US energy and climate legacy: the crucial impact of long-term policies

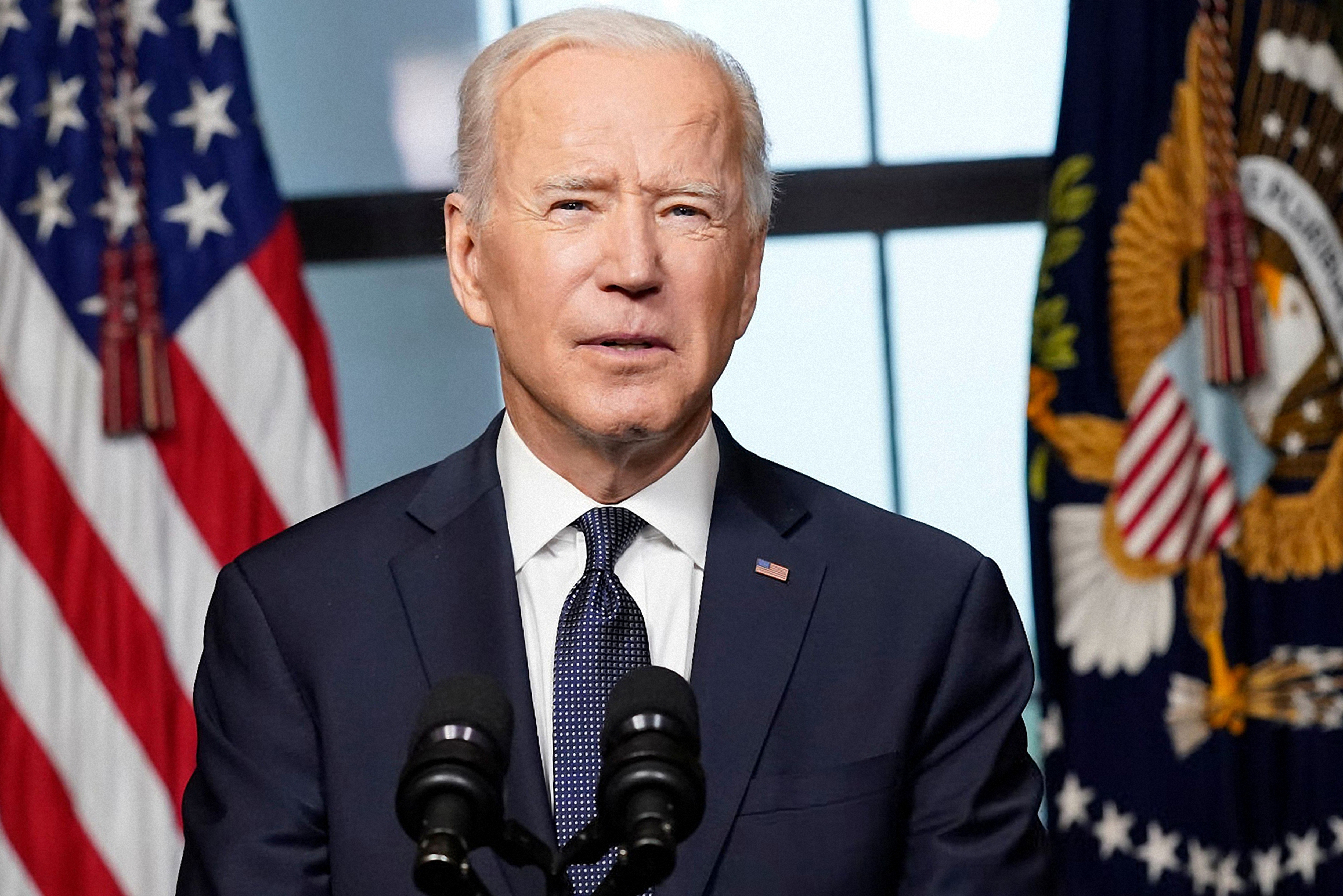

It’s no secret that the US oil and gas industry prefers Republicans. As President Biden moves towards the end of his term, he could prove to be one of the most consequential energy Presidents of modern history. But that legacy depends crucially on who follows him: Vice-President Kamala Harris, or Donald Trump.

In the late 1970s, the Democratic senator from Louisiana, Bennett Johnston, said: “We’ve gotten higher drilling rig counts, more dollars being spent, more activity, more profits being made by oil people than ever before. But do they like [President Jimmy] Carter? Oh no, they hate him because of his rhetoric.”

History bears this out. In the modern oil era, since the rise of OPEC, inflation-adjusted oil prices have averaged US $63 per barrel under Republican presidents, $84 per barrel under Democrats.

Every Republican President from Richard Nixon onwards presided over a fall in US oil production, barring one – Donald Trump. With one exception, Bill Clinton, every Democratic President in that period saw production rise. Barack Obama was not popular in Texas, but the shale revolution helped US output gain a remarkable 82% during his tenure – it had fallen 12% under his Texan oilman predecessor, George W. Bush.

Of course, we should not give Presidents too much credit or blame for these statistics. Oil and gas production and prices respond to industry trends, economics and geopolitics beyond the control of even the person in the Oval Office.

More important are the long-term policies, which may bear fruit only years or even decades after a president leaves office. Here, Biden has the potential for huge impact. This revolves around three signature pieces of legislation: the Infrastructure Investment and Jobs Act, the Chips and Science Act, and the Inflation Reduction Act (IRA). These provide trillions of dollars of funding and incentives for a range of clean energy research, technologies, and investments, including wind and solar power, energy efficiency, energy storage, hydrogen, carbon capture and storage, electric vehicles, advanced nuclear power, critical new energy minerals, and climate change adaptation.

Importantly, many of these incentives concentrate not just on deploying these technologies, but ensuring they are manufactured in the United States. With opposition to China being almost the only bipartisan issue in US domestic politics, dependence on Beijing for crucial materials and equipment seems unacceptable.

Many of the new investments relating to this legislation are in Republican-leaning states. Ohio, for example, home of Vice-Presidential aspirant JD Vance, has secured the largest-ever US solar panel factory, which started operations in February. Practical politics mean most such projects will probably survive a change in control of the White House or Congress. The US oil industry may not take climate change seriously, but it is happy to take government money to build carbon capture and hydrogen projects. However, other measures, such as tax breaks for electric vehicles, seem likely to be on Trump’s chopping block.

Some of the President Biden administration’s decisions have touched a nerve with the petroleum industry, without actually having much effect. Approvals of new LNG exports have been paused, partly inspired by misleading studies that overstate their greenhouse gas impact. This is also unwise messaging to Russia, suggesting some unwillingness to back up US allies seeking to eliminate dependence on Moscow.

But many LNG projects are already underway, probably too many for the market when considering the major expansion plans in Qatar, the UAE, Oman, Mozambique and elsewhere. If anything, a pause on new US projects probably helps the industry avoid damaging itself through too much competition.

Pauses in leasing of new oil and gas acreage, such as Alaska’s National Petroleum Reserve, modest increases in royalty rates, and tightening of rules on methane leakage, have not stopped oil and gas output from rising. Most activity is not on federal land anyway, and the industry is cautious about over-investing, and still has plenty of running room in the main shale basins.

Some parts of President Biden’s energy and climate legacy should survive his presidency under any successor. Yet the full impact of the massive investments he legislated will only be felt if they are sustained. Many of the technology seeds planted today will flourish in decades to come, in the same way that the 1970s birthed today’s wind and solar industries, and the 1980s initiated the modern shale oil and gas business.

The other area a president enjoys major influence is in foreign policy. Biden’s administration has been overly cautious in supporting Ukraine against Russia, and fears of forcing up oil prices have prevented imposing and enforcing strict sanctions. Still, Kyiv has managed to defend itself, a wider conflagration has so far been avoided, and the global energy crisis of 2022 has passed, for now.

President Biden, like Obama, has taken climate change very seriously, rejoining the 2015 Paris Agreement from which Trump withdrew, and making climate a rare spot of cooperation with China. Harris, from eco-conscious and drought-prone California, would no doubt redouble these efforts.

In contrast, Biden’s Middle East track record has been quite dismal from acts both of commission and omission. In this, he is like every US president from Clinton onwards. The two policy exceptions, Obama’s Iran nuclear deal and the Abraham Accords under Trump, were singular successes floating in a wider strategic void.

Biden’s Middle Eastern policy failures have not yet had much impact on world energy markets, with the oil and gas business shrugging off Israel’s war in Gaza, and even the blockage of the apparently crucial Red Sea to most shipping. But as Israel-Iran conflict escalates, there are still a few months to go in which he might, like President Nixon or President Carter, suffer the ignominy of being on-seat during a big Middle Eastern war that brings with it soaring oil prices. Harris or Trump might find a cold wind of renewed energy crisis blowing through their inauguration in January.

- Robin M. Mills is CEO of Qamar Energy, and author of The Myth of the Oil Crisis

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.