European Tech Sector Sees Unexpected Rebound on AI Windfall

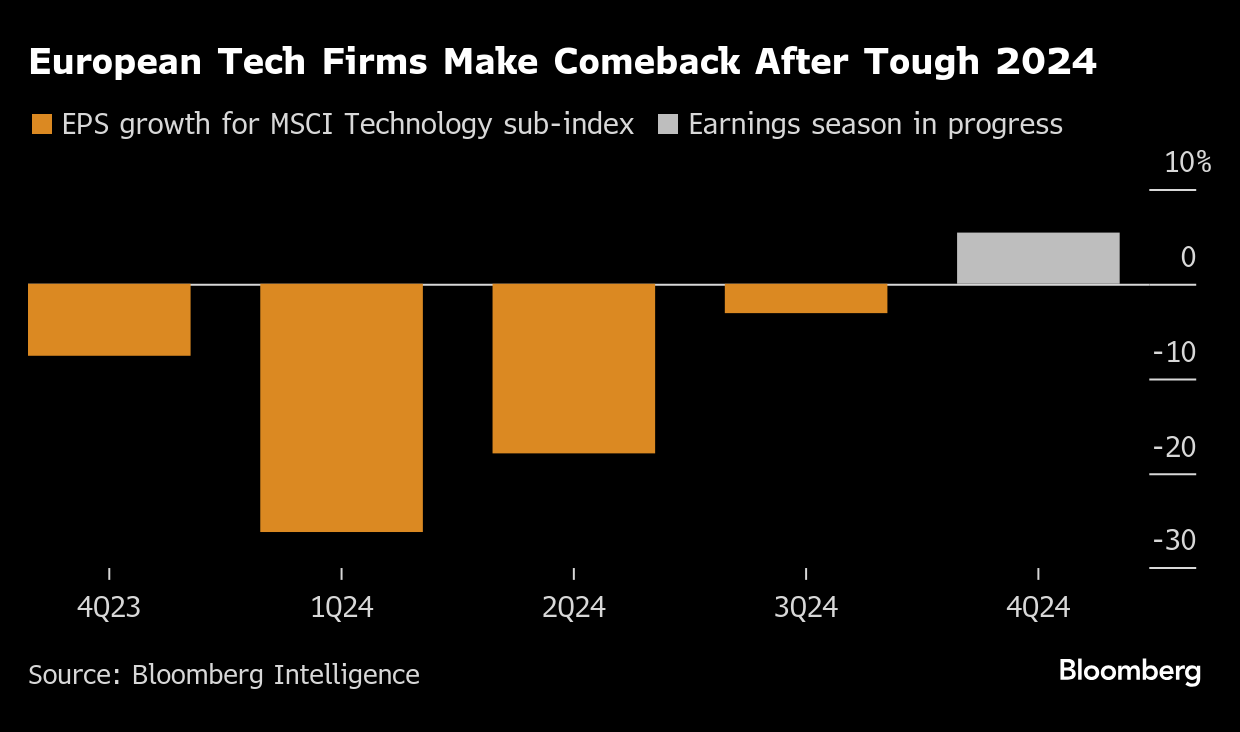

(Bloomberg) -- European technology giants are exceeding expectations this quarter, joining financial and health-care companies as one of the reporting season’s best-performing segments.

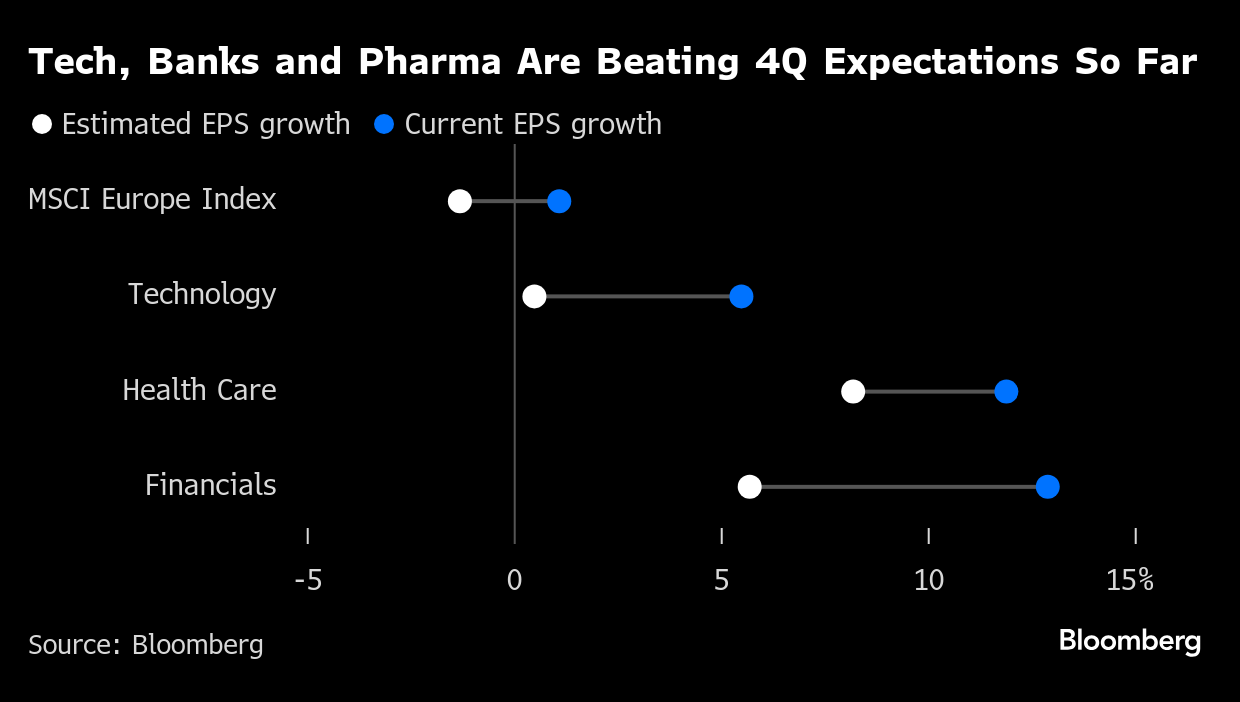

Buoyed by artificial intelligence demand, the technology sub-sector in the MSCI Europe index averaged earnings growth of 5.5% in the fourth quarter, significantly ahead of pre-season estimates of 0.5%. The MSCI Europe Index’s 1.1% per-share earnings growth is also ahead of expectations of a 1.3% decline.

Along with health care and financial companies, technology is one of three sub-indexes that has surprised most positively so far this season. That’s with companies accounting for more than 70% of the MSCI Europe index’ market value having reported. While pharmaceutical companies and banks have been bright spots for European earnings in the past year, technology is a newcomer.

The sector’s main growth drivers for the fourth quarter were ASML Holding NV and Nokia Oyj, according to Bloomberg Intelligence strategists Kaidi Meng and Laurent Douillet. The main drag on the industry has come from STMicroelectronics NV and Infineon Technologies AG.

While semiconductor companies themselves have struggled, the equipment makers are in better shape. Infineon and STMicro have “low visibility” and are still looking for the bottom in weak automotive and industrial end-markets, while their AI exposure remains limited compared with ASML, Sara Russo, a Bernstein analyst, said in an interview.

ASML, the biggest company in the sub-index by market value, reported bookings worth twice as much as analysts expected in the quarter. The company is set to benefit from surging demand for chipmaking machines, as companies are spending heavily on AI.

Meanwhile, Nokia’s mobile networks division, which makes 5G equipment, showed signs of improvement after two years of operators holding back on expensive upgrades. Overall sales were also driven by an increase in the network infrastructure unit, where one “key focus area is the upcoming growth in data centers,” outgoing Chief Executive Officer Pekka Lundmark said on the earnings call.

The second-largest company in the sub-index, software giant SAP SE, is also embracing the AI boom. SAP raised its revenue outlook for 2025 and reported 29% growth in its cloud backlog, as clients increasingly take up its AI business services offering.

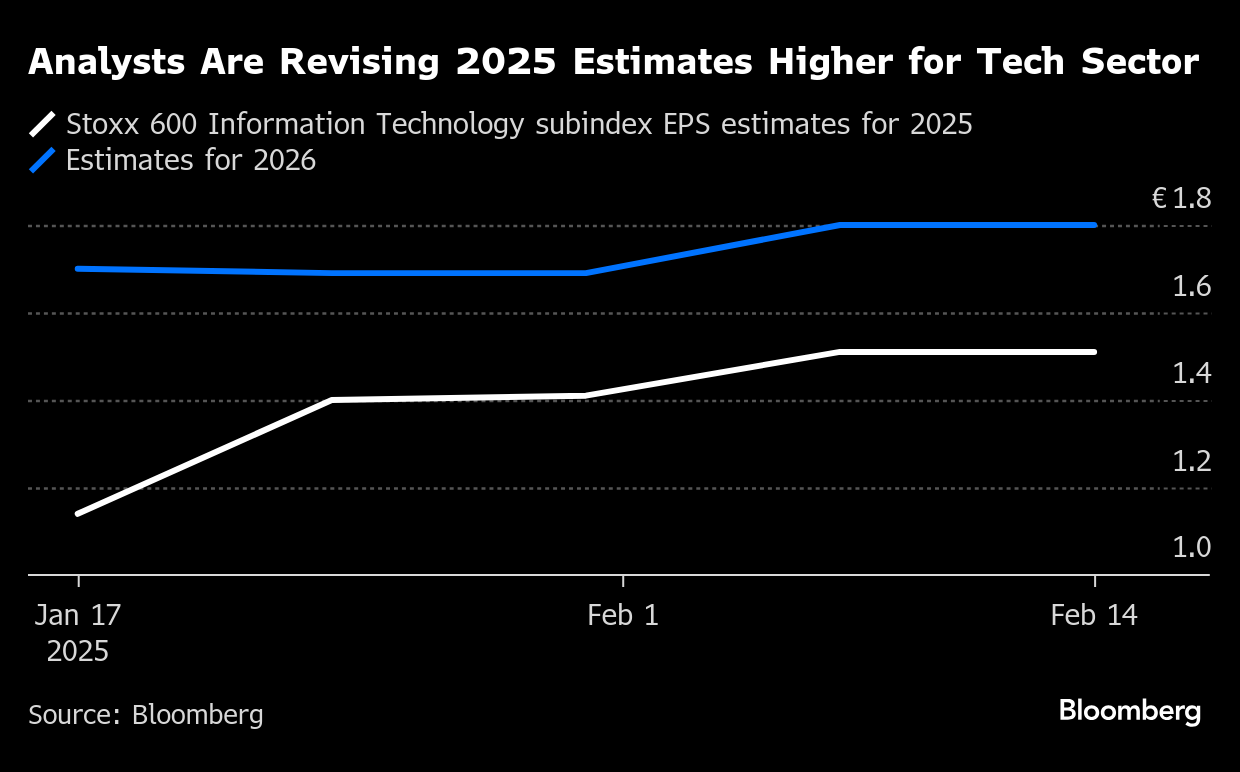

“AI-driven growth has just started to show in the EPS” for companies like ASML and SAP, BI’s Meng said, adding that AI demand is still in an early stage. Beyond 2025 and 2026, the outlook for ASML will depend on whether AI adoption by end-users can justify even higher capital spending, BI’s Douillet added.

Looking ahead, estimates for the wider technology sector are trending higher, though a sustained recovery is not guaranteed, Meng and Douillet said. Threats include US tariffs, headwinds for the chip segment from lower electric vehicle demand and industrial manufacturing, and persistent economic weakness in China and Europe.

Tariffs could hurt primarily Infineon and STMicro, though the impact might trickle down to ASML, according to Bernstein’s Russo.

“If there’s lower demand for chips because of tariffs, semiconductor companies may not buy as much equipment, but it’s a second order problem as opposed to a direct issue for ASML,” she said.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

EDF Profit Falls as Power Prices Retreat and Income Taxes Climb

Centrica Shares Surge on £4 Billion Investment Plan, Buybacks

Orano Says Rising Uranium Price May Revive Mining Projects

ADNOC Distribution and TotalEnergies celebrate two years of TEME joint venture in Egypt

Mars Joins With Fonterra to Cut New Zealand Farm Emissions

European Gas Prices Hold Near €50 With Supply Fears Easing

UK’s First New Nuclear Site Since the 1970s Begins Licensing

Scholz Leaves Germans With Worst Economic Blues in a Generation

Thames Water Takes Business Plan Dispute to Markets Watchdog