Turkish Markets Seek New Equilibrium After Sharp Monthly Drop

(Bloomberg) -- The Turkish lira and bonds are headed for their worst monthly declines since 2023 as markets seek to find new equilibrium levels in the wake of last week’s rout, sparked by the detention of President Recep Tayyip Erdogan’s biggest rival.

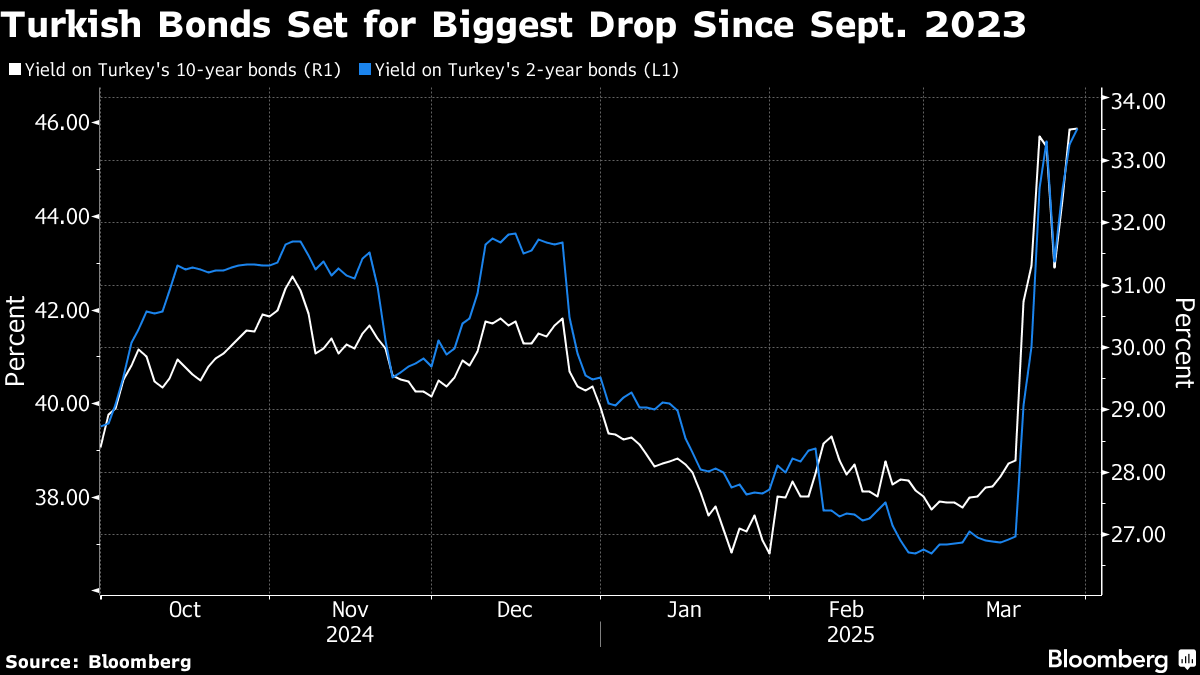

The lira weakened 4.1% in March, most in 21 months, with about 3% of that coming last week. Yields on government bonds are set for their biggest jump since September 2023, while Turkish stocks are due to decline for a second straight month.

Turkish assets plunged after police detained Ekrem Imamoglu, the mayor of Istanbul who was seen as a likely presidential candidate. Last week, Turkish stocks tumbled 17%, the lira briefly dropped past 40 against the dollar and credit default swaps rose as news of the detention spread.

The market turmoil led global banks to change their predictions on interest rates. Economists at JPMorgan Chase & Co. and Morgan Stanley no longer anticipate a rate cut at the central bank’s next policy meeting on April 17, while Goldman Sachs Group Inc. said it’s likely that the bank will raise its main interest rate by 350 basis points. Prior to Imamoglu’s detention, Turkish market watchers were almost in consensus about a fourth straight cut at the April meeting.

“Markets have reacted negatively to recent developments and will likely continue to remain volatile in the short term, but as political backlash to Imamoglu’s arrest will likely fade over time, so should the impact on markets,” said Priyank Shah, a senior emerging market investment specialist at Amundi UK Ltd.

He expects the authorities to “prioritize market stability.” Shah will remain cautious on the Turkish local rates market while maintaining a small overweight position in the lira “and keep our carry trade on” — he said, referring to a strategy that involves borrowing money in a low-rate country and investing it in one that offers a higher yield.

Turkish central bank Governor Fatih Karahan estimated that the bank had spent about $25 billion over between March 19 and March 21 to defend the lira, Goldman Sachs economists wrote in a report on Thursday. The monetary authority also raised its overnight lending rate at an unscheduled meeting to try to prop up sentiment.

At the same time, Turkey’s Capital Markets Board banned short selling and eased buyback rules.

The lira fell 0.7% against the dollar this week, slowing last week’s losses and managed to hold the line around 38 per dollar. The benchmark Borsa Istanbul 100 Index rose 4.9% and is on track for its biggest weekly gain in three weeks.

Fixed income performance was more mixed this week with the yield on two-year notes extending gains, five-year yields falling and the 10-year government bond little changed.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Myanmar Quake Toll Reaches 1,644 as Foreign Rescue Teams Arrive

TotalEnergies pursues growth in electricity by launching six new battery storage projects

France Proposes EU Carbon Market Changes to Boost Stability

I Squared Starts €2 Billion Sale of Utility Firm Energia

Boom in Uranium Stocks Fizzles as Ukraine Ceasefire Talks Build

American Electric Power Prices Its Shares at $102 Apiece

US Department of Energy reissues $900m solicitation for nuclear SMRs

Heathrow Blackout Shows Weak Spot in Airport Power Supplies

Japan, China Discuss Economy as US Tariff Pressure Rises