Merz Rips Up Merkel’s Legacy to Unleash Germany Spending Power

(Bloomberg) -- Chancellor-in-waiting Friedrich Merz plans to free Germany from the fiscal straitjacket that former leader Angela Merkel had locked her country into for more than a decade, a move that will revolutionize public finances and pave the way for Europe’s most powerful economy to bulk up the region’s defense.

Just days after winning elections, Merz sent a message of intent to ramp up spending as US President Donald Trump triggered a trade war.

If he succeeds in loosening the constitutional borrowing restriction introduced by Merkel in the shadow of the Great Financial Crisis in 2009, it could deliver a much-needed jolt to Germany’s struggling economy, kickstart European efforts to bolster security and possibly even consign to history a chapter when borrowing restraint seemed to trump most other policy objectives in Berlin.

In an era of instability, pandemic and war, the so-called debt brake that Merz wants to pare back in the name of national security stood as one of the most enduring certainties of the region’s political landscape, holding back investment in good times and shaping responses across the continent whenever turmoil hit.

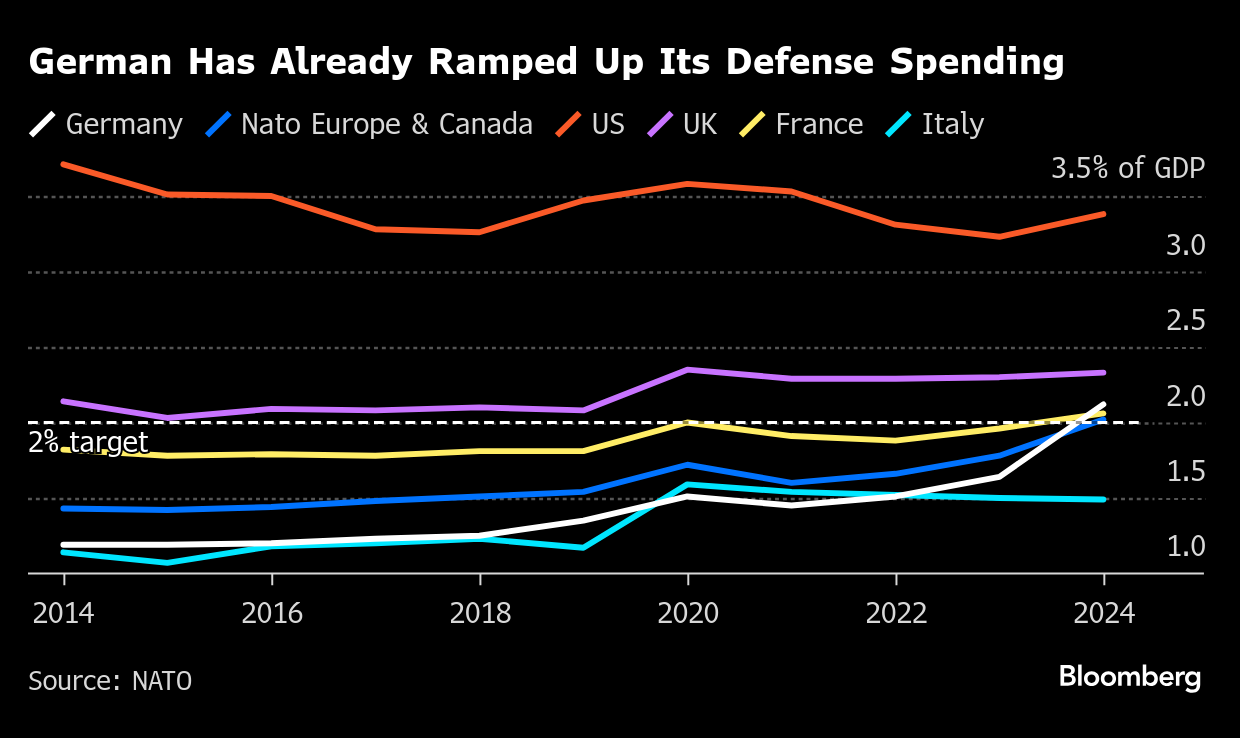

It survived the euro crisis that nearly broke up the currency union, and the Covid-19 emergency, despite strains imposed on the country’s budget. But Trump’s return to the White House, his criticism of Germany underspending on defense and Vice President JD Vance’s broadside at Europeans in Munich last month meant that something had to give.

“Events at the Munich Security Conference and in the Oval Office have clearly had a huge impact on the thinking of CDU leader Friedrich Merz,” Greg Fuzesi, an economist at JPMorgan Chase & Co., wrote in a note to clients. “Germany is heading not only for a massive U-turn on fiscal policy but also for a very strong response to the new defense and security challenges.”

While the measure has yet to pass parliament, markets have already reacted with vigor, causing a slump in German bonds and a surge in the euro. The yield on 10-year notes rose as much as 23 basis basis points to 2.73%, the biggest jump since June 2022, while the single currency gained 0.6% to $1.0689, on course for its biggest three-day gain since late 2022.

Merz’s plan would reap some political revenge on Merkel, his longtime rival for control of the Christian Democrats. She sidelined him for more than a decade while rising to become Europe’s dominant politician. The CDU is now paying the price for her decisions to shut down nuclear power and build up Germany’s dependencies on Russian energy and Chinese consumers.

The deal clinched with the Social Democrats to effectively remove most military spending from the debt brake and set up a special €500 billion ($530 billion) fund for infrastructure is all the more audacious for its method. Merz is exploiting the dying days of the last parliament to garner the required support of two thirds of lawmakers for his constitutional reform.

Even using that trick, the prospective chancellor can’t yet be sure of success, requiring backing from the Greens, who are indignant at being shut out of his negotiations. Any win would then be just the prelude to hard-fought coalition negotiations where his CDU party must now try to achieve concessions from its SPD opponents.

Longer term, the maneuver could yet cost him domestically, given that he campaigned before the Feb. 23 vote to preserve the debt brake and finance defense through social-security cuts. A commentator in Bild, the country’s mass-market tabloid, criticized Merz for breaking his word.

That reaction taps into lingering longer-term concerns on fiscal sustainability and Germans’ typical suspicion of borrowing. Such worries explain the debt brake’s enduring hold on voters — and one reason why other elements of the straitjacket won’t be discarded.

“We have been living beyond our means for years,” said Veronika Grimm, a member of the government’s panel of independent economic advisers. “Social spending is ever increasing — and will be difficult to curb anyway due to demographics. Therefore, it’s an extremely risky bet to keep postponing the need for reform by taking on more debt.”

Such misgivings are widespread, and could yet cause Merz’s plan to get watered down as it gets scrutinized in parliament in the coming week.

“It is now up to the Bundestag, with its constitutional majority, to provide these half-baked ideas with the right design,” Friedrich Heinemann, an economist at the ZEW institute in Mannheim, said in a statement. “It is essential that defense spending isn’t financed by debt in the long term.”

Merz will argue that he has history on his side, given the alarming shift in the geopolitical backdrop augured by the Trump administration.

The prospect of an injection of adrenaline to Europe’s biggest economy, which has languished in stagnation in the wake of the pandemic, is another strong case to make in the ensuing debate. Successive shocks of the energy crisis, Chinese electric vehicle rivalry and weak export demand have left Germany standing out in the region for its weakness.

“The massive shift in fiscal policy likely gives the struggling German economy a shot in the arm,” said Martin Ademmer, and economist at Bloomberg Economics. “A jump in defense spending might provide a cyclical boost. The proposed infrastructure package could deliver notable potential output gains in the long run.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Tabreed successfully issues $700 million inaugural green sukuk

UK Development Finance Arm Plans Record $2.8 Billion Investment

ADNOC and OMV to create $60 billion global petrochemical champion

Sunnova’s 71% Stock Plunge Heralds US Solar State of ‘Chaos’

ABB completes acquisition of Siemens’ Wiring Accessories business in China

Coal’s Four-Year Lows Hide a Coming Global Supply Squeeze

Australia’s Greens Eye Logging Ban in Role as Election Kingmaker

UK Enters Final Stage of Contest for Next-Generation Reactors

Engie Raises Profit Targets After Posting Bumper Earnings