Rystad Energy: North Africa-Europe interconnectors could deliver 24 GW of clean energy

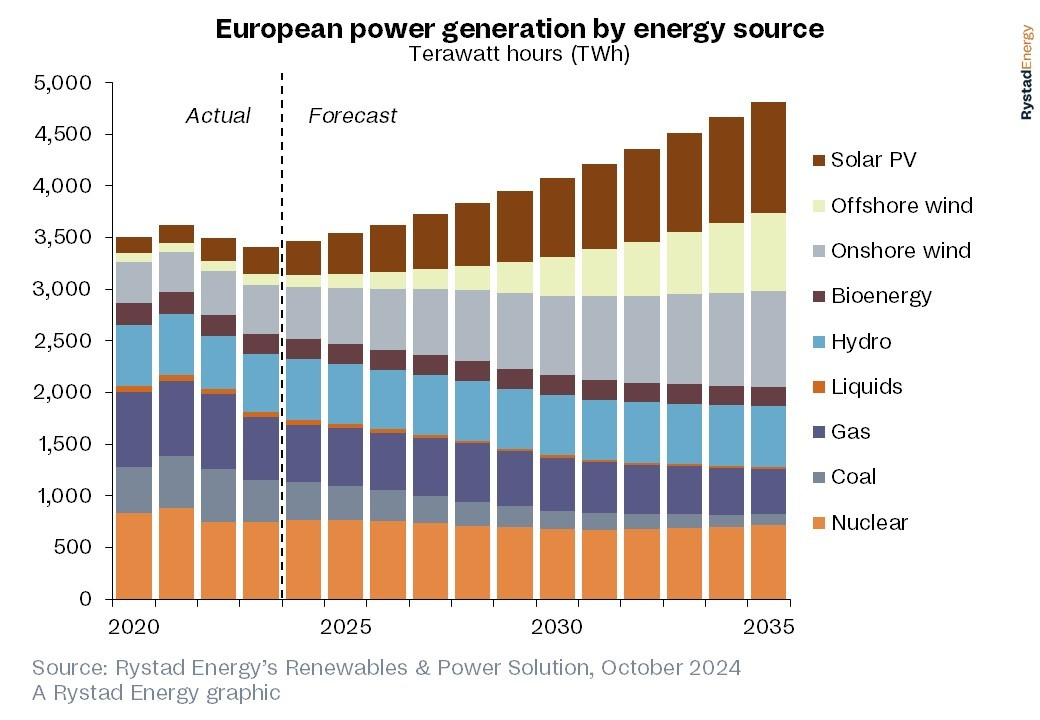

Europe’s transition to a greener power sector is gaining speed, with North Africa set to be a key enabler of this process. New capacity additions from solar and wind, weaker power demand and a partial comeback of hydropower and nuclear energy have seen Europe’s power mix turn increasingly green in the recent years. Rystad Energy forecasts 73% of the continent’s electricity will come from clean sources by 2035, with imports from North Africa potentially delivering up to 24 gigawatts (GW) through subsea interconnectors, supplying Europe with a reliable stream of clean power.

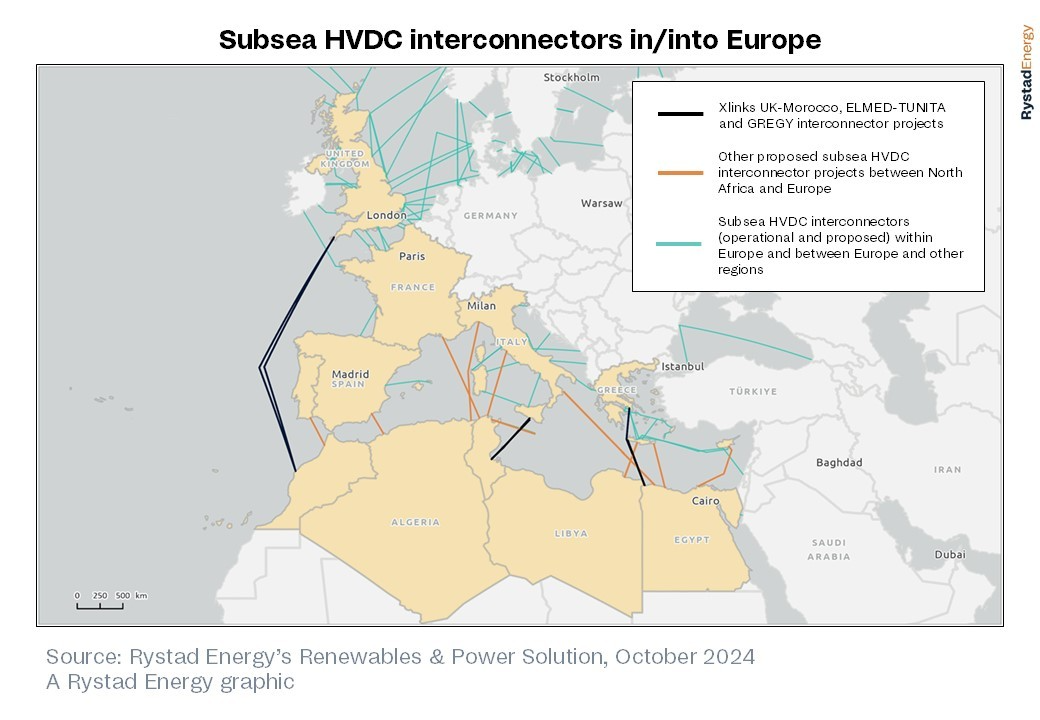

Currently, Morocco is the only African country connected to Europe by two high-voltage cables to Spain, each with a capacity of 700 megawatts (MW). A third cable of the same capacity is planned and will be further supported by major projects such as the Xlinks UK-Morocco project, which will establish 11.5 GW of intermittent renewable capacity, 22.5 gigawatt-hours (GWh) of battery energy storage, and a 3.6 GW subsea interconnection between the UK and Morocco. More interconnections are also in the works, such as the GREGY initiative between Greece and Egypt alongside the ELMED-TUNITA project between Tunisia and Italy, which has attracted significant investment from governments and financial institutions.

With these three initiatives online, about 7.2 GW of interconnector capacity and 23 GW of renewable capacity will have to be deployed in North Africa to support Europe. This includes 13.5 GW of solar PV and 9.5 GW of onshore wind, requiring an investment of more than US$27.5 billion to develop these renewable projects. Assuming all the power generated at these renewable facilities is dispatched to Europe, the three interconnections operating at maximum capacity could deliver about 55 terawatt-hours (TWh) on an annual basis – translating to 1.6% of Europe’s overall power generation currently, and potentially replacing about 6% of Europe’s fossil-based power generation.

"North Africa's renewable energy potential aligns well with Europe's goal of reducing reliance on Russian natural gas. The region’s geographic proximity makes it a natural fit for buyer-seller relationships, leading to large-scale solar and wind projects, along with subsea cables across the Mediterranean and even to the UK. Wind power in Europe peaks during the winter while solar power peaks in the summer, offering a chance to balance power supply fluctuations. This helps diversify energy sources and reduce fossil fuel use in Europe's power sector," says Nivedh Das Thaikoottathil, Senior Analyst of Renewables & Power Research at Rystad Energy.

North Africa is an emerging player in energy transition within the Mediterranean – with annual power generation exceeding 400 TWh, and the region having the highest electricity access rates in Africa. The region plays a pivotal role in the advancement of onshore wind and solar PV installations, with more than 350 GW of projects currently in various stages of development, most of which are in concept phase. With installed capacity of more than 8 GW from both solar and onshore wind, North Africa presents a compelling case for renewable energy, particularly as the levelised cost of electricity (LCOE) of these technologies has decreased significantly, from $55-70 per megawatt-hour (MWh) to below $50 per MWh over the last decade.

Furthermore, the region is home to some of the largest PV installations globally, including Egypt’s Benban solar complex, which is the largest solar project in Africa. Situated in the Aswan governorate, this complex comprises 41 separate solar PV facilities spread across 37 square kilometers and is so large that it can be seen from space. Until last year, Morocco was home to the world’s largest solar thermal power plant, the 510-MW Noor Ouarzazate solar thermal complex. Noor I and II employ concentrated solar power (CSP) technology and 12-meter-tall mobile parabolic mirrors, while Noor III utilises a solar tower. This project was developed under the build, own, operate and transfer (BOOT) model by ACWA Power Ouarzazate, a consortium that includes Saudi Arabia’s ACWA Power, the Moroccan Agency for Solar Energy (Masen), Spain’s Aries and TSK. Additionally, Africa’s largest wind power projects are found in Egypt, notably the 580-MW Gabal El Zeit and 545-MW Zaafarana wind farms.

Solar panels in sun-drenched North Africa can triple their yield compared to those in Europe, benefiting from ample space for such projects. Positioned within the Earth's solar belt, the region's daily photovoltaic power output ranges from 4.8 to 5.6 kilowatt-hours (kWh) per kilowatt-peak (kWp), compared to 3.6 to 4.8 kWh per kWp in Europe. North Africa also boasts significant wind potential, with wind speeds averaging between 7 to 10 meters per second. This disparity in energy potential is reflected in the capacity factors for both solar PV and onshore wind, with North African countries exhibiting more stable trends than their southern European counterparts.

The timely completion of renewable energy projects in North Africa is primarily hindered by supply chain constraints. With limited local manufacturing capacity, the region must rely heavily on imports to meet its growing solar and wind energy demands. This dependency not only exposes North Africa to supply chain risks and price volatility, but also highlights a significant vulnerability in its energy strategy. Similar constraints are expected in the manufacturing and procurement of high-voltage direct current (HVDC) cables.

However, the availability of HVDC and extra-high-voltage (EHV) subsea cables will present significant challenges in the coming years. As of 2023, Europe produces more than 50% of these cables, with approximately 9,000 kilometers currently in circulation globally. New manufacturing plants are anticipated to raise this supply to around 16,000 kilometers by 2030. However, projections from Rystad Energy signal that demand will exceed 75,000 kilometers by 2030, driven by the need for HVDC interconnectors and offshore wind export cables. This could create a supply-demand imbalance that necessitates intervention from Asian manufacturers, which will prompt European firms to urgently enhance their production capacity in order to meet demand.

In addition to these supply chain challenges, financing hurdles could further delay project timelines, particularly since many initiatives remain in the early development stages. Collaboration among multiple suppliers and contractors is crucial for completing cable fabrication and installation within the typical two to three-year timeframe. The concurrent development of solar PV and onshore wind projects will also help minimise delays and address issues related to cable integrity and storage costs.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.