DeepSeek’s Promise of Energy Efficiency Darkens Power Stocks

(Bloomberg) -- The selloff caused by Chinese artificial intelligence startup DeepSeek wasn’t just limited to technology stocks like Nvidia Corp. Shares in energy companies key to the AI buildout were hammered too, leaving some on Wall Street wondering if their valuations are too high.

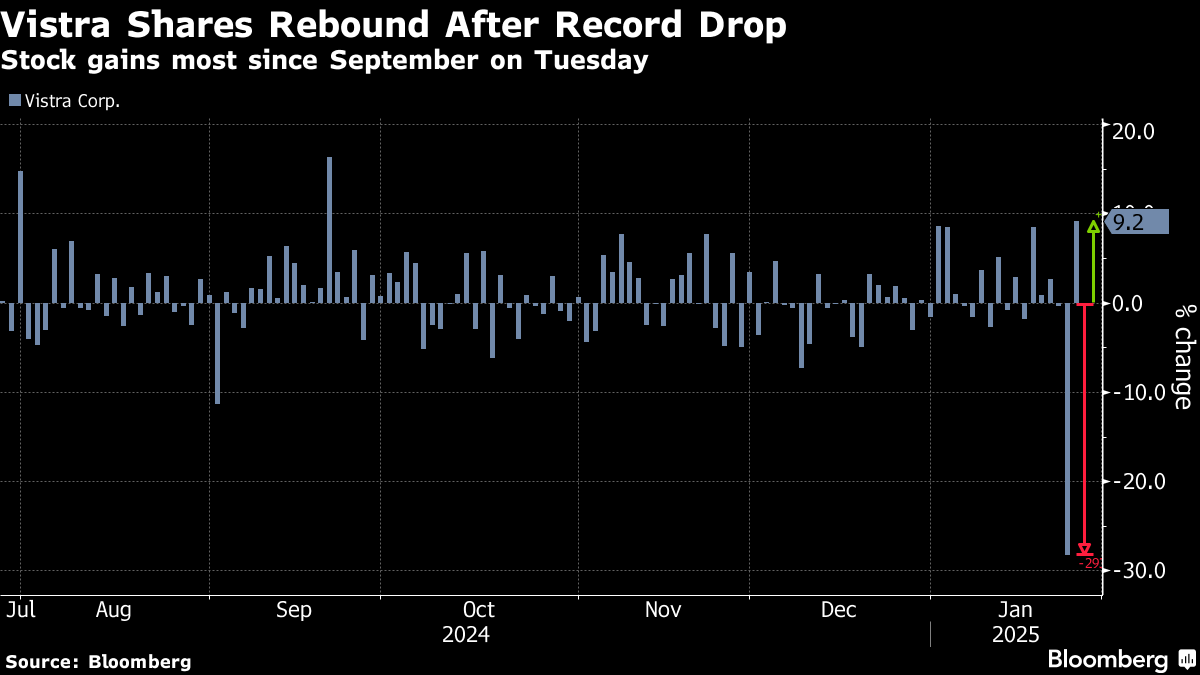

Independent power producer Vistra Corp. was the worst performer in the S&P 500 Index on Monday, collapsing 28% for its worst day on record and shedding $18.4 billion in market value in the process. Constellation Energy Corp. wasn’t far behind, dropping 21% and erasing $22.8 billion in market capitalization. While Vistra, Constellation Energy and NRG Energy Inc. partially rebounded Tuesday, the size of this week’s drop has split Wall Street strategists on the outlook for the sector.

The magnitude of Monday’s drop was so great that it “implies any uplift provided by the promise of AI data center load growth has effectively been washed out,” Evercore ISI analyst Durgesh Chopra wrote in a note to clients. He said that Vistra and NRG Energy were discounted to the point that their stock prices now imply earnings that are “on par with those of November 2023, a period prior to any data center sentiment accretion.”

To Barclays Plc. analysts Julian Mitchell and Jack Cauchi, the drop in AI and power equipment stocks Monday looked a lot like the hit to telecom and equipment stocks in 2001, when the dotcom bubble burst, and oil field equipment in 2008 and 2014, when oil prices crashed. “The problem with relying on narratives is that they can change, leaving some valuations suddenly looking very dislocated from the fundamentals,” they wrote.

In fact, Vistra’s stock price dropped to 46 times its earnings to 65 times and Constellation’s shares dropped from 41 times to 31 times its earnings. Even after Monday’s declines, those two stocks still have the highest price-to-earnings ratios in the S&P 500 Utilities Index, which trades just under 24 times its earnings.

Some on Wall Street see the dip in power producers representing a buying opportunity. Power is “the one area that will remain well needed,” regardless of competition in the AI race, said Peter Boockvar, chief investment officer at Bleakly Financial Group LLC. “By owning energy stocks, one doesn’t care which model/tech company is going to win.”

JPMorgan analyst Jeremy Tonet is encouraging investors to buy the dip in power producers. “Overall, we view the current sell-off as overdone, especially as lower AI inference costs should trigger even wider adoption of Gen AI,” Tonet said, reiterating his overweight call on Vistra given the “attractive entry point at current levels.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

China Approves 10 New Reactors in Nuclear Power Ramp-Up

Vestas Warns UK Wind-Auction Change Threatens Factory Investment

Valero Energy reports first-quarter loss amid challenging market conditions

Shell agrees to sell Colonial Enterprises stake to Brookfield subsidiary for $1.45 billion

Renault Confirms Full-Year Outlook on Strong EV Demand

ADNOC Distribution and noon partner to redefine quick-commerce convenience and speed

EU Weighs Targeting Spot Market for Russian Gas Phaseout

Altman to Step Down as Chairman of Nuclear Developer Oklo

Sulzer and Manweir form strategic partnership to enhance equipment repairs in Qatar