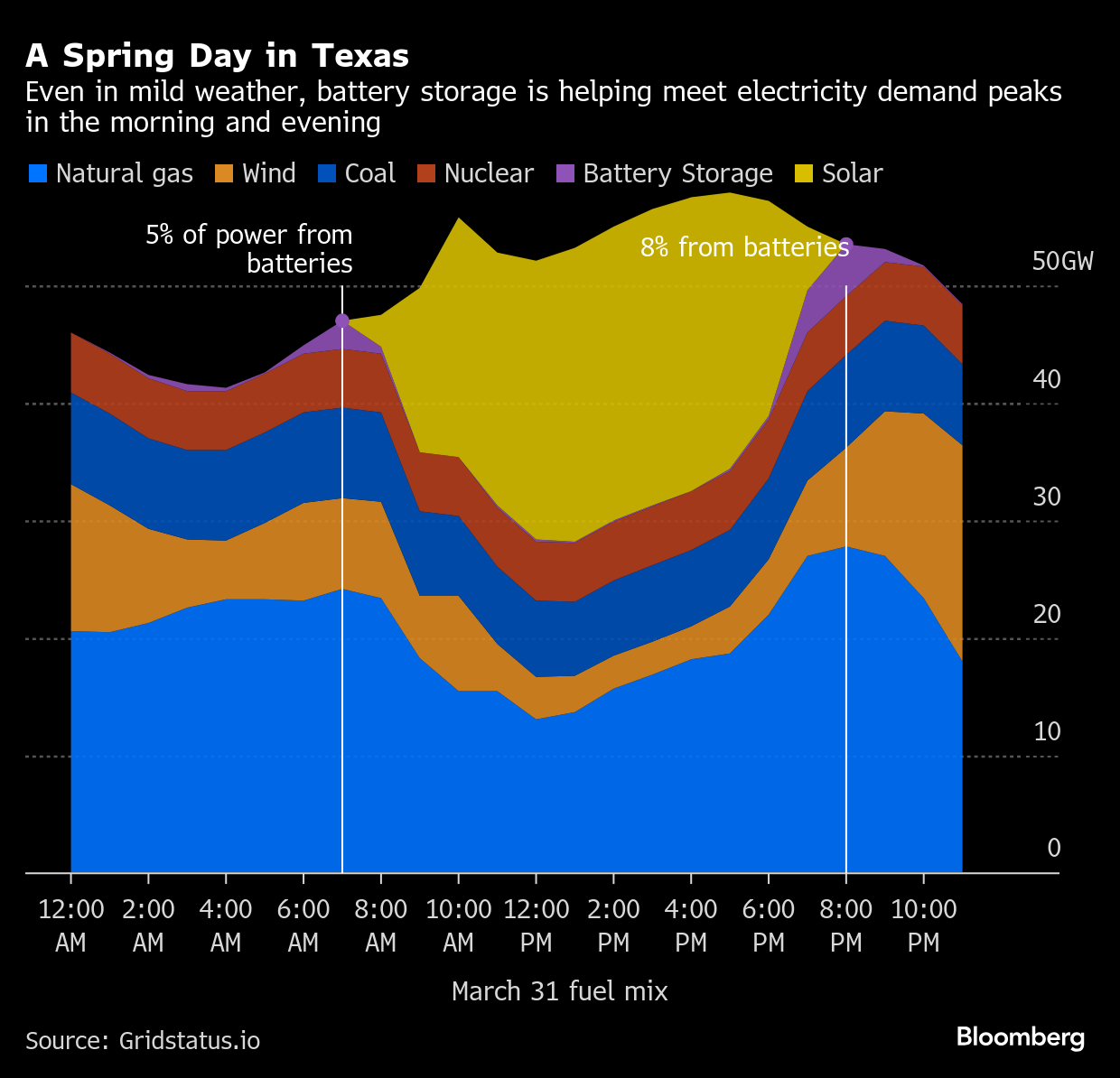

Consider the state’s energy picture in the past seven days, an average week of mellow spring weather in the Lone Star State. When demand peaked around 5 p.m. local time, almost half of Texas’s electricity came from solar and wind. As the sun set, the big batteries started discharging the electrons they’d socked away during the day when the wholesale price of electricity hovered near zero. Storage served more than 7% of the state’s electricity demand for 25 hours of the week, typically around 7 p.m., when Texans were watching TV, doing laundry and plugging in their cars for the night. Though natural gas remains the state’s primary source of electricity, batteries are steadily tamping down the demand peaks that call for fossil fuel turbines to spark to life.

What’s more, batteries can forestall energy disasters such as blackouts, something the state is no stranger to in recent years. During a series of heat waves last summer, the extra storage saved consumers from “some pretty bad situations,” according to Woody Rickerson, chief operating officer at the Electric Reliability Council of Texas, which manages the state’s grid.

Batteries are still catching up to renewable energy in Texas. The state has about 64 gigawatts of wind and solar capacity, but only about 7.4 gigawatts of storage.

While California and a host of other states are actively cultivating battery storage with subsidies and deployment goals, the infrastructure boom in Texas is largely a result of the free market, according to BloombergNEF analyst Isshu Kikuma. “The driver is actually the project economics,” he explained. “Some of the utilities actually use energy storage to replace fossil fuel assets” and batteries make it so “you can just make money.”

The cost of building battery plants has dropped by nearly half since 2017, according to BNEF.

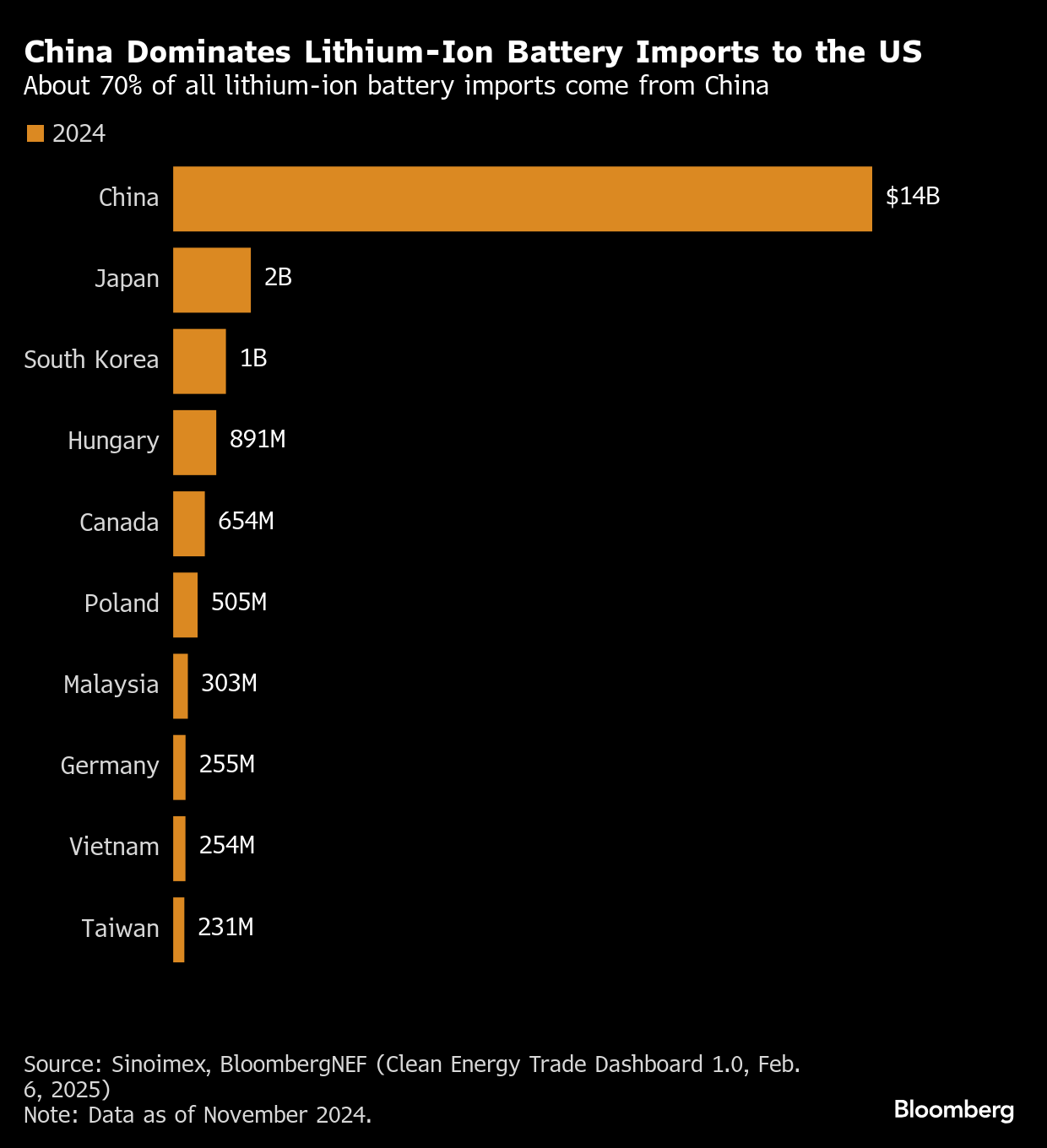

The recently implemented tariffs on China are going to have a strong negative impact on the battery industry, though. Without tariffs, BNEF estimated that the cost of industrial storage was set to fall 13% to $204 per kilowatt-hour this year. Now, a turnkey system will cost $266 per kilowatt-hour, a 17% increase compared to last year.

While Trump has said some nations including Vietnam are keen to negotiate over tariffs as they’re on pause for 90 days, China has moved to retaliate and Trump has escalated. The differing reactions and uncertainty are set to be a drag on the industry where more than two-thirds of imported batteries come from China.

Texas’s battery boom could be throttled by other policy decisions. Battery companies and the utilities that increasingly rely on them are worried Congress will cancel a 30% federal tax credit for solar and storage projects as part of his pledge to scrap climate-focused subsidies. Former President Joe Biden signed a law to incentivize battery makers to set up shop in the US, but it will take years to ramp up production facilities. (That incentive may also be in danger of getting removed or watered down.)

Meanwhile, Texas lawmakers are weighing a plan to require half of new power capacity to come from sources other than battery storage, a policy shift that would prop up the natural gas industry.

“We need to have pretty good clarity of what our capital costs are and have clarity over time because we’re building assets that take five-plus years to develop,” said esVolta’s Mann. “I get that there’s some uncertainty, but having volatility from tariffs on a day-to-day, week-to-week, month-to-month basis is pretty rough.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Edison to Bury More Than 150 Miles of Lines in LA Fire Area

EU Nations Support More Leeway to Fill Gas Storage Before Winter

Volkswagen Capitalizes on Tesla Weakness With EV Sales Jump

German Power Prices to Stay High as Link to Gas Seen Stronger

Australian Leader Unveils $1.4 Billion Plan to Reduce Power Bills

Tariff Anxiety Spurs Carmakers to Freeze Prices, Offer Discounts

South Africa Targets Development Finance Giants for Funds to Revive Cities

Exxon Sees Up to $2.7 Billion Profit Gain on Prices, Margins

Rimac Mulls Buying Porsche’s Stake in Hypercar Joint Venture Bugatti