Starmer’s ‘Decade of Renewal’ Is Already Running Behind Schedule

(Bloomberg) -- Prime Minister Keir Starmer has urged patience in what he promises will be a “decade of renewal” for the UK. The recent swings in City of London financial markets show that time is a luxury he doesn’t have.

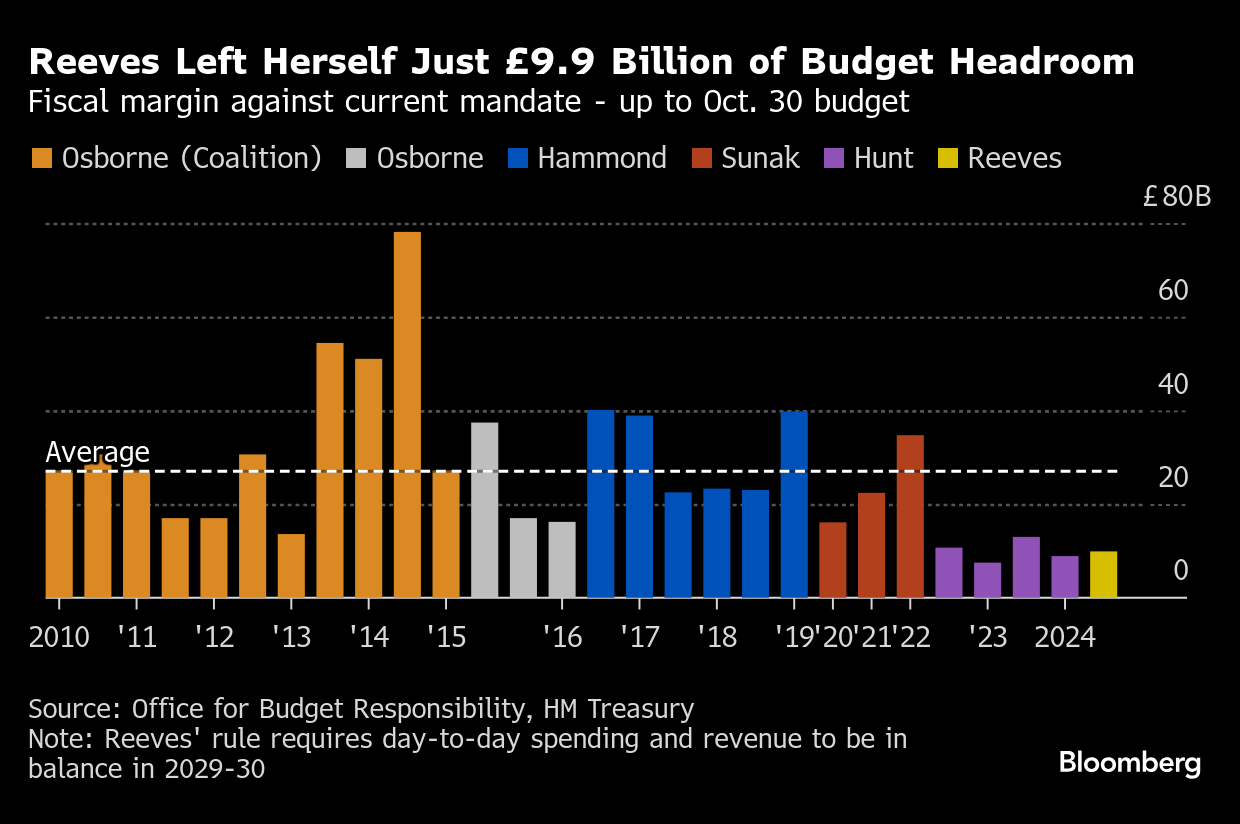

Little more than six months after leading the Labour Party back to power, Starmer and his Chancellor of the Exchequer, Rachel Reeves, have repeatedly found their long-term vision thrown into doubt by the short-term reality of the market. Bond moves have twice threatened to wipe out Reeves’ £10 billion ($12.2 billion) of fiscal headroom and exposed a lack of confidence in the project among investors, businesses and voters.

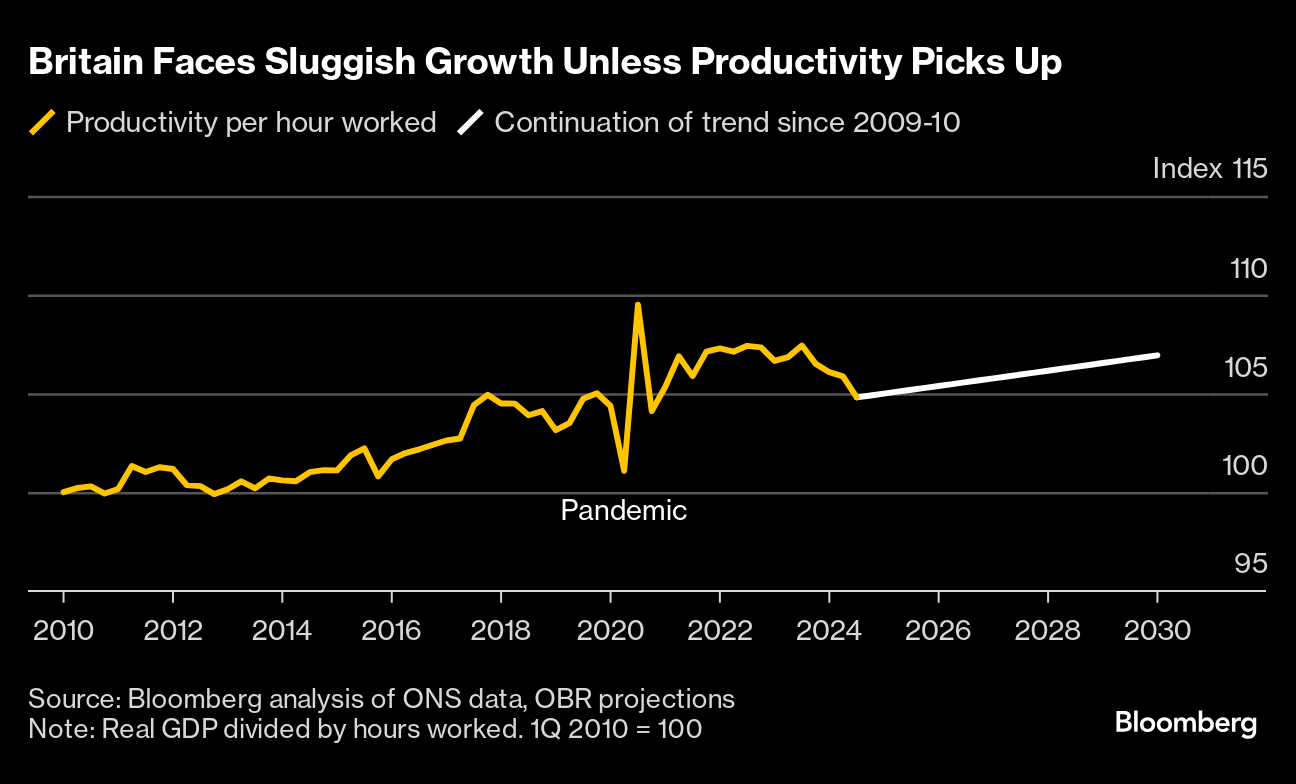

While gilt prices recovered in recent days, prompting Starmer to reaffirm Reeves’ job for “many years to come,” the convulsions since the turn of the year highlighted a deeper fragility of the UK economy and its public finances. The government is facing calls for immediate action to allay concerns that stagflation — the “British disease” of weak growth and rising prices that afflicted the country in the 1970s — is back.

Starmer seemed to acknowledge the pressure this week during a speech promoting another multi-year strategy, this time to capitalize on British leadership in artificial intelligence. “The blunt truth is we’ve got to be much bolder,” he said.

Reeves has promised a “growth speech” later this month to give investors more to look forward to after her first budget in October raised payroll taxes by £26 billion. Before she delivers it, she’ll likely hear pleas for a turnaround during appearances with Davos elites next week at the World Economic Forum, where Labour had only last year been welcomed as an antidote to 14 years of Conservative government that included Brexit.

“You need to accelerate plans and act now,” British Chambers of Commerce Director General Shevaun Haviland said. “What we don’t need is another vacuum where you see things like what happened last week in the markets.”

Big Ideas

Since taking power on July 5, Labour has produced a raft of over-the-horizon proposals on planning, pensions, health, regulation and worker skills. It is promising infrastructure, trade and industrial strategy plans in June. Starmer this week set out a 50-point vision to make the UK a global AI hub.

The prime minister has cast his long-term focus as a response to what he says was the “sticking plaster politics” of the ousted Tory government, which cycled through five prime ministers during a series of crises in the wake of the Brexit vote. He now faces a new challenge from Brexit-campaigner Nigel Farage and his populist Reform UK, which is attempting to paint Labour as out of touch with discontent voters, in an echo of President-elect Donald Trump’s successful campaign against Joe Biden.

The risk for Starmer is that he, like Biden, enacts lasting change in the economy, but fails to get credit from voters during the next election, which must be held by 2029. A sharp dive in approval since July has left Labour with the narrowest of leads over Reform UK and the diminished Conservatives.

Investors say the UK urgently needs to fix the chronic problems suppressing growth, such as low productivity, weak domestic capital markets, health care back logs and planning bottlenecks. Any overhaul of the National Health Service has been delayed for at least a year for a “national conversation” on reform, for instance, while Labour stopped short of mandating British pension funds to invest in local companies.

Unless Labour puts “meat on the bone in terms of what’s going to be done to actually empower growth,” a lack of confidence will undermine its wider agenda, Mark Dowding, chief investment officer at RBC BlueBay Asset Management, told Bloomberg TV this week. Until it does, he said, business has just one piece of hard evidence with which to judge the government’s growth project: tax rises.

The UK needs “leadership and tangible near-term action rather than long-draft proposals,” Liberal Democrat peer Susan Kramer told the House of Lords this week.

Cutting Red Tape

Reeves maintains that growth is her No. 1 mission and has promised to go “further and faster.” She’s pressed the heads of Britain’s regulatory agencies to loosen controls despite warnings from veterans of past crises.

Government officials cite a range of other measures by Reeves and Deputy Prime Minster Angela Rayner, who oversees housing plans, to demonstrate they’re serious about growth:

- £21.7 billion of investment in carbon-capture projects in northern England, which is expected to draw in a further £8 billion from the private sector

- Efforts to draft new planning legislation due out in March

- Ending a three-year battle over the demolition of Marks & Spencer’s flagship store

- Approving a data center development on protected “green belt” land

- Pushing through an expansion of London City Airport

- Extending two startup tax beneficial investment schemes for a decade

But there has been drift and caution, too. Labour’s pension reforms to increase investment in the UK were little more than an update of Tory plans. The more controversial action of mandating funds to invest 5% of their assets domestically was avoided.

Nigel Wilson, the former Legal & General chief executive who now chairs Canary Wharf Group, told Bloomberg the party should be pressing ahead with “soft compulsion,” under which funds would repay some of the tax relief on pension contributions if investment fell below 5%. The second phase of the review, to increase retirement savings, was kicked into the long grass.

Urgent reforms to social care and business rates have been ducked once again.

Airports and Nuclear

“We had quite an ideological budget when we needed a growth budget,” Wilson told Bloomberg TV earlier this week. “We have to have a sense of where we are really going to grow the economy. Not wait until March, April, May, June. We need the planning reforms and pension reforms to actually happen.”

Haviland, of the BCC, said there were quick wins to be had by approving infrastructure projects that have been sitting on ministers’ desks for some time. The northern runway redevelopment at Gatwick and the Luton Airport terminal expansion just need government sign-offs.

Upgrading rail junctions at Ely and Haughley in eastern England would reduce road freight coming through the port at Felixstowe and improve train commuting times. The plan has been on hold for a decade. The costly Sizewell C nuclear power project requires a decision.

“What the government needs to do is get on with signing off a lot of these things,” she said.

Speaking to a panel of parliamentary committee chiefs last month, Starmer continued to play the long game. “Planning will take time; the changes to regulation will take time; we have a national wealth fund that is getting record investment into the country, and that will take time,” he said.

The shock of this month’s market upheaval shows investors need something now to give them confidence he’ll ever get them done.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Modi Woos Global EV Investors in India’s Push For Green Energy

Iceland Energy Minister Plans to Speed Up New Power Plants

Aramco plans transition minerals JV with Ma’aden

Edison Move to Keep LA Power Lines Operating Draws Scrutiny

Dozens Missing in LA as High Winds Threaten to Spark More Fires

Los Angeles Fires Rage as High Winds Set to Return This Week

Bullish Brent Bets at May High Even Before Sanctions on Russia

UK Will Explore Nuclear Power for New AI Data Center Plan

Japan’s Owner of Muji Stores Looks to Build Clean Power Plants