Turkish Oil Refining Giant Tupras Shies Away From Russian Oil Due to US Sanctions

(Bloomberg) -- Turkey’s biggest refiner is restricting its purchases of Russian oil and fuels to avoid falling foul of US sanctions, the latest customer to show wariness in dealing with Moscow following the measures last month.

From Feb. 27, Istanbul-based Turkiye Petrol Rafinerileri AS, better known as Tupras, will cease to accept shipments that aren’t in compliance with a Group of Seven nations oil price cap, a person with knowledge of the matter said, asking not to be identified because the matter is sensitive and private.

Tupras was not immediately available for comment.

On Jan. 10, the outgoing Biden administration imposed wide-ranging sanctions on Russia’s oil exports, spanning 161 tankers, two large producers, numerous traders and — perhaps critically for some customers — the main Moscow-based insurer of shipments. Tupras stopped buying above-cap barrels after that date but will still accept delivery of them up to Feb. 27.

The decision to stick to the price cap means Tupras will be complying with the wishes of western powers who’ve long been trying to cut Russia’s access to petrodollars. The Kremlin in the past said it wouldn’t deal with entities that stick to the limit. Russia’s flagship Urals crude is currently hovering around the $60 a barrel threshold, data from Argus Media show, raising a question of whether the Turkish firm would be a willing buyer.

Turkey is home to the Bosphorus and Dardanelles shipping straits, through which upwards of $300 billion of trade flows on ships each year. It has previously emphasized that vessels must have appropriate cover.

Vladimir Putin’s invasion of Ukraine caused Russia to reroute its vast oil-export program as one-time top buyer Europe all but stopped purchases. That increased Moscow’s reliance on nations like Turkey — as well as key customers in India and China. Both countries have shown caution about dealing with sanctioned shipments since the Jan. 10 move.

In the past, many of Russia’s deliveries were made on a vast fleet of tankers that the country and its intermediaries amassed to work around sanctions. Such ships are barred from using western insurance if the barrels cost above the price cap. A key provider was Moscow-based Ingosstrakh Insurance Co., which was among the entities designated on Jan. 10.

The person said that from Feb. 27, all Russian petroleum deliveries to Tupras above the price caps — $60 for crude, $100 for premium fuels, and $45 for discount ones — will halt.

Top Supplier

Russia became Turkey’s top oil supplier after the 2022 invasion of Ukraine, accounting for 65% of crude and product imports. In the first 11 months of last year it imported about 29.1m tons from Russia, according to the latest data from the Energy Market Regulatory Authority.

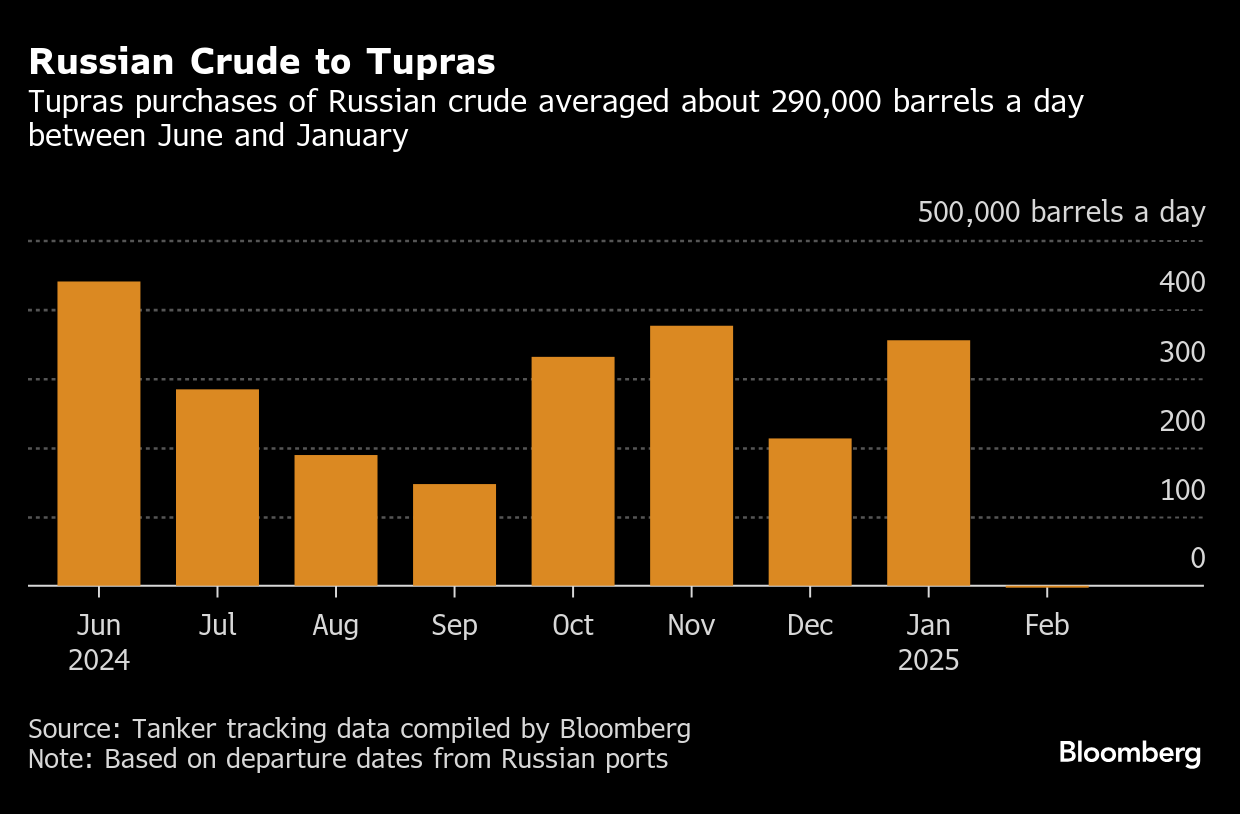

Tupras alone took about 180,000 barrels of Russia’s flagship Urals grade last year — roughly 5.5% of Russia’s entire seaborne crude export program, vessel tracking compiled by Bloomberg shows.

Last year, about 90,000 barrels a day of petroleum products — mostly diesel — was delivered into three Tupras terminals in Turkey, according to Vortexa Ltd. data compiled by Bloomberg.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Thames Water Under Fresh Investigation by UK Water Regulator

Bangladesh Seeks Full Electricity Supply From Adani Power

European Gas Prices Hit Two-Year High as Supply Fears Intensify

Iran’s Currency Slumps as Hopes Fade on Renewed US Talks

Thames Water Rescue Bidder Doubts Sale Process Feasibility

Edison Probing Retired Power Line as Possible Start of LA Eaton Fire

UK to Eases Rules for Nuclear Plants in Bid to Boost Growth

Borouge reports exceptional FY2024 net profit of $1.24 billion, a jump of 24% YOY

China Tariffs on US Oil Come as Exports Have Sunk From Peak