Energy leaders call the US a prime investment market

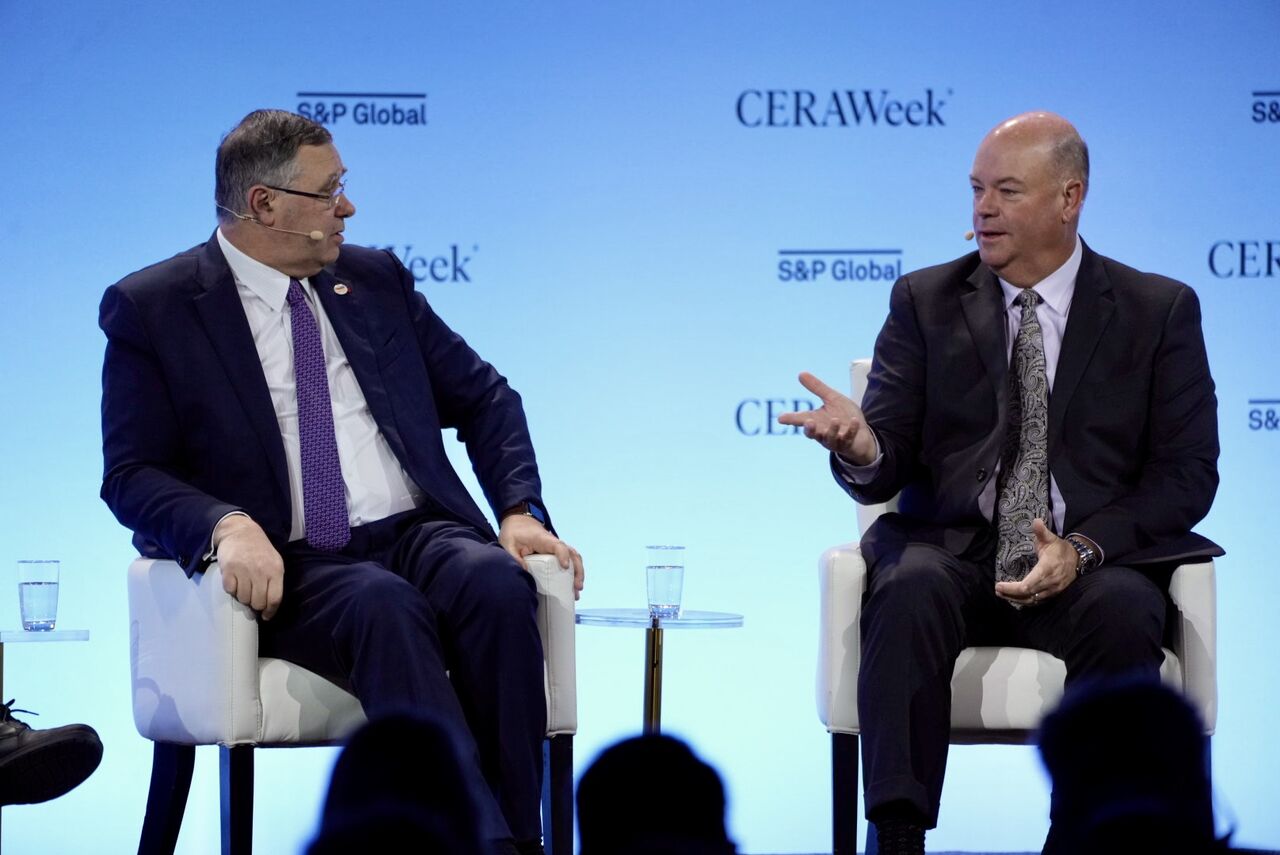

The Group CEO of ADNOC Dr. Sultan Ahmed Al Jaber and several of his energy industry peers named the US as their key strategic investment destination at a major global conference.

Speaking at CERAWeek in Houston, US on Tuesday, Dr. Al Jaber, who is also the UAE’s Minister of Industry and Advanced Technology, said: “Investing in the US is not only a priority it’s an absolute imperative. The US offers an incredibly attractive ecosystem.

“We are keen to advance our very strong economic and strategic ties to deepen our energy, technology, advanced manufacturing and trade partnerships with the US.”

Dr. Al Jaber also described the US as a natural partner in energy and AI: “This is where we see huge opportunities for the UAE to further invest and deepen partnerships with the US across multiple sectors, including the energy-AI nexus.

“It is also where our newly launched transformational international energy investment company – XRG – can play a critical role.”

Launched on November 27 last year, XRG is being positioned as an international low carbon energy and petrochemicals investment company. It has an enterprise value of around $80 billion.

Dr. Al Jaber also called for “pro-growth, pro-investment, pro-energy and pro-people” policies to help drive global growth, adding that the “world is finally waking up to the fact that energy is the solution. Energy is the beating heart of economies. It is the spinal cord of society. The time has come for us to make energy great again.”

Following Dr. Al Jaber, ConocoPhillips CEO Ryan Lance said the American energy investment climate couldn’t be any better thanks to US President Donald Trump.

“We've got probably the best energy team in the US we've had in decades,” he added.

Petronas CEO Tengku Muhammad Taufik said: “US Energy Secretary Chris Wright was correct [on Monday] in stating that at the core of any pursuit of prosperity by any society is indeed the availability of energy, and I think that is going to be central to whatever we do going forward at home and abroad.”

President Trump’s industry rallying cry of “Drill baby, drill” is a general recognition that affordable energy boosts economic prosperity, noted Woodside Energy CEO Meg O’Neill.

“‘Drill, baby, drill,’ whilst a good headline, at its heart is about reliable and affordable energy underpinning economic growth, and I think that’s quite a powerful message from the US that’s being heard around the world.”

Elsewhere, TotalEnergies CEO Patrick Pouyanne said: “There’s an abundance of natural gas in the US. So, for us, it is now a case of more exposure to the US market and less in Russia.”

And BP CEO Murray Auchincloss noted: “We see positive growth in our US upstream holdings including offshore prospects in the Gulf of America. Furthermore, we are in strong position in the Permian basin.”

That said, most executives at CERAWeek agreed that US oil production will peak between 2027 and 2030. It is expected to average a record 13.6 million barrels per day in 2025 and may rise further to 13.73 million bpd in 2026, according to the US Energy Information Administration.

However, Lance of ConocoPhilips noted: “It will be a slow decline beyond 2030.That causes some issues. Market share for OPEC+ starts rising again as US production starts to plateau and demand continues to rise as we think it will over time.

“But there's a ton of resources in the US. I've never been against this industry in terms of technology because you can always figure out a way to get more resource out of the rock.”

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.