Rystad: OPEC+ cuts constructive for 2025 crude balances

OPEC+ members announced on Thursday that they are extending voluntary production adjustments of 1.65 million barrels per day (bpd), announced in April last year, until the end of December 2026. Following a virtual meeting, the alliance also said it was extending additional voluntary adjustments of 2.2 million bpd, announced in November 2023, until the end of March next year, shifting the phase-out from September 2025 to one year later. A new compensation schedule for overproducing countries is also to be submitted by the end of this year, the members said.

Analysing the update, Mukesh Sahdev, Global Head of Commodity Markets – Oil at Rystad Energy, said: “Oil markets have been anxiously awaiting this OPEC+ meeting since the US election results made clear a Trump 2.0 presidency was on the horizon. Trump’s tariff-forward stance toward China and persisting weak demand provided the group with all of the encouragement needed to extend production cuts until the first quarter of 2025.”

Here are the latest decisions by OPEC+ members at a glance:

- Extend the voluntary adjustments of 1.65 million bpd announced in Apr 2023 until the end of December 2026.

- Extend the additional voluntary adjustments of 2.2 million bpd announced in November 2023 until the end of March 2025 with shifting the phase out from September 2025 to September 2026.

- New compensation schedules for overproducing countries to be submitted by the end of December 2024.

According to Sahdev, the overall signal to the market “is constructive and will likely prevent any price downsides in the short term. The announcement makes crystal clear that the group is worried about both a potential supply glut and a lack of compliance with production targets among member countries.”

Rystad Energy observed that the OPEC meeting produced a predictable outcome: extending production cuts. Crucially, OPEC+ reemphasised that monthly changes can be paused or reversed at any time, it said, adding that with the latest announcement, the production profile and oil balances clearly indicate an acknowledgment of the emerging supply glut without the extension in 2025.

According to Rystad Energy, the following are the market signals emerging from the OPEC+ announcements:

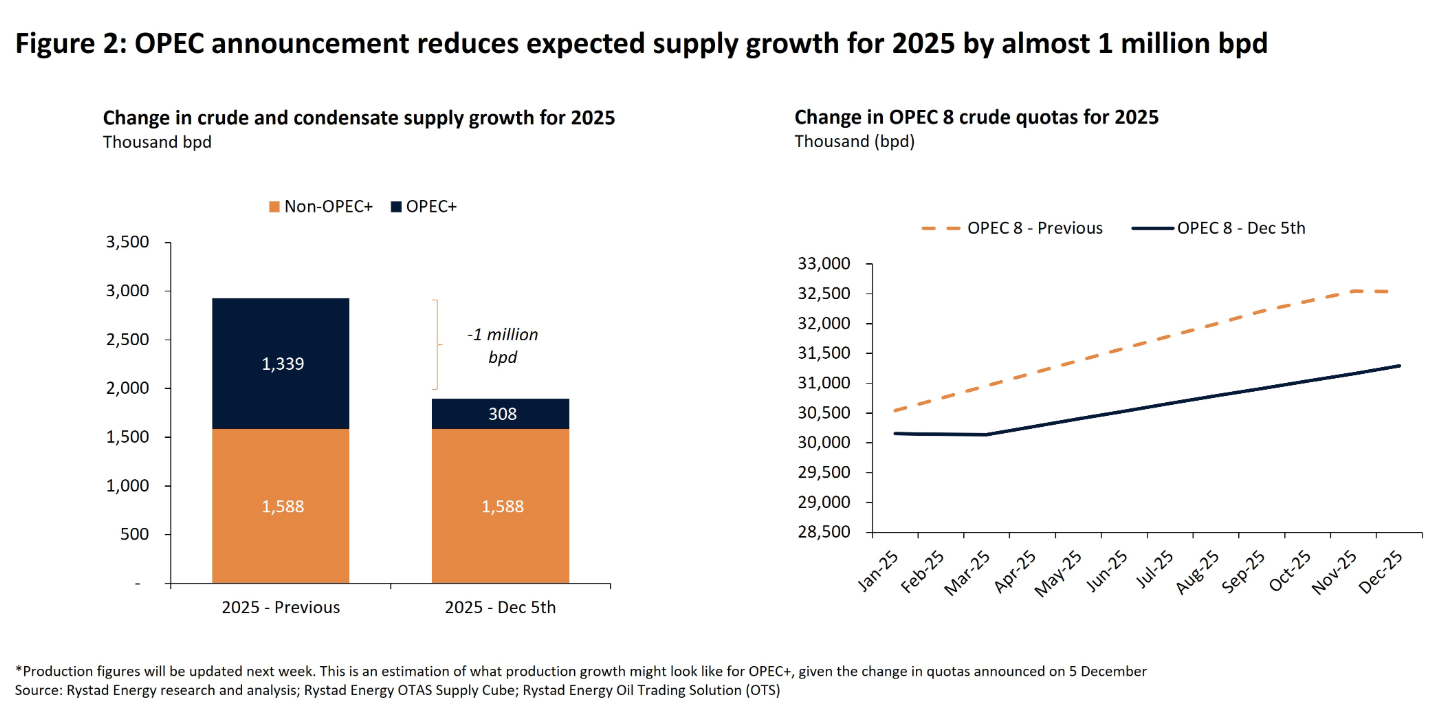

- The phase out of cuts shift from 12 months to 18 months is constructive for the crude balances for 2025, with a swing from average 0.7 million bpd surplus to average 0.3 million bpd deficit.

- An important announcement was also the confirmation that the UAE’s new baseline (300,000 bpd higher) will only start in April 2025 and will be gradually phased in over an 18-month period. The previous guidance was that the new baseline would start in January 2025 and would be gradually implemented over a 9-month period. This subtle but important change in UAE production guidance is relevant and shows a strong commitment from the country towards OPEC+.

- The overall impact on supply growth in 2025 is reduced by 1.03 million bpd , and the crude and liquids balances surplus are reduced by the same amount, respectively. In 2025, crude and condensate were oversupplied by 700kbd, now short 335kbd (swing of 1030kbd). The liquids balance was oversupplied 1.25mbd, now oversupplied 215kbd (same swing of 1030kbd).

- The speculation of Kazakhstan potential exit owing to overproduction has not played out as anticipated and in line with our call that a consensus solution will be reached to stay with the group. This adds a bullish bias for the balances.

- As per our analysis, OPEC+ does not seem to be overly concerned about the non-OPEC+ supply and need for a price war to bring a correction. Our estimates indicate that the non-OPEC+ supply growth will likely face headwinds from the buying countries correction in refinery demand as lower margins will persist in 2025, driving higher closures in those countries.

- Despite the signal that phase out of cuts is delayed to Sep 2026, it can be assumed that this is given as a lot depends on how the Trump 2.0 rhetoric on US production growth and sanctions on Iran, Venezuela plays out along with tariffs on Canada and Mexico.

- The tapered phase out news will likely put pressure on the back-end of the more that front end. The extension of cuts to Mar 2025 certainly helps the front end of the curve stay supported. Maintaining crude market in backwardation seems to be an important unstated goal for the OPEC+ along with maintaining price stability.

- The delayed phase-out also signals that OPEC+ acknowledges the weakness in Chinese oil demand and is not anticipating a surprise rebound anytime soon given Trump’s possible tariffs against China.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.